'Necessity is the mother of invention'...

'Necessity is the mother of invention'...

Humans are great problem solvers. But we're also – for good reason – inherently lazy.

This relates to another saying that's a natural partner to the one above: "Why fix what isn't broken?"

When things are going well, it's a rare person who tries to improve a process. It's when a problem arises that people focus and find a solution.

Across the globe, plenty of problems are emerging for businesses due to the disruptions from the coronavirus.

The Economist published a great article late last month covering exactly the kind of innovations that are popping up to counter some of the problems...

Whether it's real estate brokers giving virtual 3-D tours of houses to prospective buyers or food retailers improving online order fulfillment by employing people to collect deliveries overnight in stores, the coronavirus pandemic has indeed been the mother of innovation.

What type of new innovations have you seen in your personal life (or seen a business do) that you never expected to see? Let us know at [email protected]... We'll plan on highlighting a few examples later this week.

The past month has been a great time to put money back into the market...

The past month has been a great time to put money back into the market...

But not every investor will make the right choices for the current environment.

You may consider yourself more of a value investor, a growth investor, or something completely different.

In any scenario, though, great investors change their strategy to match the stock market cycle... even if their bias is to growth or value.

For example, although growth investors typically look for companies with high future earnings potential and strong momentum, the best of the best understand that value investing outperforms momentum early in a bull cycle.

Conversely, Warren Buffett-style value investors who buy stocks with strong economic moats, bright management teams, and cheap valuations may loosen their standards as we enter the momentum stage of a bull market.

Regardless of your own personal investment philosophy, you need to think in the context of the market cycle when investing.

We've just gone through one of the fastest, most intense market drops in the history of the modern stock market.

We're still likely to have a few quarters of uncertainty depending on how well corporate earnings hold up... but the fundamentals for the next bull market are in place.

Nobody knows all of the long-term economic effects of the coronavirus... And in late March and early April, a lot of companies' stocks fell farther than they probably should have.

All of a sudden, "value hunting" was – and still is in some areas – a wildly popular investment strategy. The concept is simple – buy companies trading cheaper than they were before the downturn that are positioned to fully recover or come out better than prior to the pandemic.

It's a simple enough concept, but there's a lot of pitfalls investors need to be aware of...

At this stage, many companies that look cheap likely won't fully recover – we call them "value traps."

And often, it's tough to tell the difference between a value stock and a value trap.

Here at Altimetry, we often talk about how signals in credit markets help inform the equity markets.

It's no different when we're looking for value stocks versus value traps.

Right now, it's time to avoid companies with low-quality credit. That's where you'll find the biggest value traps.

We've written in previous essays about how the big rating agencies – Moody's, Standard & Poor's, and Fitch – rate corporate credit on a scale from triple-A (little to no risk) to C or D, which both indicate a company in default, depending on the agency.

The agencies have two broad categories of rating – investment grade ("IG") and high yield ("HY"). Investment grade is considered high-quality credit, while high yield is considered lower quality and riskier.

Corporations with HY credit often have more volatile stocks because they're more sensitive to credit risk. These companies typically fall farther during bear markets, which may seem like a good buying opportunity right now.

However, that's not the case...

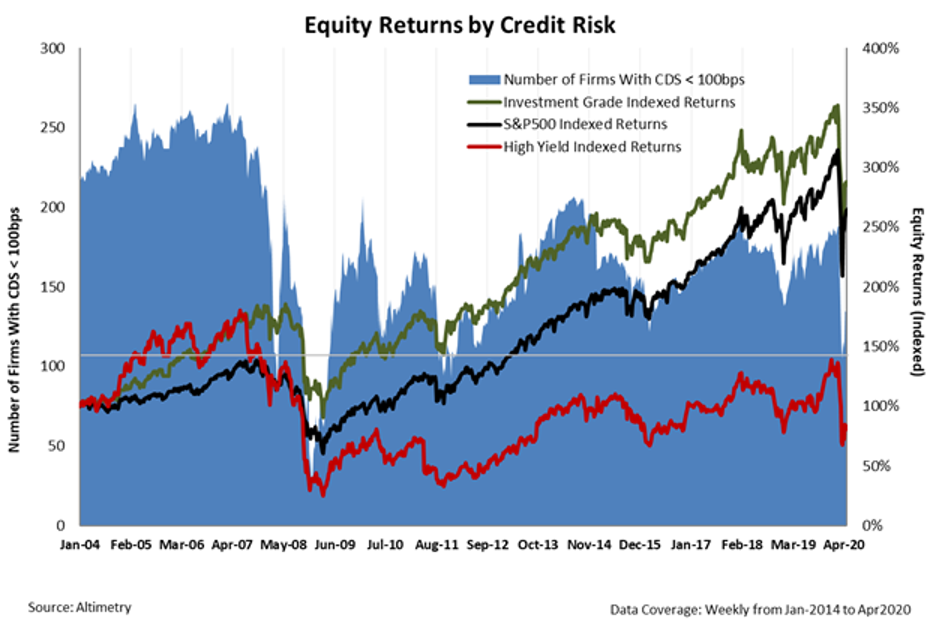

In the chart below, you can see how HY and IG companies have performed since 2004 – including before, during, and after the Great Recession.

Even though HY companies outperformed IG companies from 2004 until early 2007, they were also the first companies to start falling when the housing market collapsed.

Not only did HY companies fall farther, but they have barely recovered since. On the other hand, IG firms and the market as a whole have been much stronger. Take a look...

Because these companies end up having operational issues as they work off their debt, they can't recover as fast as healthier, safer companies. This is why we see a lot of value traps in the HY space.

Right now, they look cheap... but history says they're not likely to recover like their IG counterparts.

There are diamonds in the rough, of course. But if you're thinking about picking HY stocks to buy, you have to be selective and dedicate the time for proper due diligence. Otherwise, you may end up falling for the dreaded value trap.

Regards,

Joel Litman

May 11, 2020

'Necessity is the mother of invention'...

'Necessity is the mother of invention'...