As we turned the calendar to 2024, investors were hoping for a Federal Reserve pivot...

As we turned the calendar to 2024, investors were hoping for a Federal Reserve pivot...

But the latest data isn't playing along.

The year kicked off with stronger-than-expected job numbers. Unemployment held flat at just 3.7%, which is lower than the Fed was hoping for. Not to mention, October's unemployment rate was recalculated at just 3.8%... down from its originally reported 3.9%.

A strong job market is a mixed blessing. It suggests resilience, but it also complicates the Fed's policy path.

Inflation is proving persistent, too. It ticked back up to 3.4% in December after falling to just 3.1% in November.

Investors are starting to lose hope that the Fed will cut interest rates at early as March. And every month that passes without a pivot puts more pressure on the economy's ability to achieve a graceful slowdown...

The market is on tenterhooks... and many folks believe a shift to lower interest rates is essential.

The market is on tenterhooks... and many folks believe a shift to lower interest rates is essential.

Their rationale is clear – lower rates would allow struggling companies to refinance their debt more affordably. That could help avert a wave of bankruptcies.

But the Fed knows cutting rates too early would be deadly for the economy. If prices and the job market don't cool off, we could set ourselves up for an entirely new cycle of high inflation.

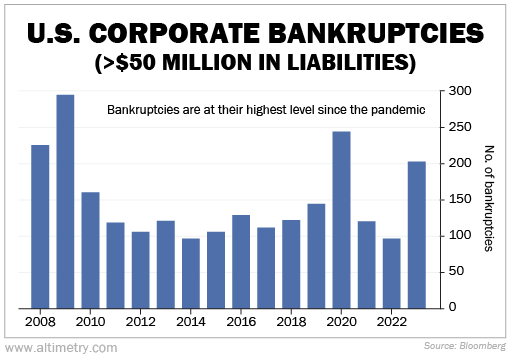

A short-term recession might be the lesser evil. But that's not what the corporate world wants to hear. Last year's fast rate hikes led to a 108% increase in major corporate bankruptcies.

Take a look...

After such a brutal year for bankruptcies, investors are having a tough time wrapping their heads around why the Fed hasn't cut rates.

When companies don't have enough cash, it starts a chain reaction. Bankruptcies mean people lose their jobs and investors lose money. Banks and lenders start to get nervous and make it harder for everyone to borrow money.

This isn't just about a few big companies struggling...

This isn't just about a few big companies struggling...

It's a sign of a bigger problem that could spread to many businesses. Companies that were just getting by before are now starting to fold.

But the Fed would rather deal with a wave of bankruptcies than another wave of inflation... which would undo two years' worth of rate hikes and put us back at square one.

Investors still hope that the Fed will start easing rates soon. That's why the market is completely flat to start the year. But the rate-cut window seems to be closing, especially since inflation and employment data just won't budge.

Stocks have very little reason to keep rising. There's already plenty of strain in the corporate sector. If interest rates remain high, the stock market is going to pull back.

Regards,

Rob Spivey

January 22, 2024

P.S. Today's credit environment could be a disaster for most assets over the next 12 to 36 months. But it's actually the perfect setup for one particular type of investment – completely outside of stocks.

I've been "pounding the table" on this rare opportunity since last year... and it's so critical that Altimetry founder Joel Litman and I recently re-opened our original presentation, covering what we're seeing in full.

We took our offer off the web last week. But due to popular demand from readers, I'm thrilled to announce that we're bringing it back for a short time. Please don't put it off any longer... If you're ready to protect your portfolio with this crucial step, listen to our urgent message right here.

As we turned the calendar to 2024, investors were hoping for a Federal Reserve pivot...

As we turned the calendar to 2024, investors were hoping for a Federal Reserve pivot...