Based on cash flow alone, our favorite shadow-bank punching bag's real estate fund didn't do so bad last year...

Based on cash flow alone, our favorite shadow-bank punching bag's real estate fund didn't do so bad last year...

The Blackstone Real Estate Income Trust ("BREIT") generated $2.7 billion in cash flow in 2023.

BREIT mostly invests in what we'd consider "good" parts of the real estate market... like multifamily homes, warehouses, and data centers.

Last year's cash flow was just $22 million less than what it saw in 2022. That's solid performance considering how difficult 2023 was for the real estate market.

However, BREIT also paid out $2.8 billion to investors... In other words, the fund paid out more money than it made.

It was the first time that BREIT didn't make enough money to cover its payouts.

That's never good news for a real estate investment trust ("REIT"). While REITs are required to pay out most of their income, paying out all of or more than what they make is dangerous and unsustainable.

As we'll discuss today, this may be just the beginning of BREIT's troubles...

REITs are special investment vehicles...

REITs are special investment vehicles...

They typically don't have to pay taxes because they pay out most of their taxable earnings via dividend payments.

In general, to qualify as a REIT, companies are required to pay out at least 90% of their income to shareholders.

As long as REITs are paying out between 90% and 100% of their income, they are in the "safe zone."

If REITs start paying out more than that, they can get into trouble quickly...

That's because they are forced to find capital in other ways – maybe by taking out a loan or by divesting assets. And if a dividend payment can't be covered by a REIT's earnings... well, it might have to cut the size of its dividend.

On average, cash flows for publicly listed U.S. REITs cover about 125% of their payouts... so they usually have plenty of cash left over.

By comparison, BREIT's 2023 cash flow only covered 95% of its payouts. So it had to sell some of its properties to cover the rest.

And unfortunately, it looks like things will only get worse from here...

And unfortunately, it looks like things will only get worse from here...

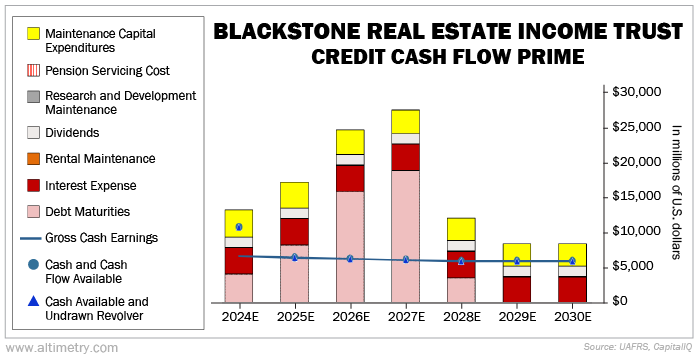

We can see this through our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent BREIT's obligations through 2030. This is what it needs to pay to keep the company from going under.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

BREIT doesn't have enough cash flows to meet all of its obligations in any of the next seven years. Starting next year, it doesn't even have the cash to cover its debt.

Take a look...

Unless there's a dramatic change in BREIT's cash position, the fund will have to make some tough decisions...

Unless there's a dramatic change in BREIT's cash position, the fund will have to make some tough decisions...

Banks aren't thrilled with the idea of lending to real estate right now... So BREIT may have to sell off more assets if it wants to keep its dividend up. If it doesn't divest, it might have to disappoint investors by cutting its payout.

That said, BREIT has been investing in data centers like crazy.

As we said earlier, data centers are a "good" part of real estate. The world uses more data each year... and we need somewhere to store it.

Part of the reason BREIT's dividend payout grew faster than its income is because it's still building data centers... That means it doesn't have tenants to start paying rent quite yet.

Once the fund is able to start charging rent on those buildings, it should alleviate some of the pressure.

But until that happens – which may be months, if not years, from now – its cash issues will likely only get worse.

Regards,

Joel Litman

April 25, 2024

Based on cash flow alone, our favorite

Based on cash flow alone, our favorite