At first it was merely a trickle of defaults...

At first it was merely a trickle of defaults...

Now, it looks more like a flood.

It has been more than three years since the onset of the pandemic, and work from home is still sending shockwaves through the economy.

A few months ago, Swedish office-building owners made headlines for mailing the keys to their properties back to banks as their fortunes soured. There have been regular rumblings about others doing the same since then.

And in February, two top-tier U.S. real estate companies became the next dominoes to fall... Pimco's Columbia Property Trust and Brookfield (BN).

They defaulted on commercial real estate ("CRE") mortgages because they did the math, plain and simple. It didn't make sense for them to keep paying for these properties, especially with rising interest rates.

Pimco and Brookfield aren't alone. Headlines are starting to flow in about office owners defaulting. All signs point to the same thing...

CRE is in trouble.

An estimated 330 million square feet of U.S. office space will be vacant by 2030. And 17% is already vacant right now.

It isn't just vacancies that are forcing office owners into a tight spot, either. They're being squeezed by their debt in one specific way. And one specific company is right in the thick of it... "vampire squid" shadow bank Blackstone (BX).

Today, we'll explain what shadow banks have to do with the mess in CRE. As you'll see, Blackstone has been lending like crazy. It's only a matter of time before something gives.

There's a ticking time bomb in CRE financial statements...

There's a ticking time bomb in CRE financial statements...

This year, $92 billion of office mortgage debt from shadow lenders is coming due. It will be by far the highest amount in the next five-plus years.

And it couldn't come at a worse time for office owners.

Before the pandemic, CRE vacancy rates were just above 11%. By the middle of last year, they had surpassed 15%. Soaring vacancy rates mean less cash flow for CRE companies. The last thing you want is for your cash flows to dry up right before a big debt maturity.

Even the CRE-owned buildings that don't have imminent debt maturities are facing another serious issue. Almost 50% of CRE debt is floating-rate debt.

U.S. homeowners learned the hard lessons of floating-rate debt in the 2000s. Many people bought houses with adjustable-rate mortgages ("ARMs") which offered a low introductory rate for a few years.

After that introductory period, the interest rate would snap up to the current market rate... which was often several percentage points higher.

That caused a lot of homeowners to default, which contributed to the Great Recession. Now, folks know how important it is to lock in low rates for as long as possible.

CRE didn't get the memo. The companies that refinanced their debt out several years still face another issue... Even if their debt isn't maturing, the cost of maintaining it is rocketing higher as cash flows plunge.

Said another way, soaring interest payments are threatening these companies left and right. This distressed environment even extends to trophy assets like Blackstone's Willis Tower (formerly the Sears Tower), which has $1.3 billion in mortgage debt on it.

It's not just about the vampire squid being a CRE owner...

It's not just about the vampire squid being a CRE owner...

Blackstone is also one of the biggest shadow bank lenders to CRE firms.

Or really, we should say it takes other people's money to lend... and gladly lights it on fire.

It does this through its real estate finance arm, Blackstone Mortgage Trust (BXMT). BXMT has been around for decades. It makes primary first mortgages on CRE properties globally.

BXMT frequently shows up on investors' radars because it pays a fat dividend yield. Right now, it yields 14%.

Blackstone would argue that BXMT's loans are safe because they're floating rate. And it only makes loans with loan-to-value ("LTV") ratios lower than 75%... meaning the loan is worth less than 75% of the property value. If the loan value stays the same and the property value falls, the LTV gets higher.

The thing is, CRE prices are cratering. A lot of those LTV ratios are getting a lot higher. And it's happening far faster than Blackstone wanted.

And since these are floating-rate mortgages, they're almost certainly becoming less affordable for Blackstone's clients.

The keys will likely start getting mailed back to Blackstone soon.

And when that happens, public stock investors will be on the hook...

And when that happens, public stock investors will be on the hook...

BXMT lends using other people's money, not Blackstone's. Whenever it wants to make a new loan, it issues new equity to an average Joe.

Blackstone is selling an investment that only accredited institutional investors should be exposed to. These loans have a complex risk profile. Most shareholders likely don't understand the ins and outs.

Investors bought more than $1 billion in new equity from BXMT over the past two and a half years. They almost certainly didn't know what they were getting into... because they never would have bought in if they had.

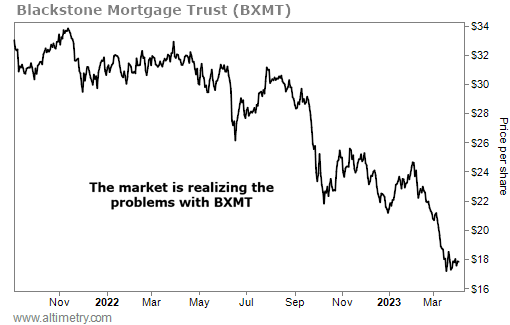

The market is starting to catch on to the problems in CRE. BXMT stock is down 46% in the past year and a half.

Take a look...

Even though shares are cratering, Blackstone doesn't care. It's collecting a fixed 1.5% management fee – and hoping for an incentive fee – as everyday investors lose money.

We wouldn't be surprised if BXMT becomes a big, fat zero in the coming CRE nuclear winter. Blackstone is going to get hurt on both sides... as a CRE owner, and as a lender to other CRE businesses.

Most institutional investors wouldn't be caught dead with their money in Blackstone these days. So to us, the bigger issue is that this shadow lender has foisted its losses on unsuspecting individual investors.

This is just another way Blackstone's shadow-bank vampire squid empire is putting the economy at risk. And for investors, it's yet another reason to avoid real estate... and BXMT's fat yield.

Regards,

Joel Litman

April 5, 2023

At first it was merely a trickle of defaults...

At first it was merely a trickle of defaults...