U.S. corporations got some temporary relief earlier this month...

U.S. corporations got some temporary relief earlier this month...

Thanks to a massive wave of refinancing in the first quarter, companies were able to push back debt headwalls by a few years.

They trimmed this year's high-yield debt maturities by 75% and next year's by about 50%. That gives them a little more room to breathe... and reduces this year's default risk, which originally had investors spooked.

It's a massive weight off many companies' shoulders – but one industry hasn't been so lucky...

Regular readers know we've had a handful of concerns for commercial real estate ("CRE") heading into 2024. A lot of these companies have struggled to refinance their debts, as most banks are unwilling to take on the risk. And the situation just keeps getting worse...

The national office vacancy rate rose from an already abysmal 19.6% in the fourth quarter of 2023 to a record-breaking 19.8% in the first quarter of 2024. That's the highest vacancy rate we've ever seen.

With vacancy rates creeping higher and piles of debt coming due soon, office real estate investment trusts ("REITs") are especially in a heap of trouble.

Today, we'll highlight one such company. It's one of the largest office REITs in the U.S. – but that isn't enough to help it escape its debt woes.

Debt headwalls have been mounting for office real estate for quite some time...

Debt headwalls have been mounting for office real estate for quite some time...

And unfortunately, the industry seems to have missed the refinancing boat.

A lot of CRE loans come from midsize banks, which are struggling today. New York Community Bancorp (NYCB), for instance, was on the brink of collapse back in March because of its CRE loan portfolio.

It likely would have failed if a group of equity investors hadn't stepped in with a billion-dollar lifeline.

That said, the move was an exception to the refinancing wave we've seen... Other struggling banks can't expect to be bailed out with a cash infusion like NYCB was.

Most lenders wouldn't touch CRE with a 10-foot pole today. And now even some of the very biggest commercial REITs are in trouble.

Just look at California-based Kilroy Realty (KRC)...

It's the fourth-largest office REIT in the U.S., with 121 office properties mostly on the West Coast and in Austin, Texas.

The company has a market cap of roughly $4 billion... and is sitting on nearly $5 billion in long-term debt.

A lot of that debt comes due in the next few years. And it's way more than Kilroy can handle...

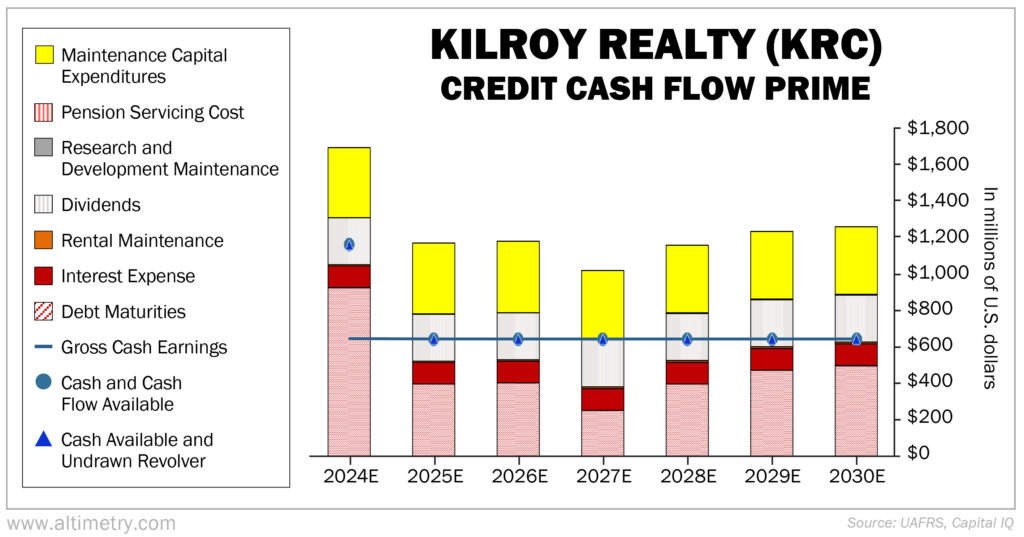

We can see this by looking at our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent Kilroy's obligations through 2030. This is what it needs to pay in order to keep the lights on... to prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Kilroy doesn't have enough cash flow – or cash on hand – to cover its obligations in any of the next seven years.

Take a look...

Even with Kilroy being one of the largest players in the industry, it just has too many obligations... including a large debt headwall in 2024.

Nearly $1 billion comes due this year alone.

Mounting debt headwalls. Falling occupancy rates. And banks that are unwilling to help CRE companies refinance... It simply doesn't look good for Kilroy.

Commercial real estate seems to be missing out on the refinancing party. That means it's only a matter of time before these companies start defaulting on their obligations.

We'd continue to avoid this industry at all costs.

Regards,

Rob Spivey

April 17, 2024

U.S. corporations got some temporary relief earlier this month...

U.S. corporations got some temporary relief earlier this month...