The Federal Reserve is messing with the banking system once again...

The Federal Reserve is messing with the banking system once again...

The last time regulators made such a move was in late 2007.

Indeed, it's easy to think of the Great Recession as no more than greedy banks selling risky home loans and complex financial instruments.

That was certainly part of it.

Banks, driven by the allure of easy profits, had recklessly given out mortgages to individuals with questionable creditworthiness. They had to create new kinds of loans like "NINJA" (which stands for "no income, no job, no assets") to keep selling more products.

In other words, banks were lending to folks who had no way of repaying their loans.

When many of these borrowers defaulted, the so-called "subprime bubble" burst, sending shock waves through the financial world.

However, during this period, there was a bigger underlying issue for banks: "mark to market" accounting.

Basically, mark-to-market accounting requires companies to value their assets and liabilities at their current market price, rather than their historical cost.

Stocks "mark up" and "mark down" constantly throughout the day. (This is what's referred to as "marking.")

Meanwhile, assets like houses usually only change their "mark" every few years when they change hands.

In 2008, the Fed mandated that banks use mark-to-market accounting. Unfortunately, this caused them to mark down the loans they had given to subprime borrowers. And as loan values fell, folks began to panic...

Several big banks faced old-fashioned bank runs, investors ran for the hills, and we faced our worst bear market of the century.

As we'll explain today, the Fed is trying to meddle with the banking system once again. And despite its good intentions, it may actually be setting us up for an even deeper credit crisis...

The Fed is tightening reserve requirements...

The Fed is tightening reserve requirements...

Back in July, the Fed's Board of Governors proposed that America's biggest banks (those with at least $100 billion in assets) raise their capital requirements by about 20%.

In essence, that means they need to keep 20% more cash relative to their loan portfolios.

This will be an absolute nightmare for the credit market... especially given that banks are already tightening their lending.

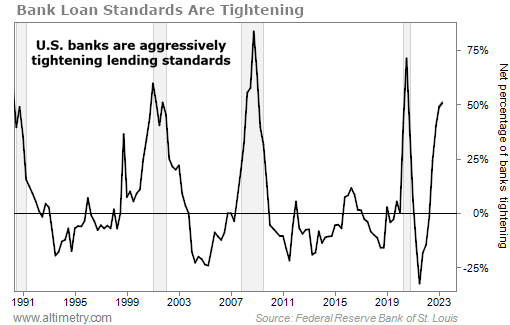

We can see this by looking at the Senior Loan Officer Opinion Survey ("SLOOS").

The SLOOS is a quarterly poll conducted by the Fed to gauge the health of the banking sector. It asks loan officers if their lending rules have tightened, eased, or stayed the same over the past three months.

The survey's results also help the central bank gauge business and household demand for loans.

This information offers a snapshot of the economy's financial well-being. And it can hint at future economic trends... which helps both policymakers and investors make informed decisions.

In the second quarter, 51% of banks tightened their lending standards. That's about as high as it gets without triggering a recession...

As you can see, any time the percentage of banks tightening lending standards has topped 50%, we've entered a recession (as marked by the areas shaded in gray).

Banks pulled back on lending to protect themselves from losses. They were concerned about financial stability and the health of the broader economy... Thus, they prioritized safeguarding their assets and maintaining liquidity.

Now, the Fed is proposing boosting capital requirements for big banks – and that's bad news for banks and borrowers alike.

You see, for banks, higher capital mandates mean they need to hold a greater proportion of their assets as capital. This can reduce their ability to lend and potentially decrease their profitability.

For borrowers, a tighter lending environment can translate to less available credit. It also means more stringent loan-approval criteria... and possibly higher interest rates.

Collectively, these factors can stifle economic growth. Banks end up becoming more risk-averse, and consumers and businesses face challenges in accessing needed capital – which could potentially lead to defaults.

This means that the amount of banks tightening their lending standards will just keep climbing.

A potential credit crunch is right around the corner...

A potential credit crunch is right around the corner...

As we showed you, banks are aggressively tightening lending standards today. And increased capital requirements could make that even worse...

Though the Fed is ultimately trying to protect the economy, its proposal will likely only force a bigger credit crunch and a major refinancing issue. It will set us up for a significant crash and market panic.

Regards,

Joel Litman

September 27, 2023

P.S. The Fed insists the worst is over... But every warning sign on Wall Street is telling a different story. If you don't want to get blindsided by the next market crash, you must heed my latest warning...

Tonight at 8 p.m. Eastern time, I'll reveal the crisis that will affect a tidal wave of money – including hundreds of stocks, many of which you probably own. I'll also share the No. 1 way to protect your portfolio from the next market disaster.

It's not options... crypto... or anything you've likely considered before. But billionaires and top hedge funds are already pouring billions of dollars into this strategy. I'll share the full details, for free, tonight. Reserve your spot here.

T

T