Home buying has been surging during the coronavirus pandemic...

Home buying has been surging during the coronavirus pandemic...

And September data show that the trend isn't letting up. As industry publication HousingWire explained late last month, existing home sales jumped more than 9% from August and more than 20% from a year ago.

During fall and winter, housing prices usually round off and sales slow. And yet, the median home price rose another 14.8% in September to more than $300,000.

Inventory is also turning over quicker than ever... 71% of homes sold were on the market for less than a month.

These staggering numbers show a tangible way in which the "At-Home Revolution" is playing out. Because people are spending more time inside, they especially want to live in a house that suits them. For many folks, this has resulted in a flight to the suburbs to have more open and green spaces.

Furthermore, homebuilders can't build fast enough. Total housing inventory is measured in months, by counting how long it would take to sell all existing inventory. The month's supply of inventory was 2.7 months, down from four months only a year ago.

This trend is a structural shift in the way consumers are spending. As we highlighted last week, these changes are likely to last longer than the pandemic itself.

And once people move to the suburbs and get bigger houses, lifestyles change...

Urbanites rely on public transportation, while those in suburbs predominantly use cars. People in cities also tend to go out for food more often than those in suburbs do. Additionally, many folks in city apartments don't have their own washer and dryer. Instead, they must go to the laundromat to clean their clothes.

This continuing modern migration will create a plethora of industry shifts. These are huge changes... and the companies that can take advantage are poised for massive gains in their stock prices.

One firm that investors would expect to benefit from the surge in homebuying is Zillow (ZG)...

One firm that investors would expect to benefit from the surge in homebuying is Zillow (ZG)...

The company is best known for its online platform, which allows anyone to look up properties from around the country and find out the "Zestimate" – an estimate of the price of the property if it were currently for sale.

Additionally, Zillow shows the details of any homes for sale, including transaction history and general information about a property.

Another powerful application of the website is its aggregate information. Zillow shows how prices have changed in different zip codes and predicts how the median home price will change in the next 12 months.

The company has been building these core competencies for more than a decade. And yet, despite the value to these insights, it appears that Zillow has mostly never made a profit.

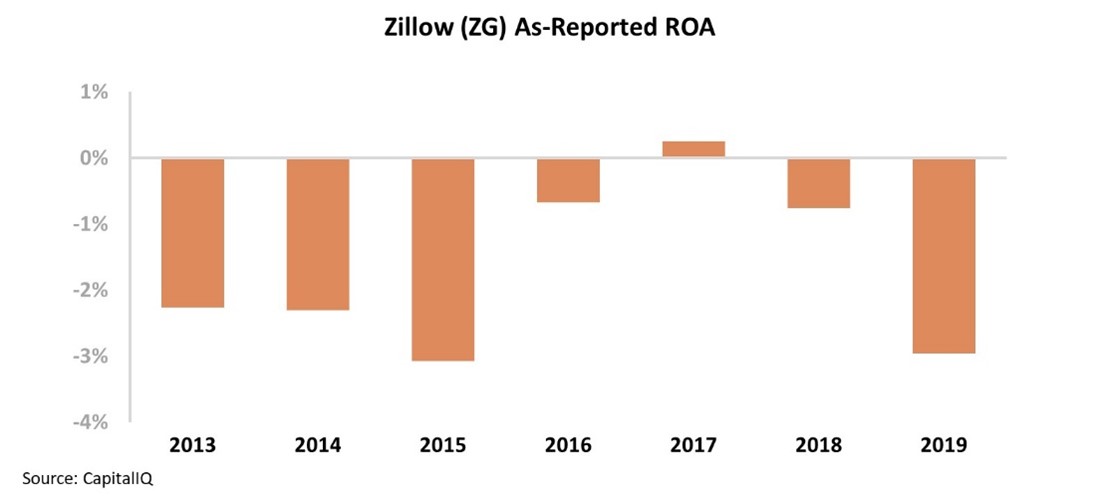

The company's as-reported return on assets ("ROA") has been mostly negative over the past seven years – ranging between negative 3% and 0%. Take a look...

Considering the disappointing as-reported profitability, it's only logical that management might try to diversify the business. With that in mind, over the past three years, Zillow has pivoted from being just a platform for information... It has expanded into becoming a market maker in the housing market.

Zillow has sought to buy homes in specific markets it finds attractive – leveraging its superior analytics and putting its balance sheet to work to profit from a new business angle. The eventual goal is to buy homes at a good price on the back of its liquidity and analysis and then sell them for a profit.

Zillow's management team chose this avenue thanks to all of the data the company collects. Management believed it could use this information to find insights in the housing market that other buyers may not have.

Again, considering how unprofitable Zillow appears to be, management's strategy change makes sense. If the company isn't profiting from its data analytics on the platform, it should use the platform to profit in new ways.

However, this strategy meant that Zillow would no longer be a high-growth, "asset light" tech start-up. Now, Zillow is more like a bank – borrowing and deploying capital to buy and sell homes.

Management was aware of the possible downsides, but chose the new strategy in an attempt to boost profits.

But the real problem is that management wasn't looking at the correct numbers. GAAP accounting is distorting Zillow earnings and profitability metrics.

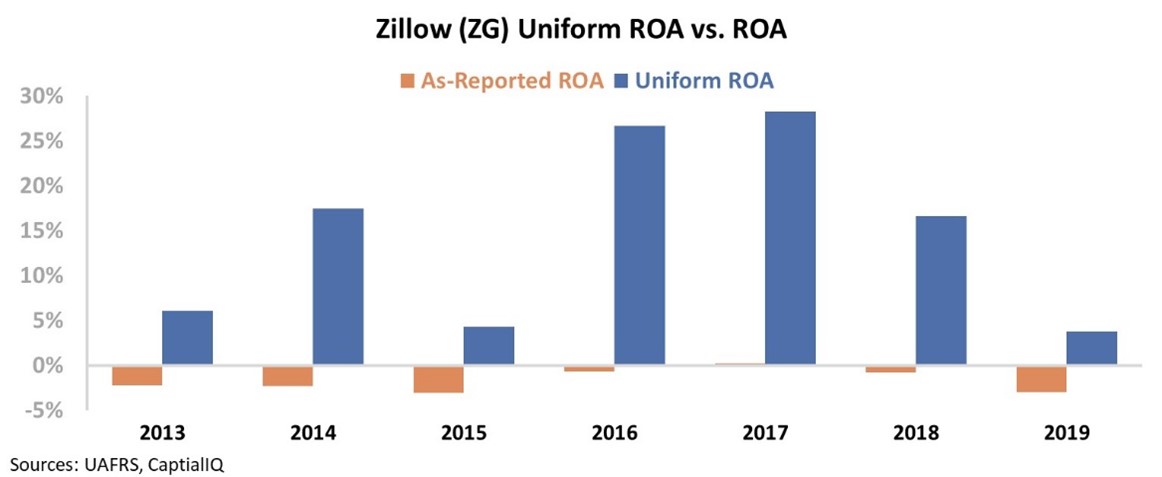

Uniform Accounting shows that the company actually had robust profitability prior to changing its strategy. Zillow's Uniform ROA was more than 20% in 2016 and 2017. The company was a cash machine as a platform business – the kind of technology platform investors pay a premium for.

However, Uniform ROA has cratered since the company implemented its new strategy. Zillow is investing too heavily in a business with low returns and high asset intensity. The result is a meager 4% Uniform ROA in 2019.

Zillow shows how as-reported metrics don't just mislead investors and make them miss big opportunities... Bad accounting data can also mislead management into making bad strategic decisions.

Zillow diverted too far from its original strategy and now has a less efficient business.

With Uniform ROA crumbling over the past two years, Zillow looks like a stock that investors should be wary of.

Regards,

Rob Spivey

November 24, 2020

P.S. The At-Home Revolution will create both winners and losers from the massive societal shift. It's critical to be selective... Not every company that looks like an obvious winner will turn out to be a good investment.

That's why in Altimetry's Hidden Alpha, we've used the power of Uniform Accounting to look past the as-reported "noise" and identify the best stocks to profit off this trend. Learn more here.

Home buying has been surging during the coronavirus pandemic...

Home buying has been surging during the coronavirus pandemic...