The electric-vehicle ('EV') market has come a long way in recent years...

The electric-vehicle ('EV') market has come a long way in recent years...

According to the International Energy Agency ("IEA"), nearly 1.8 million EVs were registered in the U.S. last year. That's more than three times as many as in 2016.

Industry darling Tesla (TSLA) gained the first-mover advantage, but more and more legacy car names like Ford Motor (F) and General Motors (GM) are beginning to enter the space.

Additionally, as part of its efforts to promote clean energy, the Biden administration plans to spend billions of dollars rolling out EV charging infrastructure across the country.

EVs aren't just affecting the auto and energy markets, though...

With the amount of technology packed into modern EVs, the sector is contributing to the ongoing semiconductor shortage.

The EV space is also disrupting a sleepier, often overlooked market: metals recycling.

For decades, after the useful life of traditional internal combustion engine ("ICE") cars ended, the car parts were reused as much as possible.

From the copper wiring, steel, and aluminum that make up much of a vehicle to the engine block and frame of the car, almost everything has a second purpose. And these items aren't only reused for other cars...

For example, close to 65% of a total ICE system within a vehicle is made up of iron and steel. These two metals are easily recyclable for other uses besides cars.

However, the EV composition is much more complex. These vehicles are more environmentally friendly on the road, but there's a more complicated end-of-life process.

Roughly 25% of these vehicles' materials are toxic. This mostly comes from the electric battery, which includes lithium ion and cobalt that can be hazardous to deal with.

Furthermore, electrical components and other more complex materials within the cars, such as rare earth metals, are harder to deal with.

As a result, the EV market is pressuring legacy metal processors...

As a result, the EV market is pressuring legacy metal processors...

These companies will have a difficult time navigating the differences in the EV market.

It's mainly because they aren't exactly profitable businesses to begin with. Adding complexity will only make operations more difficult.

For examples, one of the largest publicly listed companies operating in this space is Schnitzer Steel Industries (SCHN).

The company essentially recycles ferrous and non-ferrous scrap metals. It also manufactures a number of finished steel products.

And as our Uniform Accounting analysis shows, Schnitzer Steel hasn't been a great business historically...

And as our Uniform Accounting analysis shows, Schnitzer Steel hasn't been a great business historically...

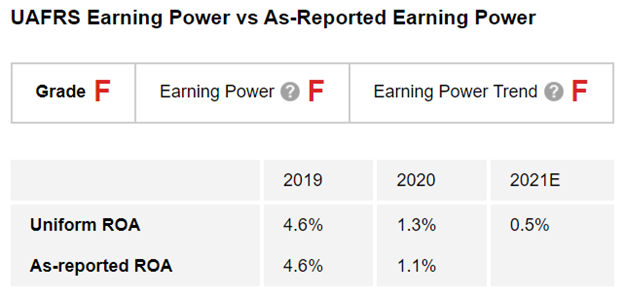

As regular Altimetry Daily Authority readers know, GAAP financial metrics are full of discrepancies. Uniform Accounting removes more than 130 distortions in as-reported financial metrics, and our Altimeter tool compares the as-reported and Uniform numbers to grade stocks based on their real financials.

After we clean up the GAAP numbers, we can see that Schnitzer Steel is currently failing to be a successful business, with its return on assets ("ROA") in cost-of-capital territory.

On a Uniform basis, the company's ROA has declined from 5% in 2019 to 1% in 2020. And this number is expected to further decline by the end of 2021.

Due to this weak profitability and poor trend in ROA, Schnitzer Steel earns an "F" Altimeter grade across the board for Performance. Take a look...

And if Schnitzer Steel needs a lot of capital expenditure ("capex") to upgrade its equipment to navigate the new world of EVs, its returns may end up looking even worse.

The coming EV future will lead to big winners and losers...

The coming EV future will lead to big winners and losers...

As the EV trend gains more momentum, it will create massive changes in demand. Companies like Schnitzer Steel might struggle to adapt.

However, that also means there's a lot of money to be made for investors who are positioned to benefit from the shift.

In our Altimetry's Hidden Alpha newsletter, we put our Uniform Accounting analysis to work in the space to identify three companies that are primed to be big winners from the trend... and they have the potential for big upside ahead. We also found five popular companies in the space that investors should avoid at all costs.

Hidden Alpha readers can access the report right here. If you aren't a subscriber yet, you can learn more about Hidden Alpha – and find out how to gain instant access to this report, as well as the full portfolio of open stock recommendations – by clicking here.

Regards,

Rob Spivey

July 1, 2021

The electric-vehicle ('EV') market has come a long way in recent years...

The electric-vehicle ('EV') market has come a long way in recent years...