A 'megastorm' might be coming for California...

A 'megastorm' might be coming for California...

After a decade of drought, the Golden State may soon be in for the opposite problem. That's because weather patterns are shifting in the Pacific Ocean. Scientists forecast that a huge plume of water vapor could make landfall in California, causing devastating rains.

We're not talking about minor flooding. The state could get 26 times more water than the Mississippi River discharges at any time.

While California needs water, this isn't what most had in mind. The megastorm could lead to flooding, mudslides, burst dams, and destroyed farmland. It could cause at least $725 billion in damage... more than five times the damage of Hurricane Katrina.

When I (Rob) lived in Sacramento, I experienced a mild version of this phenomenon. For a month straight, it rained continuously in the city.

It made skiing in the Sierras great, because the rain turned to snow in the mountains. But the rain disrupted city life. And that was just from a small water vapor trail.

As our climate becomes more volatile, consumers are willing to pay for stability.

That's where generator makers like Generac (GNRC) come in...

That's where generator makers like Generac (GNRC) come in...

Our Altimeter tool can reveal how climate problems and work-from-home tailwinds have benefited Generac. It shows us easily digestible grades to rank stocks based on their real financials.

It has been just over two years since we recommended the company in our Altimetry's Hidden Alpha advisory. Generac is a major provider of backup power-generation products for residential, light commercial, and industrial markets in the U.S.

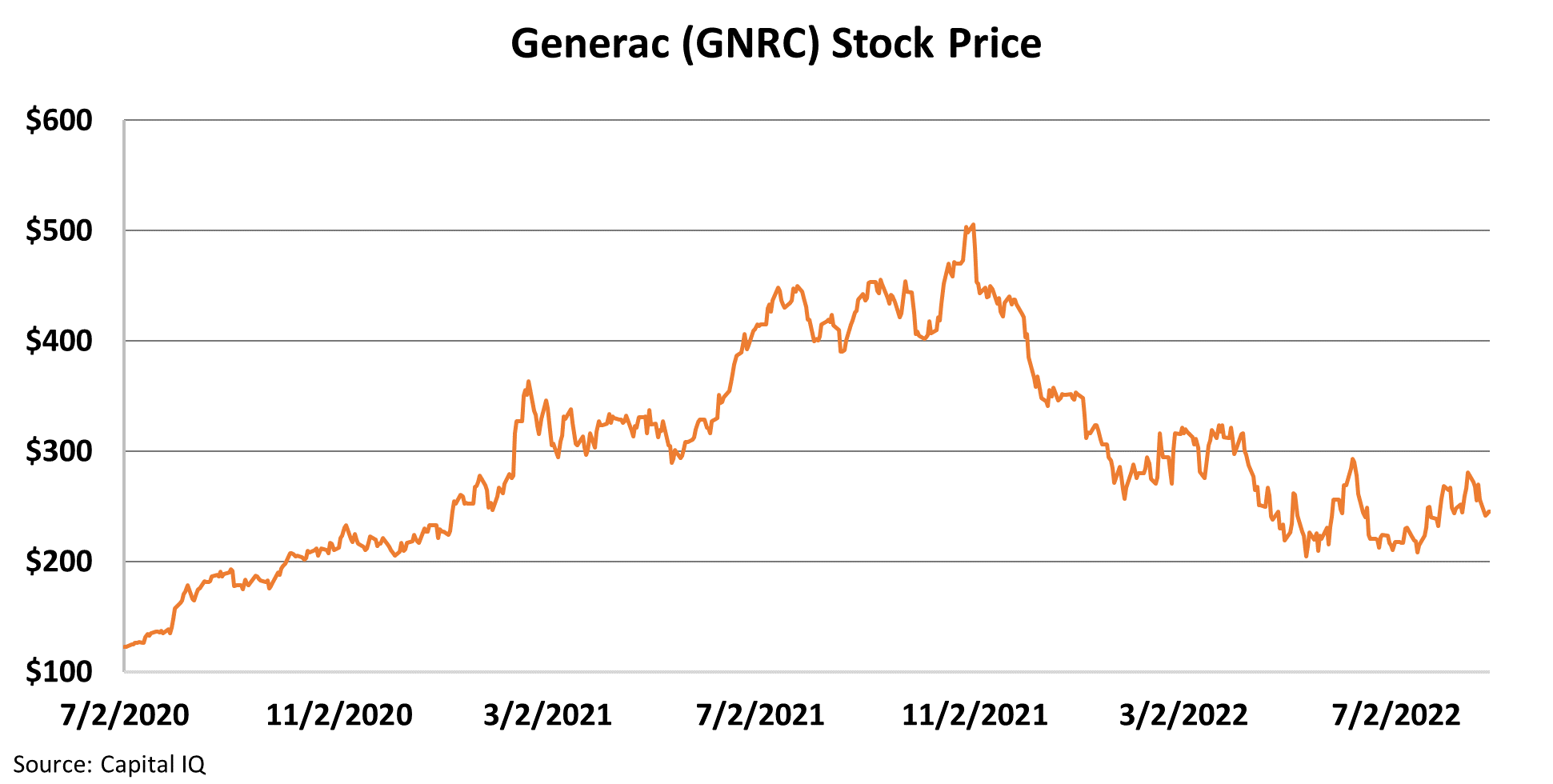

Since we recommended the stock, subscribers who followed our advice are up roughly 108%. As you can see in the chart below, portable generators and independent power solutions have gone from a luxury to a necessity...

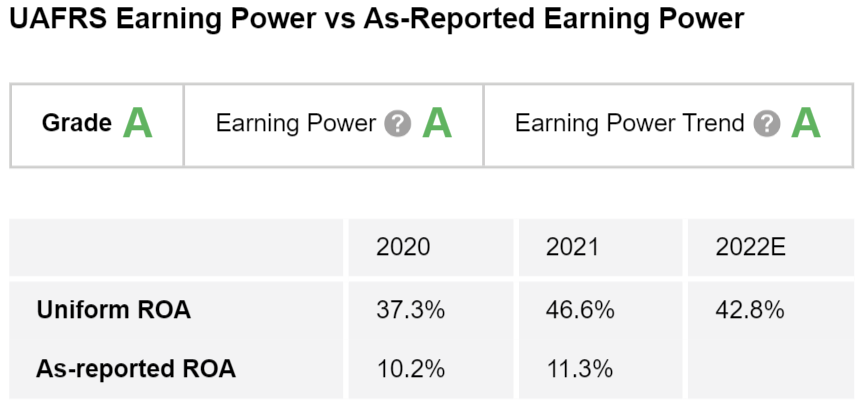

Generac is already the leader in the power-generation products market. And it's consistently expanding its reach every year. Despite this, as-reported metrics make the company look weak...

Generac's as-reported return on assets ("ROA") was 10% in 2020 and 11% in 2021. For comparison, the average U.S. company returns about 12%. Generac's numbers appear quite low for an industry leader.

But Uniform Accounting takes out the distortions in Generac's returns. It provides us with a clear picture of the company's true profitability...

Using The Altimeter, we can see that the company's profitability actually soared during the pandemic. Uniform ROA reached 37% in 2020 and 47% in 2021. This earns Generac an "A" Earning Power grade.

Plus, Uniform ROA is expected to stay strong... clocking in at 43% through 2022. Generac earns an "A" in Earning Power Trend, too.

Weather patterns are becoming more extreme. That should benefit Generac... meaning its high returns could persist. Even after doubling since the pandemic, this climate-change beneficiary still has room to grow.

Regards,

Rob Spivey

August 25, 2022

A 'megastorm' might be coming for California...

A 'megastorm' might be coming for California...