Editor's note: Asset management firm Blackstone (BX) has been quietly wrapping its tentacles all over the investment world... and that's bad news for unsuspecting investors.

Today, we're revisiting the first essay in our favorite series of the year. Since we first sounded the alarm about Blackstone on March 22, investors seem to have forgotten about the risks lurking beneath this company's surface.

If you want to check out the rest of our analysis, we covered more about Blackstone on March 29, April 5, April 12, April 19, and April 26. In the meantime, here's an updated look at our initial warning to investors...

Vampire squids are all over the financial-services industry...

Vampire squids are all over the financial-services industry...

Back in 2010, journalist Matt Taibbi saddled Goldman Sachs (GS) with its infamous nickname...

He called the massive investment bank a "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money."

That's quite the image.

As Taibbi detailed in his article "The Great American Bubble Machine," Goldman alumni ran many – if not most – of America's largest financial institutions. And importantly, they also sat at the heads of all the major government regulatory agencies.

So when a bunch of Goldman alums ran banks like Wachovia and Merrill Lynch into the ground during the 2008 financial crisis, their friends at the U.S. Treasury Department, the World Bank, the New York Stock Exchange, and numerous central banks stood ready to bail them out.

Goldman traders and bankers had been just as busy wheeling and dealing to fuel the dot-com bubble as any other bank.

As Michael Lewis' bestselling book The Big Short (and the Oscar-winning film of the same name) highlighted, Goldman also quite successfully made money on both sides of the housing bubble... generally to the long-term disadvantage of its customers.

Regulators have somewhat defanged the giant vampire squid since then. Goldman is regulated like all other banks. When the Federal Reserve is peering over your shoulder for regular stress tests, it takes some of its risk-taking opportunities off the table.

In fact, if you look at the entire financial system now, you'll find another vampire squid at the heart of it all... Blackstone (BX).

Blackstone is usually described as an asset management firm. However, the reality is more complicated. When you look at its 34 subsidiaries, you'll discover Blackstone has wrapped its tentacles around... everything.

Its web of operating entities covers residential real estate, life-sciences investments, direct-lending private credit platforms, office real estate investment trusts ("REITs"), mortgage trusts, and a hedge-fund platform.

And here's the problem... That list includes the areas of the economy that we think are the most likely to get in trouble in the coming months and years.

Blackstone avoids a lot of regulatory scrutiny because it's not a bank, even though many of its activities make it look like one.

And when you have a company that doesn't get regulated like a bank even though it acts like a bank... that's a big risk.

Blackstone has big problems... lots of them.

Blackstone has big problems... lots of them.

Blackstone's risk is not just that it's everywhere. It has also been lending in risky areas that regulated banks have abandoned. It's the kind of lending used to bring down banks.

Blackstone has heavy exposure to real estate and private equity. It has a ton of leverage in those areas (often given by other Blackstone entities).

And over the past year or so, we've started to see headlines pop up about Blackstone's business running into trouble.

First, the Blackstone Real Estate Income Trust ("BREIT") began limiting investor withdrawals last December. Though it didn't guarantee anything was wrong, the withdrawals still dinged Blackstone's reputation.

Then Blackstone funds started to face real default risk. It has defaulted on more than $1 billion in its commercial mortgage-backed securities ("CMBS") this year.

In February, it defaulted on a $270 million CMBS on several Manhattan apartment buildings. Then, it defaulted in March on a more than $500 million CMBS tied to Finnish offices and stores... and on a $325 million Las Vegas property.

Its real estate portfolio has been facing challenges ever since the pandemic. The wars in Ukraine and the Middle East are also causing uncertainty.

This is just the beginning of the issues for Blackstone...

This is just the beginning of the issues for Blackstone...

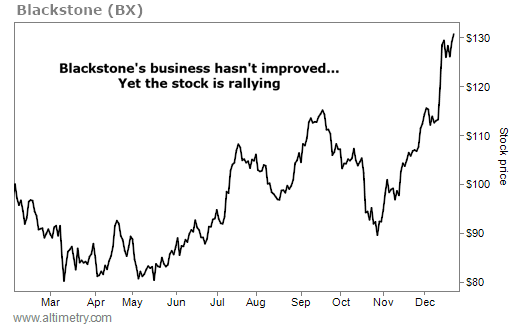

And yet, the market has once again lived up to its short memory.

While Blackstone started the year down 13%, the stock has rallied in a big way. It's now up 76% year to date...

Blackstone is not a better business now than it was at the start of the year.

It's at the epicenter of the issues with mark to market and the broader shadow-bank problems we discussed back in March.

Rising interest rates have hurt the performances of many assets in Blackstone's private equity, real estate, and private lending activities. Blackstone hasn't had to confront those losses... yet. So it has been able to dodge investor attention for much of the past two years.

But it can't hide forever. As the market starts to catch on, it will have to reprice a maze of public and private investments. That means further trouble for Blackstone's fees and its stock, and for the investors in its fund.

Regards,

Joel Litman

December 27, 2023

Vampire squids are all over the financial-services industry...

Vampire squids are all over the financial-services industry...