Apple (AAPL) has been a dominant player in the tech hardware market for decades...

Apple (AAPL) has been a dominant player in the tech hardware market for decades...

And along the way, it has become incredibly reliant on China.

Apple leans on the country's specialized manufacturing and labor to produce more than 95% of its iPhones, AirPods, iPads, and Mac products.

And unlike Big Tech peers Alphabet (GOOGL) and Meta Platforms (META), Apple relies on China for both manufacturing and sales.

That's bad news considering the latest update from Beijing...

China recently imposed restrictions on iPhone use among government employees, citing security concerns. On top of that, it's considering a probe into Apple's high app store fees and third-party restrictions.

Simply put, China thinks Apple is behaving like a monopoly. And it's not the first time a government has made this claim...

A 2024 antitrust ruling by the European Union forced the company to allow third-party apps and payment systems on its devices.

As we'll explain today, a similar move in China could erode Apple's profitability... and, in time, crush its market dominance.

The Chinese landscape is changing...

The Chinese landscape is changing...

China makes up a substantial part of Apple's total revenue... In fiscal year 2023, roughly 19% of sales came from China.

This is now under threat, as the competition intensifies and regulatory risks mount.

Apple lost its position as China's No. 1 smartphone seller for the first time last year. In fact, it fell all the way to No. 3... behind local competitors Vivo and Huawei.

Not only are these Chinese companies gaining market share, but the government is also putting its thumb on the scale...

Unlike its competitors, Apple doesn't typically allow third-party apps on its devices. In addition, it charges up to 30% on all in-app purchases.

If China forces Apple to lower those fees and allow third parties, its revenue stream could tumble.

Despite these challenges...

U.S. investors don't fully acknowledge the growing risks for Apple...

U.S. investors don't fully acknowledge the growing risks for Apple...

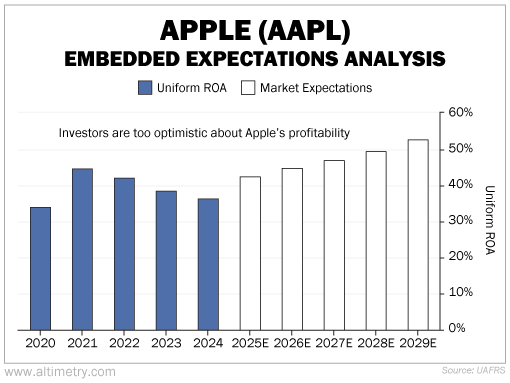

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Apple's Uniform return on assets ("ROA") was as high as 45% in 2021 – close to four times the U.S. corporate average.

Right now, investors expect that number to increase over the next five years... reaching 53% by 2029.

Take a look...

Those expectations seem overly optimistic, given all the challenges we've outlined. We think Apple's Uniform ROA is more likely to fall than rise.

On top of that, the trade war between the U.S. and China is far from over. That could further weaken Apple's grip on the market... and eat into profitability.

Any further escalation could put Apple in real jeopardy...

Any further escalation could put Apple in real jeopardy...

Right now, China is applying a lot of pressure on the tech giant.

Increasing local competition, regulatory challenges, and geopolitical uncertainty are making it harder for Apple to do business.

Yet it needs the Chinese market to make and sell its products – to retain global dominance.

It's a delicate balance. And Apple can't risk upsetting China any more than it already has.

Big Tech investors need to acknowledge these problems sooner rather than later. Otherwise, they could be in for a rude awakening.

Regards,

Joel Litman

February 26, 2025

P.S. My February Master Class series starts tonight at 6 p.m. Eastern time. And if you haven't RSVP'd, there's still time...

In this two-part series, I'll cover Wall Street's "Financial Industrial Complex" – and the key strategies you need to sidestep the system and make smarter investment decisions.

I'll even show you how to read between the lines of what CEOs and CFOs are saying... using techniques I've presented to top executives and government leaders.

These Master Class lessons are free to Altimeter Pro subscribers. You should have received your invitation earlier this week.

For anyone else who wants to join, reserve your spot (and a free 30-day Altimeter Pro trial) right here.

Apple (AAPL) has been a dominant player in the tech hardware market for decades...

Apple (AAPL) has been a dominant player in the tech hardware market for decades...