With the election on the horizon, voters are fixated on inflation... and how it's stealing from their wallets.

With the election on the horizon, voters are fixated on inflation... and how it's stealing from their wallets.

According to recent polls, about 20% of folks say inflation is their No. 1 concern. The next largest is health care, at 14%.

And in the middle of summer, with many people on vacation, they're feeling the effects of inflation in one particular area... at the pump.

The Biden administration gets a lot of blame for inflation, including the high oil prices that plagued consumers for a lot of 2022. The president didn't have as much control as a lot of folks think.

Oil prices surged because Russia, a global oil exporter, invaded Ukraine. Almost the entire Western world embargoed Russian oil, causing supply to dry up when demand was still strong.

Regardless, Biden knows he'll be judged for how inflation and consumer prices move over the next few months.

He's prepared to do whatever it takes to keep prices low... and that has investors worried about one oil major in particular.

Biden needs to keep flooding the market to keep oil prices affordable at the pump...

Biden needs to keep flooding the market to keep oil prices affordable at the pump...

Just last month, one of his top energy advisers said the administration is willing to take oil out of America's Strategic Petroleum Reserve ("SPR") to keep prices low.

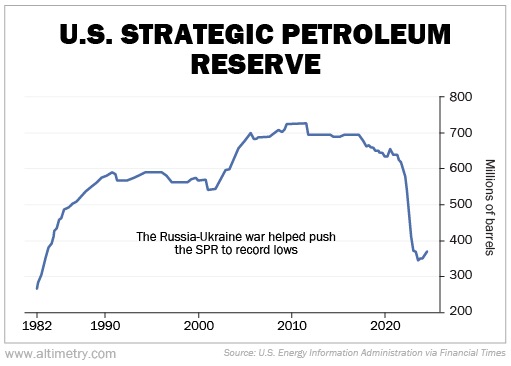

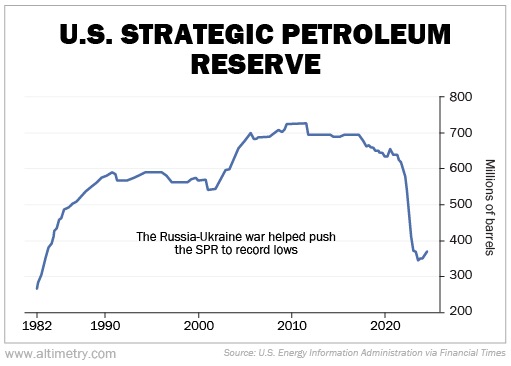

The SPR is a government-owned oil stockpile saved for energy-related emergencies. Biden has already drained a lot of it over the past few years.

Oil prices have surged more than 50% since Biden took office. The SPR has hit its lowest levels since 1983... mainly due to the drain of oil reserves during Russia's invasion of Ukraine.

Take a look...

Biden was already under fire for these oil issues. He's now fighting for votes after the recent presidential debate. Republican candidate and former President Donald Trump has also been using inflation against Biden in his campaign.

The president is doing everything in his power to cool inflation, especially in energy. That's why he's willing to tap further into the SPR to keep prices low.

And while Biden's efforts may help his presidential chances, it has a lot of investors worried about big energy companies like ExxonMobil (XOM)...

And while Biden's efforts may help his presidential chances, it has a lot of investors worried about big energy companies like ExxonMobil (XOM)...

Exxon is the biggest oil company in the U.S., with a market cap of about $500 billion.

With its acquisition of Pioneer Natural Resources last October, the company has more than doubled its presence in the Permian Basin... one of the most prolific oil and gas regions in the world.

And yet, despite Exxon's boom, investors are leaning slightly bearish.

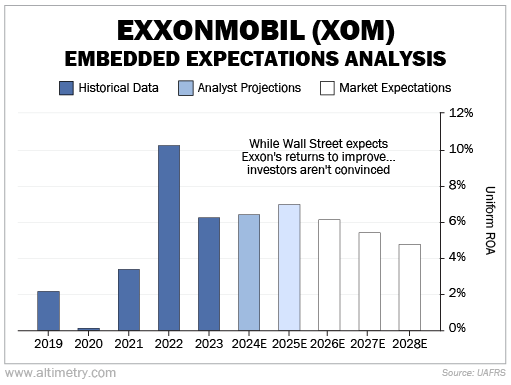

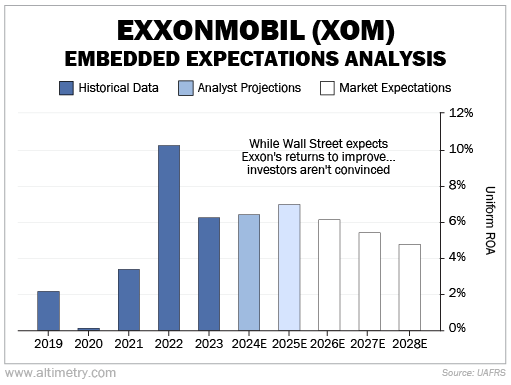

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Exxon's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Exxon's Uniform return on assets ("ROA") was up and down in the past five years. Returns were near zero in 2020 as oil prices plunged. They rose to double digits when prices peaked in 2022.

Last year, Uniform ROA was slightly above 6%. As you can see in the chart below, Wall Street analysts expect it to reach 7% by 2025... while the market believes it will fall to 4.8% by 2028.

Investors are concerned about possible short-term pricing pressure on oil. We think they're overreacting.

Unless oil prices decrease significantly moving forward, these folks are being far too bearish. Biden needs to keep oil in a "sweet spot" for the next several months. He'll probably release enough oil to keep prices flat or slightly down through the election.

He won't send the entire industry into a price glut. He can't afford to abuse the SPR that blatantly... It would scare off voters in the other direction.

Exxon is known to be a high performer when oil prices surge...

Exxon is known to be a high performer when oil prices surge...

And although we don't see a huge increase on the horizon, pressure on oil prices could very well relax after the election.

Exxon is well-positioned to capitalize on such an opportunity with its attractive upstream portfolio.

Investors should keep a close eye on oil prices... and not just because of Exxon. This commodity will remain an important driver of inflation.

And it might even be a decisive factor in the upcoming election.

Regards,

Joel Litman

July 10, 2024

With the election on the horizon, voters are fixated on inflation... and how it's stealing from their wallets.

With the election on the horizon, voters are fixated on inflation... and how it's stealing from their wallets.