Pension funds regret their huge investments in private equity ('PE')...

Pension funds regret their huge investments in private equity ('PE')...

For the past few decades, these funds have been scrambling for ways to boost the returns on their investments.

They were willing to do almost anything... particularly since a good portion of those investment returns covers benefits for teachers, firefighters, and other public workers.

First, these funds allocated more into equities over fixed income. Then, they gave money to hedge funds. And when that didn't make up the deficit, they turned to illiquid investments like PE.

Pension-fund portfolio managers love PE because it appears less volatile than other assets. They think leverage and operational improvements can goose returns and help make up for budget shortfalls.

PE deals load up debt on companies' balance sheets. And in good times, that debt amplifies returns for investors.

Investment in private equity by large U.S. public pensions is at a record high. It sat at around $500 billion out of a total of $4.5 trillion in assets in 2021, according to the Boston College Center for Retirement Research.

Now, the market is souring. Some pension funds – like the Maryland retirement system, Alaska's state fund, and the Mendocino County, California pension fund – are reevaluating their investment decisions.

And our favorite "vampire squid," Blackstone (BX), will be a big loser from this change in the winds.

These funds are recognizing that they went too far into PE... at the worst time possible.

These funds are recognizing that they went too far into PE... at the worst time possible.

As it turns out, those "lower-volatility assets" are actually much more volatile than many folks realize.

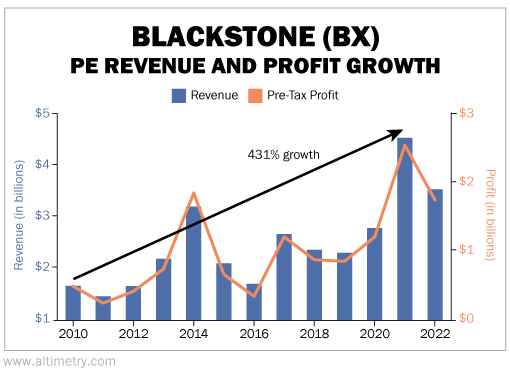

Blackstone spent a decade and a half convincing those investors to pour money into PE. It reaped big benefits from that push.

From 2010 to its peak in 2021, revenue from Blackstone's PE business was up 431%... from $828 million to $4.4 billion. Profits grew at a similar rate.

Take a look...

Pension funds poured money into PE with hardly any consideration for the risks. Now, they're all trying to squeeze out of a tight door at the same time.

And Blackstone's performance is already suffering...

In the past year alone, revenue and profits for this segment are down around 30% from their peaks. Higher interest rates and slowing economic growth have crimped Blackstone's ability to generate returns. It can't even pay off the massive debt loads on its portfolio companies.

In February, six PE portfolio companies went bankrupt. That's the highest monthly number since the heart of the pandemic in mid-2020.

Standard & Poor's predicts 78 potential bankruptcies in 2023. That would be more than double what we saw in 2021 and 2022. That would be one of the highest bankruptcy rates since the Great Recession.

We've talked a lot about Blackstone's shadow-banking real estate boondoggle in the past several weeks. Even so, we shouldn't forget that Blackstone started as a PE firm. That's still a big part of its business.

In the fourth quarter, private equity contributed roughly one-third of Blackstone's earnings. These mostly came from its Blackstone Capital Partners flagship private equity funds.

And here's the scariest thing about these funds...

A lot of their portfolio companies are about to run into trouble. And yet, they've got a massive $87 billion of "dry powder" to take money from investors.

That dry powder store is ready to explode...

That dry powder store is ready to explode...

So much cash would normally be great in a down market. Liquidity can help a fund take advantage of discounts.

However, the vampire squid may have other plans... We wouldn't be surprised if Blackstone used some of that dry powder to bail out troubled investments.

After all, it has already been extending credit to portfolio companies. And PE companies have been trading assets among themselves for a long time. Since they don't have to report prices every day, it keeps investors from seeing what a company is really worth on the open market.

All these shadowy transactions mean you should watch out for the PE world... And keep a close eye on Blackstone in particular. Things are going to get hairy in this tough environment.

Management will likely start talking about how that dry powder means the company can get distressed assets at great valuations. That's simply brushing aside larger concerns.

Statements like that really mean they're planning on shoveling more investor money into a broken asset class – one that they helped break and can't fix.

Blackstone will have to deal with a lot of unhappy fund investors who won't want to give it money next time around. And that means its revenue, profits, and stock price will likely trend much lower in the coming months.

Regards,

Joel Litman

April 19, 2023

Pension funds regret their huge investments in private equity ('PE')...

Pension funds regret their huge investments in private equity ('PE')...