Even the biggest auditor on Earth couldn't be trusted...

Even the biggest auditor on Earth couldn't be trusted...

In the early 2000s, the U.S. accounting industry was in shambles.

A wave of corporate fraud had come to light, threatening to shake up the financial world – if not the broader economy.

Enron and WorldCom were brought down in two of the biggest accounting scandals in history. And one auditor stood at the center... Arthur Andersen.

At the time, Arthur Andersen was the largest auditing firm in the world. It was known for its high standards and quality risk management. Yet, the U.S. Securities and Exchange Commission discovered it was complicit in several high-profile accounting scandals...

It had helped Enron bury its mountains of debt in shell companies. And it was accused of signing off on inaccurate financial reports for WorldCom.

Both Enron and WorldCom went bankrupt. And the public ultimately lost trust in auditing firms...

That led to the creation of the Public Company Accounting Oversight Board ("PCAOB") in 2002.

You can think of the PCAOB as the government's "auditor of auditors." It ensures that auditors are correctly reporting their clients' accounting data.

In the 20 years since the Arthur Andersen scandal, the PCAOB hasn't had great things to report. And the problem is getting worse...

The PCAOB report for 2022 revealed that about one-third of all audits conducted by U.S. accounting firms had material errors... up 9 percentage points from 2021.

And yet, even though audit quality is declining, it's not all doom and gloom...

As we'll explain today, learning how to identify these accounting errors can give you a huge leg up on most investors. After all, companies' results frequently look worse than they actually are...

You just can't trust the numbers...

You just can't trust the numbers...

Auditors have a tough job.

After all, some smaller auditing companies don't even have established quality-control systems. That makes it harder to guarantee quality reporting right off the bat.

On top of that, these so-called errors aren't always 100% wrong. Even U.S. generally accepted accounting principles ("GAAP") have some room for interpretation.

This is part of the reason why we developed Uniform Accounting in the first place. We recognized that investors were lacking good, consistent data to make smart investment decisions.

If you're paying close attention, you can often tell when accountants let their clients get away with too many discretionary charges...

You see, when management teams expect disappointing results, they can intentionally make those results look even worse. That way, future quarters look better by comparison. We like to call this a "big bath."

One way executives do this is by writing off "underperforming" assets. These write-offs incur charges that make net income and earnings look lower than they actually are. They also make a company's balance sheet look smaller.

There were plenty of big baths during the worst of the Great Recession...

There were plenty of big baths during the worst of the Great Recession...

In late 2008, companies knew they were going to disappoint investors, so they made their earnings look even worse.

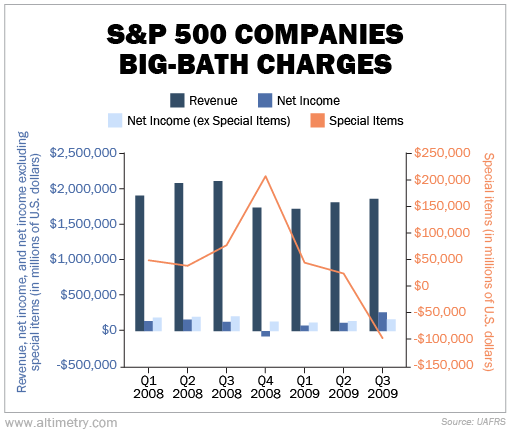

In the following chart, you can see how companies in the S&P 500 Index performed during the worst of the Great Recession. We've included revenue (the dark blue bars) and as-reported net income (the middle blue bars) as a baseline.

We've also broken out what are called "special items." These are one-time expenses like asset-impairment charges, restructuring charges, and legal fees. Companies have some discretion over when and how much to charge here.

The orange line shows special-items charges over time. And the light blue bar shows what net income would've been if we excluded those special items.

As you can see, revenue fell nearly 20% from the third to the fourth quarter of 2008. And net income turned negative, down 159% over that time frame...

Now, the drop in net income excluding special items wasn't nearly as bad – a decline of only 36%. The orange line shows just how much companies leaned into the big bath... with special-items charges more than quadrupling from normal levels.

In total, corporations reported more than $200 billion in special-items charges in the final quarter of 2008.

Cash earnings were already under strain... and companies' big-bath charges made things look worse.

Most investors saw the results in late 2008 and panicked. Companies' shares started tanking. And it looked like the S&P 500 was heading for big trouble.

However, those who understood companies were intentionally making their earnings look worse had a great chance to pick up shares for cheap.

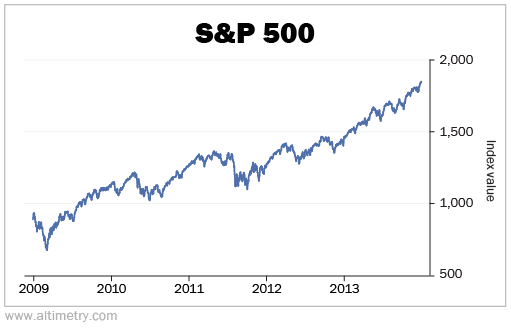

Most of these earnings results came out during the first few months of 2009. That's also when the S&P 500 bottomed. The smartest investors got in right when these companies were all taking a big bath.

Check it out...

By the second quarter of 2009, both earnings and revenue for companies in the S&P 500 were back up again. And, as you can see, investors started putting their money back to work...

Through the end of 2013, the market had rallied more than 170%.

We could see another wave of big baths soon...

We could see another wave of big baths soon...

If last year's PCAOB report is any indication, more audits will likely be flagged for accounting errors.

The economy is getting worse. We still expect a recession next year. And management teams will be looking to wipe the slate clean however they can... potentially making earnings look weaker than they actually are so that future results look much better.

That means more big-bath opportunities will be right around the corner when the recession reaches its worst.

Be on the lookout for companies that start taking significant charges. Those stories tend to make headlines... and they typically scare a lot of investors away. When that moment comes, we'll be buying – not selling.

After all, it's a flaw in the accounting system... not a sign that the economy is doomed.

Regards,

Joel Litman

September 13, 2023

Even the biggest auditor on Earth couldn't be trusted...

Even the biggest auditor on Earth couldn't be trusted...