The Rhine River is drying up...

The Rhine River is drying up...

Starting in the Swiss Alps, the Rhine connects six countries with Rotterdam – Europe's largest seaport. It has been a vital trade route since the Roman Empire, acting as a crucial waterway for transportation and the global supply chain.

But drought conditions are starting to hurt commerce. The Rhine's water level fell to about 12 inches on August 15. Current projections are for the river to rise slightly by September. But experts expect the overall downtrend to continue throughout the rest of the year.

The last time this happened, in October 2018, the Rhine was shut down for 132 days due to severe drought. It devastated the parts of the supply chain that relied on river traffic.

In an average year, more than 160 million tons of goods travel along the Rhine. Last year, 128,000 ships came and went from the Port of Rotterdam.

Any disruption to this infrastructure means serious delays to the area's supply chain, which ripples across the global economy.

With global warming leading to recent record-breaking heat waves, this problem is only going to get worse.

Unfortunately, this issue isn't specific to the Rhine...

Unfortunately, this issue isn't specific to the Rhine...

The Danube River, the second longest in Europe, is also drying up. That's slowing down the grain trade in central Europe.

And the Po – Italy's "king of rivers" – is 2 meters lower than usual. It's having trouble sustaining the rice crops that help feed the country.

Much of the world is scrambling to solve underlying climate-change problems. But in the meantime, as water levels keep falling, countries could look to dredging as a short-term solution.

Dredging is essentially digging out a river... scooping out mud, weeds, and other particles clogging it. This allows for more water to collect, which could temporarily improve these drought issues.

Serbia has already started dredging its stretch of the Danube. If other countries decide to embrace this solution, dredging companies would massively benefit.

Take Orion (ORN), a marine engineering and construction company. Because it specializes in water construction and infrastructure, Orion would be perfectly positioned to meet increased dredging demand.

Prior to the Great Recession, demand for Orion's services was booming. Global trade was growing rapidly, and the U.S. was importing and exporting more goods.

The 2009 American Recovery and Reinvestment Act helped Orion keep the lights on through the Great Recession. It provided billions of dollars in stimulus to keep the economy going. It included more than $100 billion for infrastructure spending like dredging.

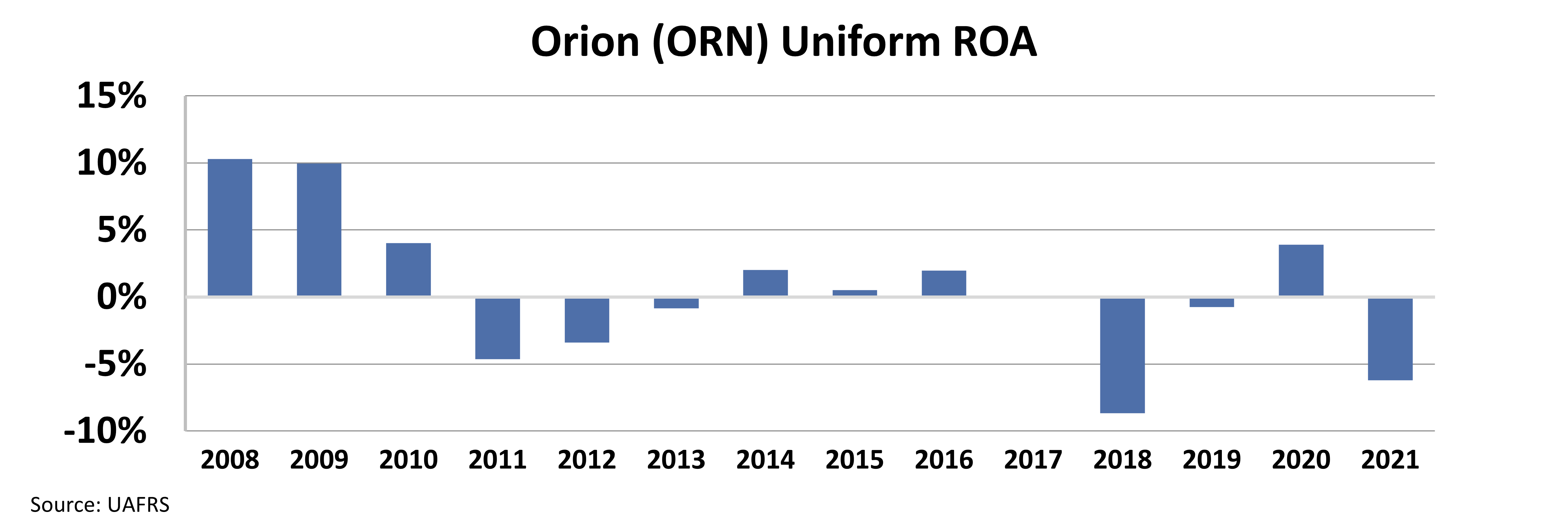

Before the financial crisis, Uniform return on assets ("ROA") was holding steady at 10%. But since then, investment in infrastructure has dried up – and so have Orion's returns.

Take a look...

Since 2010, Orion's returns have been volatile... ranging from negative 8% to 4%.

But more investment is likely around the corner...

But more investment is likely around the corner...

Two key factors will be critical in driving demand for Orion going forward.

First, the 2021 Infrastructure Investment and Jobs Act ("IIJA") will inject some much-needed cash into American infrastructure. This is exactly what Orion needs to create better returns.

Second, as we already explained, overseas nations might need to rely on river dredging due to droughts like the one in the Rhine. As more rivers dry up, Orion will be a clear leader in marine and waterway solutions.

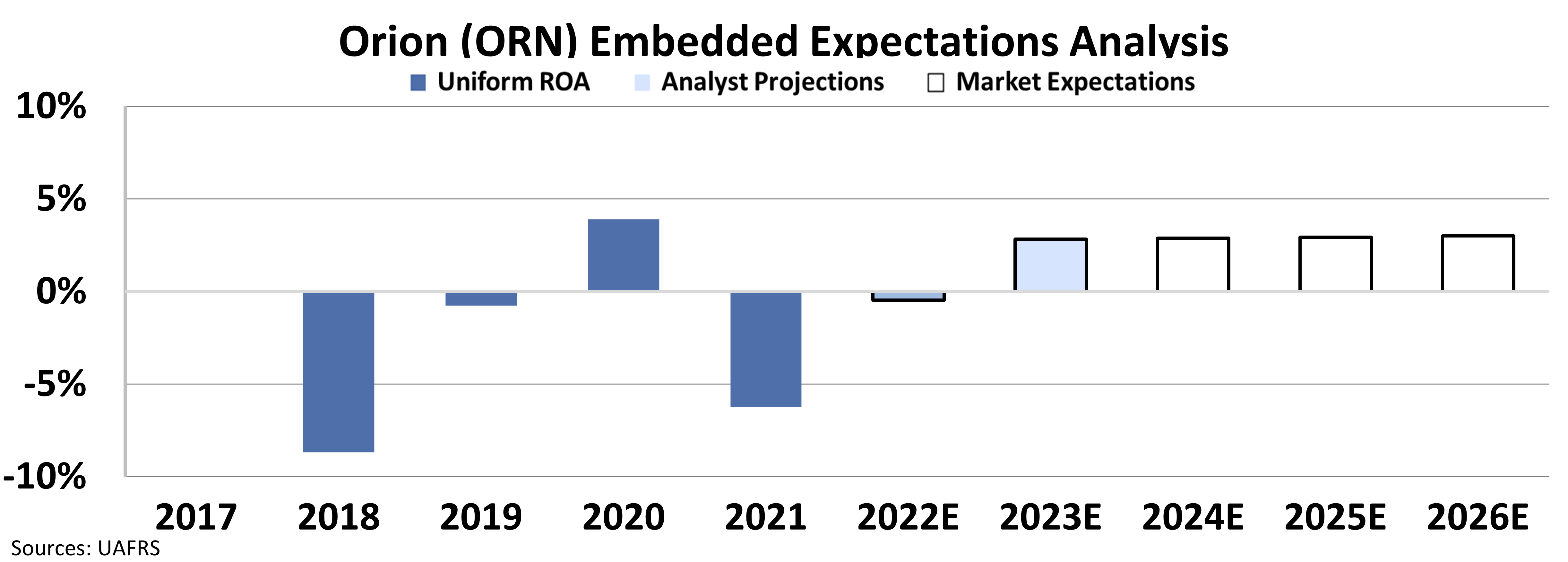

To see if the market is pricing in these tailwinds, we can use our Embedded Expectations Analysis ("EEA") framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions only come out as garbage. So we've turned the DCF model on its head with our EEA model.

We'll use Orion's current stock price to determine what returns the market expects. Check it out...

Orion's EEA makes it clear that the market isn't accounting for these two major tailwinds. Investors expect just a 3% ROA going forward.

But thanks to the company's low valuations... investment from the IIJA... and the ever-increasing consequences of climate change, Orion could very well beat expectations going forward.

Regards,

Joel Litman

August 30, 2022