Last week, news broke about a misconduct investigation involving Norfolk Southern (NSC) CEO Alan Shaw...

Last week, news broke about a misconduct investigation involving Norfolk Southern (NSC) CEO Alan Shaw...

And the market didn't care. At least, not much...

Shaw had been working at Norfolk Southern since 1994. He worked his way up to becoming a CEO in May 2022. And last week, he was fired for an alleged inappropriate workplace relationship.

The investigation is still in the early stages, so we're far from knowing the full story. But that isn't our main point of focus today...

You see, a major event like a CEO investigation or firing would typically cause a huge move in the stock... especially if it involves people who have been working for the company for a very long time.

Norfolk Southern's stock hasn't moved much, though. Shares are about flat since the news hit. Today, we'll explain why investors have barely batted an eye...

Shaw's firing wasn't entirely unexpected... even if the reason was a surprise.

Shaw's firing wasn't entirely unexpected... even if the reason was a surprise.

While he was popular among Norfolk Southern employees, there were also many parties that wanted to get rid of him. Ancora Capital, an activist investment firm, was one of them.

Ancora held Shaw responsible for the company's underperformance. He was in charge of the company when a train carrying hazardous materials derailed and caught on fire in Ohio last year.

That incident destroyed Ancora's trust in him. The firm claimed Norfolk Southern would be better off with someone else in charge. Earlier this year, it acquired a $1 billion stake in an effort to get control of the board.

In May, Ancora's initial attempt failed. The firm only won three seats out of seven proposed candidates on Norfolk Southern's 13-member board. But it didn't stop there...

Ancora gathered the support of two unions, an investment advisory firm, and most importantly Cleveland-Cliffs (CLF) – one of Norfolk's largest customers.

Amid all this pressure, things eventually turned out the way the firm wanted. As we mentioned, though, the stock hasn't risen much... even with Shaw gone.

That's because the investors already had a good grasp on this company...

That's because the investors already had a good grasp on this company...

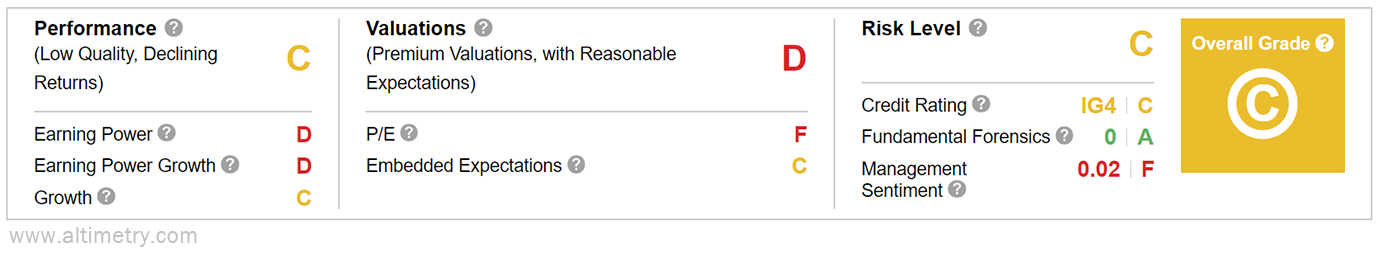

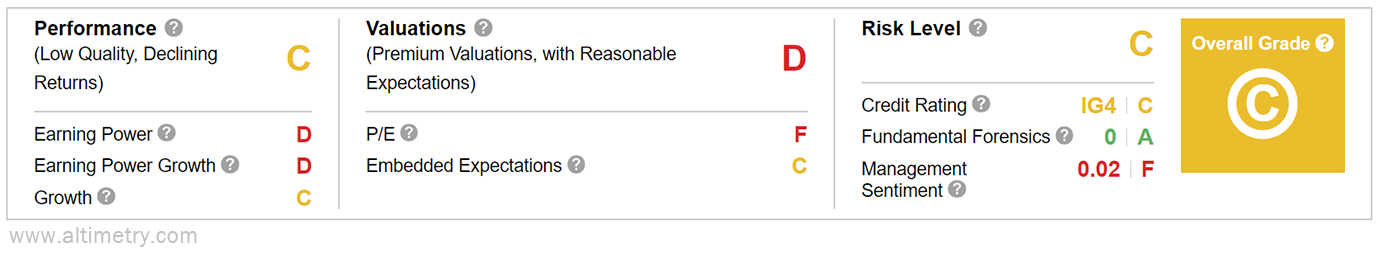

To understand what's going on with Norfolk Southern, we can take a closer look using the Altimeter Pro.

It cuts through the noise of flawed generally accepted accounting principles ("GAAP")... and assigns companies easy-to-understand grades using Uniform Accounting metrics.

Norfolk Southern's Uniform return on assets ("ROA") was 7% last year... the worst profitability it has seen since COVID-19 started.

Wall Street analysts don't expect a recovery, either. They think returns will fall to 6% this year, or half of the corporate average. The Altimeter Pro gives Norfolk Southern a "C" Performance grade.

Shares are too expensive for this level of performance. The stock trades at a 26 times Uniform price-to-earnings (P/E) ratio, above the long-term corporate average of 20 times. Norfolk Southern gets a "D" for Valuations.

Take a look...

Whether or not you agree that Shaw leaving is a good thing for Norfolk Southern, there's not much room for investors to act... The stock is already expensive.

That's likely why shares didn't fluctuate much after the news. Any "turnaround" story has already been priced in.

Regards,

Joel Litman

September 18, 2024

P.S. The Altimeter Pro offers straightforward grades for more than 5,000 U.S.-listed companies... and can even alert you when there's a major move in the financials.

For a limited time only, I'm offering access to this elite tool for only $99 a month – along with more than $1,500 in free research and bonuses.

Plus, each week, you'll get our Altimeter Weekly report... which breaks down some of our top "Opportunities" and "Stay Away" stocks, and a lot more insights. Click here to learn more.

Last week, news broke about a misconduct investigation involving Norfolk Southern (NSC) CEO Alan Shaw...

Last week, news broke about a misconduct investigation involving Norfolk Southern (NSC) CEO Alan Shaw...