European real estate is suffering...

European real estate is suffering...

And it's just the start of an issue that could send shock waves around the whole world.

Publicly listed European real estate companies are rolling over hard. Valuations are crashing. The STOXX Europe 600 Real Estate Index, which tracks publicly listed European real estate companies, has dropped to levels not seen since the 2011 European debt crisis.

We're seeing significant defaults, too. British bank Lloyds Banking (LYG) is scrambling to offload a £175 million senior loan for a Canary Wharf office block that's about to mature. The property is owned by Cheung Kei, a Chinese real estate firm.

Notably, Cheung Kei has already defaulted on another nearby office block financed by Lloyds. A broker has been appointed to sell that property. So this is the second default that Lloyds is facing.

Those are just a few of the headlines. A real estate storm is brewing on both sides of the Atlantic.

Large real estate investors in the U.S. stand on the precipice of the exact same calamity that's playing out in Europe. And as we'll explain today, Blackstone (BX) – the "vampire squid" shadow bank we've been warning you about for weeks – will be at the epicenter.

Real estate has been a core part of many institutional investors' strategies...

Real estate has been a core part of many institutional investors' strategies...

Unfortunately, these endowments, pension funds, and high-net-worth family offices are facing a dilemma.

These organizations represent a huge slug of the investment world. The U.S. pension industry alone has $35.5 trillion in assets under management ("AUM") in 2020. And in 2021, nearly 10% of pension AUM was in private equity and real estate.

And the growing fault lines in real estate are only going to get wider.

We wrote last Wednesday about how commercial real estate ("CRE") is in trouble. The mainstream media first took notice when Swedish landlords started sending keys back to their offices.

And we've already showed you that this issue isn't localized to Scandinavia. It's not specific to Europe, either. This is a widespread problem that's only going to get worse from here.

And the firm with the biggest exposure is none other than the vampire squid itself.

This private equity business is a real estate monster...

This private equity business is a real estate monster...

A lot of investors carry a big misconception about Blackstone. They still think it's primarily a private equity manager.

Blackstone is the largest real estate firm in the world. Its Blackstone Real Estate Partners ("BREP") funds have exposure to everything... from green office buildings and massive warehouses to multifamily apartments and single-family homes.

The company makes money on its fee-earning AUM. It's far more exposed to real estate than private equity. And the product mix has been growing aggressively into real estate in the past 12 months.

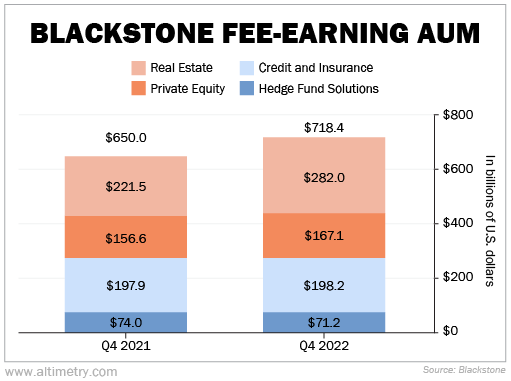

In 2021, Blackstone's real estate holdings made up 34% of its total fee-earning AUM... versus 24% for private equity. By the end of last year, real estate was up to 39% versus 23% for private equity.

Take a look...

As you can see, Blackstone's real estate investments grew by more than $60 billion in the past year. And much of its credit and insurance AUM is directed toward real estate as well.

When you factor that in, its exposure looks even more concerning. It's at the heart of the $11.7 trillion in illiquid private equity and real estate assets, which use a lot of leverage to goose returns.

All that debt would already be a problem with higher interest rates. Rising rates mean higher interest payments for borrowers.

Much of these real estate investments were bought under the assumption that rates would never again rise a lot in the future. Blackstone (and others like it) didn't factor in a sufficient margin of error to support these higher financing costs.

And that's before we even get into the backdrop of negative economic trends surrounding falling office space usage, lower rent prices, and more.

You might think these issues would be enough for Blackstone to pump the brakes...

You might think these issues would be enough for Blackstone to pump the brakes...

And yet, the vampire squid accelerated its investments in real estate.

Property prices are falling. Green Street's Commercial Property Price Index, which tracks unleveraged commercial property values in the U.S., is down 15% year over year. So the increase in Blackstone's real estate investments wasn't because the value of its holdings went up.

Most people don't directly invest in Blackstone funds. So you might think your portfolios are safe. After all, you have no exposure to such risky interests... or so you believe.

The reality is, if you've ever donated to a charity, paid for tuition, or have a pension plan, you're very exposed to these risks. Remember, the investors you're trusting with your money have significant investments in Blackstone's ticking time bomb of shadow-banking assets.

It's just a matter of time before the drumbeat of headlines in Europe makes its way to the U.S. And that's going to seriously hurt Blackstone's profitability... and its investors' pockets.

It's yet another example of how Blackstone is creating a world of trouble for investors.

At the very least, folks should steer clear of Blackstone and all its funds. And if you do give a lot to charities or universities – or rely on a pension for your livelihood – you might want to check on just how exposed you are to the vampire squid.

Regards,

Joel Litman

April 12, 2023

European real estate is suffering...

European real estate is suffering...