Two men walk into a bank looking for a $1 million loan...

Two men walk into a bank looking for a $1 million loan...

One is a successful businessman with a hefty $10 million in cash. He also has investments and a business under his belt, with $20 million in debt... all with the same bank.

The other is a diligent Amazon (AMZN) worker with a spotless credit record, zero debt, and $50,000 in savings.

Now, let me ask you a question – who's more likely to snag that $1 million loan?

If you guessed the businessman, congratulations. You're absolutely right.

The bank knows this man well. It sees his $10 million in liquid assets... and figures his business must be doing all right to manage a $20 million debt load.

An extra million dollars is a small step up... just 5% more debt.

As for the Amazon worker, the bank doesn't have much to go on. A $1 million loan would be a huge leap from what this guy is used to handling.

While it might seem counterintuitive, this is the same situation you see countless times in corporate America. Today, we'll explain why huge companies with a lot of debt often get better treatment than small companies that look safer on the surface.

Regular readers know we've talked a lot about credit over the past few months...

Regular readers know we've talked a lot about credit over the past few months...

Even if you've never set foot in the bond market, what's going on in credit can have a huge impact on stocks. So we always urge folks to keep an eye on credit health, particularly in a volatile market like this.

That's why we were so impressed with a recent question from subscriber Robert B. of Bristol, England.

He noticed that tools like our Credit Analyzer rely on market cap as a factor for determining credit health. Specifically, the larger the company, the better the Market Equity Liquidity grade it receives.

Meanwhile, Recovery Rate gives us a general idea of how much money creditors can expect to recover in a bankruptcy. It's roughly the value of a company's assets compared with its debt.

And our Asset Backing grade averages Liquidity and Recovery Rate.

Here's how it looks when you put it together in the Credit Analyzer...

Robert made the point that smaller companies might have an edge in debt management and asset liquidation... therefore giving them higher recovery rates than larger companies. In terms of assets, it's like the difference between having to sell 10 vans versus 1,000.

He wondered whether market cap, or the total value of a company's shares, might not tell the whole story about its ability to settle debts. That value is really in the hands of shareholders, after all.

However, let's go back to our $1 million loan example...

However, let's go back to our $1 million loan example...

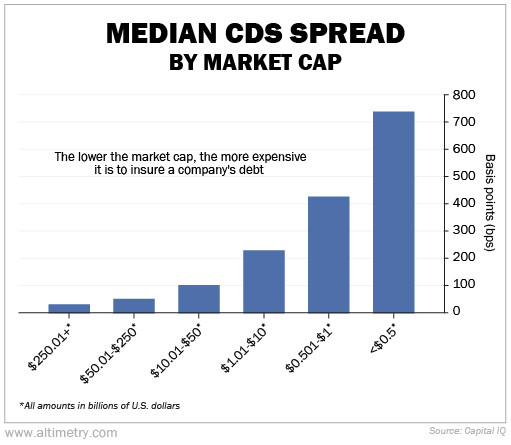

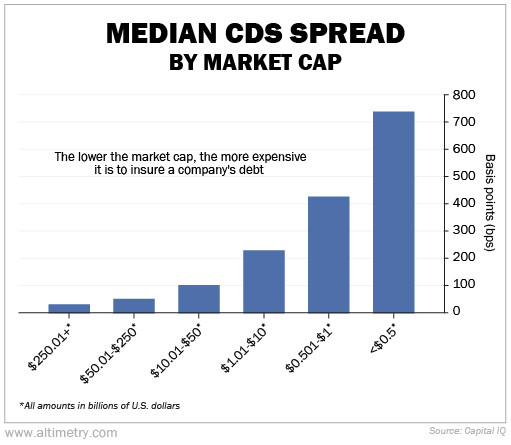

When it comes to corporations, we can see a similar relationship through credit default swaps ("CDS")...

A CDS is a type of financial derivative that allows an investor to "swap" or offset their credit risk with another investor. It provides insurance against the risk of a default by a particular company or by companies of different sizes.

The price of a CDS is also called the "spread."

Like our businessman with $10 million in cash, larger companies often have a proven ability to sustain debt. They typically possess stronger defenses against market shifts... like a wider customer base or a more diverse product line.

Smaller companies tend to have higher CDS spreads. Lenders view them as much riskier and aren't as willing to lend to them.

For companies with market caps of more than $50 billion, CDS costs are less than 100 basis points ("bps") per year... or 1% of the price of the loan.

Companies with market caps below $1 billion cost more than 400 bps (4%) per year to insure. And the very smallest companies – those worth less than $500 million – cost investors more than 700 bps (7%) per year.

Take a look...

CDS spreads are a risk assessment based on track record and scale. So when smaller companies have higher spreads, it's the market's way of saying that it hasn't seen enough...

Investors don't trust that smaller companies can handle this much debt.

Bigger often equals better in the credit world...

Bigger often equals better in the credit world...

This doesn't mean big companies can't fail or that small ones are always risky. It's about patterns and probabilities.

That's why when we look at credit risk, we're not just looking at a company's current debt or assets. We're also checking its history of managing debt, its liquid assets, and what the market thinks of its ability to keep the lights on and the doors open.

And when it comes to assessing the credit risk of the stocks and bonds you own, don't assume a company with less debt is automatically safer.

Banks pay attention to credit history... and they'll make sure to take care of their biggest customers.

Regards,

Joel Litman

December 20, 2023

Two men walk into a bank looking for a $1 million loan...

Two men walk into a bank looking for a $1 million loan...