There's no way around it... The banking sector had an ugly week.

There's no way around it... The banking sector had an ugly week.

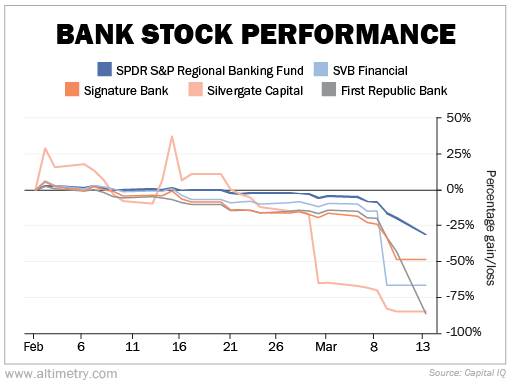

It started last Wednesday, when cryptocurrency clearinghouse Silvergate Capital (SI) announced it was shutting down. Silvergate had become the go-to bank for cryptocurrency businesses over the past decade.

The stock, which was already in a strong downtrend, plunged 42% in a day... effectively wiping out shareholders.

Two days later, Silicon Valley Bank ("SVB") – a subsidiary of SVB Financial (SIVB) – collapsed in similar fashion. Its problems stemmed from its proximity to the venture capital ("VC") world.

And the pain wasn't finished... Over the weekend, commercial banking enterprise Signature Bank (SBNY) was taken over by regulators as well. Many folks fear First Republic Bank (FRC) could be the next to fall.

The market is spooked. The S&P Regional Banking Fund (KRE), which tracks a basket of bank stocks, is down 13% since Silvergate collapsed. Folks are wondering if this is the beginning of another 2008-style financial crisis.

It's not.

To put it simply, these banks made some unfortunate mistakes in a tough environment. All three suffered from the same problem. That doesn't mean the entire system is going to come crashing down.

Today, we'll examine exactly what went wrong with Silvergate, Silicon Valley Bank, and Signature... We'll explain why what happened doesn't reflect a larger problem in the financial sector... And we'll detail what you should expect from the market going forward.

What we're seeing feels a lot like 1929...

What we're seeing feels a lot like 1929...

For the past 100 years, a system called the Federal Deposit Insurance Corporation ("FDIC") has insured bank deposits.

The FDIC was created in 1933. Its goal was to restore confidence in U.S. banks after the early years of the Great Depression.

Under the FDIC, depositors didn't have to worry about leaving their money with a bank... no matter what happened to the bank itself. The FDIC guaranteed they'd get at least some of their cash back.

This system also dissuaded depositors from rushing to withdraw money when they thought a bank might go under – what's known as a "bank run."

That changed last week.

Silvergate's big depositors were crypto exchanges. So you might think it collapsed because clients like Binance or Coinbase or the now-defunct FTX couldn't pay it.

That's not what happened. And it wasn't something nefarious or fraudulent, either.

Those exchanges were depositors at Silvergate...

Those exchanges were depositors at Silvergate...

They'd take cash in from crypto investors and it would end up at Silvergate.

Silvergate did the same thing every bank does with its deposits. It invested them. In Silvergate's case, it did this through loans to crypto companies, as well as generally "safe" investments like mortgage-backed securities ("MBS") and U.S. Treasurys. Its loan portfolio was tiny compared with its MBS and Treasury investments.

The crypto market entered a brutal "crypto winter" in 2022. Bitcoin, the most popular crypto, dropped from more than $47,000 per coin to as low as $15,000 per coin.

Investors already wanted out of the crypto market. So the exchanges pulled cash from Silvergate to send it back to customers. And then, FTX went down...

FTX was one of the biggest crypto exchanges in the world. Everyone panicked about what its bankruptcy meant for the other exchanges. Crypto investors rushed to take out money even faster. Exchanges had no choice but to follow suit, yanking money out of Silvergate as fast as they could.

Silvergate couldn't keep up. Because of how fast money was being drawn down, it had to sell its investments to raise cash. And because interest rates have been rising, those investments were losing value.

So when Silvergate sold its investments to raise cash, it was taking losses. Once depositors got wind of how big those losses were, they panicked again. Last week, they all scrambled to get out and protect their cash.

That forced Silvergate to sell more assets at a loss... until regulators had to step in.

SVB was a different version of the same story...

SVB was a different version of the same story...

The bank wasn't exposed to the crypto disaster. Instead, SVB has enjoyed nearly 40 years as the place for VC money. And 2021 was a banner year to be a VC bank.

Interest rates were low. VC firms had plenty of money flowing in. They were making big investments in startups. And all those companies and funds were depositing their money into Silicon Valley Bank.

In 2021, SVB's deposits rose from $102 billion to $189 billion. That's a massive jump.

It couldn't possibly loan out that money to venture companies fast enough. As fast-growing as VC can be, it still has limits. So SVB took $87 billion in new deposits... and invested roughly $63 billion of it into MBS, $11 billion in U.S. Treasurys, $3.5 billion in municipal bonds, and the rest in traditional loans.

Well, crypto wasn't the only industry to get crushed last year. As we've been telling you for months, it was also a tough time for VC.

With interest rates rising, investors weren't as interested in investing in companies that might not make money for years – or even decades. That meant all those startups relying on cheap financing saw that cash dry up before their eyes.

They couldn't take losses to grow forever. They were forced to make a profit or withdraw their remaining cash.

So, much like what happened with Silvergate, SVB's clients started to draw down their deposits. Deposits dropped $16 billion by the end of 2022. They've fallen more since.

And much like Silvergate, as the bank's deposits started falling, it had to start selling its investments.

It had put a ton of money in investments like MBS when they were at their lowest-ever yields. With interest rates rising, it took huge losses on those investments as it sold them.

You just read what we wrote about Silvergate... And unless you've been living under a rock, you probably already know what happened next. SVB didn't have the cash to pay all its depositors. The bank collapsed.

It's not just that Silvergate and SVB were heavily exposed to industries that got crushed...

It's not just that Silvergate and SVB were heavily exposed to industries that got crushed...

There's something else special about the two banks that put them at the epicenter of this mess. It has to do with their depositors... and the FDIC.

The FDIC insures deposits up to $250,000 in any depositor's bank account. If a bank goes belly-up, any cash above $250,000 isn't insured. The excess deposits become unsecured creditors.

If the bank goes bankrupt, depositors have to wait for it to be wound down before they can hopefully get all their money back.

The big exchanges that banked with Silvergate had way more than $250,000 in their accounts. They had billions of dollars. So did many of the VC firms that banked with SVB.

They knew their money wasn't protected by insurance. So when things started looking dicey, depositors rushed to the exits to protect themselves.

This last piece of the puzzle is why investors have also been targeting Signature and First Republic.

Signature Bank was down 23% on Friday. Shareholders lost everything once regulators seized it. Like Silvergate and SVB, many of Signature's depositors had uninsured balances. The bank even had some crypto exposure. So it was caught up in the maelstrom.

First Republic dropped 53% at its lowest last Friday. It has cratered another 33% from there as we go to press.

These banks have started dragging down the entire regional banking industry, which is down roughly 30% since early February. Take a look...

First Republic Bank also caters to high net worth ("HNW") individuals with big account balances. A lot of these folks invest in areas like venture capital. So investors are acting as though it must be the next shoe to drop.

Bank regulators stepped in over the weekend to say that all U.S. bank deposits – no matter how high they are – are recoverable. Even before that, investors betting on First Republic's downfall were missing the point.

Now that regulators are standing behind all deposits, it removes the risk of a bank run and a liquidity crunch entirely. And bank regulators are offering to lend against bank assets at book value. That mean banks won't need to sell assets at a loss even if depositors take money out of their accounts.

That means First Republic's depositors likely won't force it into the same situation that took down Silvergate, SVB, and Signature.

And even without bank regulators stepping in, First Republic Bank probably wasn't at risk...

And even without bank regulators stepping in, First Republic Bank probably wasn't at risk...

Yes, similar to the others, First Republic does have a HNW client base. However, its assets don't lose value like these other banks. It's the opposite of how Silvergate made its money.

Silvergate had a tiny loan portfolio and a lot of Treasurys and MBS. And those Treasurys and MBS lost value because of rising interest rates.

First Republic, on the other hand, has a huge loan portfolio. So its investments aren't losing value, and the bank is still collecting its cash.

On top of that, it doesn't have the same concentrated exposure to markets that are facing their own capital crunches. That's different from Silvergate's and Signature's crypto clients, or Silicon Valley Bank's VC exposure.

The same is true for the rest of the regional bank space...

Many regional banks dropped at the end of the week and early this week as people started worrying about potential contagion.

Almost none of these regional banks are going to have the same issues as Silvergate, SVB, and Signature. They don't have the same concentrated depositor bases in volatile, crashing industries.

In short, the market is punishing all other bank stocks... when Silvergate, SVB, and Signature weren't like all other banks.

A number of bank stocks in our own Altimetry's High Alpha and Microcap Confidential portfolios have been caught up in this panic. As it stands, we don't believe their businesses are at risk.

That doesn't mean the markets aren't in any danger from the past week's events...

That doesn't mean the markets aren't in any danger from the past week's events...

The chronic issue that contributed to the downfall of Silvergate, SVB, and Signature was asset values in the financial system.

The past year brought one of the fastest interest-rate jumps in history. And that means many traditionally "safe" assets – those that offer value by generating steady income streams – are worth a lot less than they have been historically.

The owners of those assets have been doing everything in their power not to mark the value of those assets down. That's especially true in the spooky-sounding "shadow banking" industry.

Shadow banks provide services similar services to the banking industry... only they fall outside of banking regulation. Hedge funds and investment managers that provide financing for real estate projects are two examples.

These shadow banks don't have to report the value of their assets unless they're forced to sell something. They're doing what they can to avoid selling. Because once they do, investors will realize just how widespread the issue is.

We'll dive more into this issue in the coming weeks. In the meantime, don't panic about all banks... because what happened with Silvergate, SVB, and Signature wasn't typical. It was a reflection of specific problems with their specific business models.

There might still be some choppiness as the market processes what just happened. However, we expect the majority of regional banks to recover.

Regards,

Joel Litman and Rob Spivey

March 14, 2023

There's no way around it... The banking sector had an ugly week.

There's no way around it... The banking sector had an ugly week.