You can't build an apartment complex in a day...

You can't build an apartment complex in a day...

In the midst of the pandemic, it seemed like everyone wanted a bigger home. For some people, that meant rushing to the suburbs. For others, it meant looking for a bigger place in the city.

Developers saw this demand and acted as fast as they could. Even so, it took time. Builders needed permits before they could build out infrastructure... and then they had to construct the buildings themselves.

In the meantime, demand far outstripped supply. Prices for rental homes soared. And private-equity ("PE") firms wanted a piece of the action.

These folks knew that rent prices are "sticky." Once a renter is willing to pay a certain price, the unit probably won't get cheaper. So at worst, investors thought they could keep rent prices flat. At best, they could keep raising rent forever.

PE shops have been big real estate buyers for the past decade-plus. Last year, investors bought 22% of all U.S. homes. They assumed that since renters don't have much negotiating power, prices would always stay high.

And one of the largest homebuyers and building-financiers has been at the heart of it all... our favorite "vampire squid," Blackstone (BX).

As we'll explain today, Blackstone and other PE firms fell victim to their own hubris. They took on more and more debt to finance these properties... figuring there would always be plenty of renters to cover costs.

Now, all of those pandemic-era new builds are starting to come online. Rental prices are falling. And it's going to cause a lot of pain for these investment vehicles.

PE firms have set up massive funds to invest in single- and multifamily homes...

PE firms have set up massive funds to invest in single- and multifamily homes...

They aren't buying these houses to live in them. They're looking to rent them. They thought that rental prices could keep on rising in perpetuity.

Last year, Blackstone raised more than $24 billion in debt for a $30 billion real estate fund. That's a huge amount of debt.

These shops weren't counting on what data-analytics firm CoStar says is the biggest supply of new homes since 1986. Amid this massive influx, the rental market slowed way down.

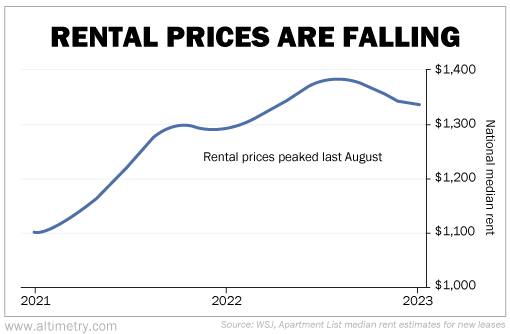

People simply couldn't afford what property owners were asking for. And with all this new supply, they didn't have to anymore. Rents fell nationally for most of the second half of 2022.

Take a look...

As you can see, rental prices have been in a steady decline for months.

And that means all those multifamily real estate funds... built by PE shops that assumed rents can only go up... are now running for cover as that idea blows up in their faces.

Blackstone in particular has been in trouble for months...

Blackstone in particular has been in trouble for months...

Back in December, the Blackstone Real Estate Income Trust ("BREIT") was already preventing its investors from withdrawing their money. We wrote at the time that it might be the "Bear Stearns moment" of this cycle.

BREIT is a fund that lets high-net-worth ("HNW") investors buy into commercial real estate properties. At the time, it looked like they were rushing to pull money out in order to draw liquidity from a healthy real estate asset.

Now, things look a little different for BREIT. It seems like people saw the writing on the residential real estate market wall. Perhaps they realized that nothing is impervious to falling if the supply-demand balance gets too out of whack... not even rent prices.

Remember that Blackstone and other PE shops have been big buyers of homes and apartment buildings for decades. If they can't keep buying, that could put even more pressure on prices.

And that might leave a lot of endowments, pension funds, and HNW investors holding the bag.

The story doesn't end there for Blackstone... Next week, we'll jump into another ticking time bomb in its web of operations.

In the meantime, stay far away from the housing sector. The rocky times for Blackstone and the real estate market are just getting started.

Regards,

Joel Litman

March 30, 2023

You can't build an apartment complex in a day...

You can't build an apartment complex in a day...