It's the end of the venture-capital ('VC') mega-fund era...

It's the end of the venture-capital ('VC') mega-fund era...

In 2022, 35 VC funds raised more than $1 billion each. That was more than three times the amount of capital raised in any year before 2021.

VC funds invest in new, private companies with high-growth prospects... And there's typically a lot of uncertainty about whether they can reach their potential. "Big" venture funds rarely exist. It's hard to deploy that much capital in tiny, brand-new companies.

One billion dollars is a staggering amount of cash to raise. And that didn't happen last year alone... In total, 60 funds in 2021 and 2022 raised $147 billion in VC assets.

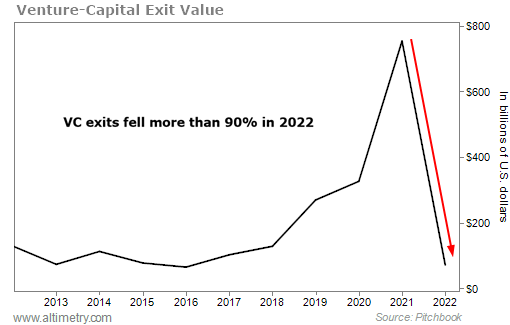

Investors rushed to recreate the big gains that were making headlines at the time. Around $1 trillion in VC "exits" took place in 2020 and 2021, which helped fuel the mania. (When a company is sold or goes public in the VC industry, the VC fund can exit its position.)

That means VC funds got $1 trillion in cash and public equity stakes for their investments during that time period.

Many investors are now nursing a serious VC hangover. Exits tanked in 2022... just as money flooded the space. Illiquid VC investments have been dealing with performance problems.

And you can probably guess what "vampire squid" shadow bank started shoveling client money into this illiquid market... right before things got ugly.

Say it with me now: Blackstone (BX).

VC exits plunged in the fourth quarter of 2022...

VC exits plunged in the fourth quarter of 2022...

They fell far below any level since 2018. Overall, 2022 had the lowest value of exits since 2016 and the second-lowest value of exits in the past decade.

Take a look...

Unlike standard investments, the only way VC funds really make money on their investments is by selling them...

These startups don't generate any cash flow initially... and their stocks don't trade freely because the companies are privately held. So when VC funds can't sell their stakes, investors generally don't get any returns at all.

And that's the market Blackstone rushed into, just as things were about to slow down.

It's not a big VC investor. Only about 3% of Blackstone's client capital is focused on the space... though that's not for lack of trying. The company only dedicated a small amount of capital to VC because it entered the space late... just as the game of musical chairs started slowing down.

Ultimately, Blackstone could only buy up small slices of the VC space...

In 2018, Blackstone acquired life-sciences investment firm Clarus, which it rebranded as Blackstone Life Sciences ("BXLS"). It largely invests in late-stage venture health care companies just before they go public.

And in July 2020, it launched Blackstone Growth ("BXG") to aid its scramble into late-stage venture opportunities.

Since that launch, the BXG fund has not performed well at all. Its internal rate of return ("IRR") is essentially 0%. It offers a 1.1 times multiple on invested capital in the overall portfolio.

Said differently, the "high growth" BXG has offered investors a 10% gain in three years. The S&P 500 Index is up 39% over the same time frame.

Blackstone added a second BXLS fund in 2020 called BXLS V. The new fund launched with $5.7 billion in capital, or five times the money it had put into Clarus. In 2020 alone, BXLS V invested in large life-sciences companies like biopharmas Alnylam Pharmaceuticals (ALNY) and Reata Pharmaceuticals (RETA), and medical-device giant Medtronic (MDT).

Like Clarus, BXLS V has only offered weak returns. It has seen just a 3% annualized return on the $4.8 billion put into the fund since the 2020 launch.

The VC world is grappling with too much money-chasing and too few ideas. Declining exits and high interest rates are hurting valuations. That backdrop means Blackstone's situation isn't going to change anytime soon.

Blackstone's desire to be the 'everything' shadow bank has set it up to fail...

Blackstone's desire to be the 'everything' shadow bank has set it up to fail...

The company rushed to get clients invested in these funds, just as we were approaching a market top. Those same clients will be sitting on capital that earns an abysmal return for some time.

Further, Blackstone has helped fuel explosive growth in a number of illiquid investment markets. It has overinvested in residential real estate... propped up the commercial real estate market while accumulating dangerous levels of debt... and bet big on private equity while bypassing regulations with creative workarounds.

And as we revealed today, it even heaped investor money into the venture world just as VC mania reached its peak.

The company has sought to profit in the short term... while helping the entire illiquid investment world balloon to unsustainable levels.

Many of these bubbles are starting to deflate thanks to higher interest rates and changing economics. Further, the easy money that once chased these investments is running out. And while Blackstone employees have been collecting their checks, the company's clients, its stock investors, and the broader economy have all suffered.

Blackstone and its shadow-banking peers fueled a lot of markets in their cash grab... They helped shovel debt into the economy like a duck being fattened up to make foie gras.

And a lot of those markets are now fueling a significant slowdown in credit. They're steering the U.S. economy straight into the mouth of a recession.

Stocks will likely remain rocky for now. The economy must work its way out of the gluttony. And that could take some time...

Because when a monster as terrifying as this vampire squid wraps its tentacles around the market, it doesn't stop until it gets its pound of flesh.

Regards,

Joel Litman

April 26, 2023

It's the end of the venture-capital ('VC') mega-fund era...

It's the end of the venture-capital ('VC') mega-fund era...