As we here at Altimetry know well, new businesses emerge from any crisis...

As we here at Altimetry know well, new businesses emerge from any crisis...

Back in 2009, the global financial system was reeling from the Great Recession. Most of Wall Street was blindsided by the collapse of the housing market and banking giants such as Lehman Brothers.

However, some folks across the world were able to spot the risk, such as the hedge-fund investor Michael Burry – made famous by the book and movie The Big Short.

These investors were able to profit from a system that had allowed for easy writing of sub-prime mortgages, a proliferation of financial instruments backed by these risky mortgages, and the improper rating of these instruments by the ratings agencies. This perfect storm almost brought the financial world crashing down.

However, new growth often emerges in the wake of recessions. Just as one example, Valens Research – the institutional investor arm of Altimetry – opened its doors in the wake of the financial crisis.

At Valens, we spotted a market opportunity to provide financial metrics untainted by GAAP accounting standards. Additionally, we saw the need to provide unbiased, accurate credit ratings, as an alternative to the big ratings agencies that had failed in 2008.

Market failures create the opportunity for savvy entrepreneurs to realize their vision and fix an existing problem. Harvard Business Review understands this trend well... in July 2015, the publication released a packet aimed at teaching new business owners how to build a business case and attract investors. Just last month, Harvard Business Review sent a reminder e-mail out to readers that this packet exists, promoting its importance in the midst of the pandemic... It's betting on those green shoots after the crisis.

Considering the current economic situation, this may seem like a bad time to create a new company... but two factors are working in entrepreneurs' favor...

First, as the U.S. Federal Reserve has done its best to provide excess capital to keep the U.S. economy running – suppressing interest rates and pushing valuations sky-high – investors are desperate for places to make a good return.

In addition, with the huge effect of the "At-Home Revolution," entrepreneurs who can take advantage of consumer spending moving to the home can get ahead in the current market.

One way that the Harvard Business Review would recommend getting a business started could be solving a small solution for a big customer, say an original equipment manufacturer ("OEM") that supplies a product used across the globe. In fact, that's how today's company made a name for itself...

Anyone who bought a computer in the 2000s probably remembers the term 'bloatware'...

Anyone who bought a computer in the 2000s probably remembers the term 'bloatware'...

This refers to the excessive, pre-installed software that OEMs put on your computer before you ever turn it on. Most bloatware is games or pointless apps that users rarely access. These additions end up slowing the computer down and taking away processing power from more useful apps.

Fortunately, with computers becoming more streamlined over the past decade, this trend appears to have declined. Similarly, in the recent past, phones would only come with a single page of essential apps.

However, one company is trying to change this by partnering with the phone OEMs and phone carriers to bring the world of "bloat" to your handheld devices.

Today, virtually every company has an app to further its business model. Whether this is a core part of the firm's strategy or a way to reach new customers, mobile apps are essential in the modern business environment. Companies would pay a large price to see these apps pre-installed on a factory device.

Digital Turbine (APPS) – a company that Altimetry Daily Authority reader Ken requested we review – enables mobile operators and OEMs to control and monetize devices through advertisements and forced app installations. Its main customers are telecom giants Verizon (VZ) and AT&T (T), which account for more than 67% of the firm's revenue. Digital Turbine allows these carriers to monetize mobile content by removing many of the steps it takes to find and download an app from the app store.

App developers can pay to have their products on a list of apps that come pre-installed when users activate a new phone. Developers can also pay to send post-installation alerts, notifications, and reminders to promote apps over the life of the phone. Digital Turbine is effectively bringing back bloatware, except now it can take a cut of the profits.

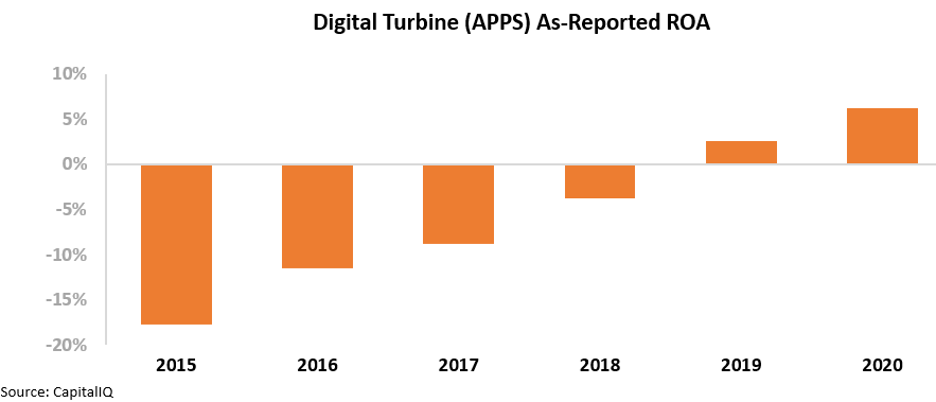

It would appear this strategy has been somewhat successful for Digital Turbine. Looking at the as-reported numbers, the company has recently inflected to positive profitability, but returns still remain low.

Digital Turbine's as-reported return on assets ("ROA") grew from negative 18% in 2015 all the way to 6% in 2020. While these returns are still below corporate averages, the steady move higher shows a positive trend to turning profitable. Investors seeing this would reasonably assume Digital Turbine's focus on being a background operator for these larger companies has begun to bear fruit... even if the company isn't yet profitable enough to get really excited about.

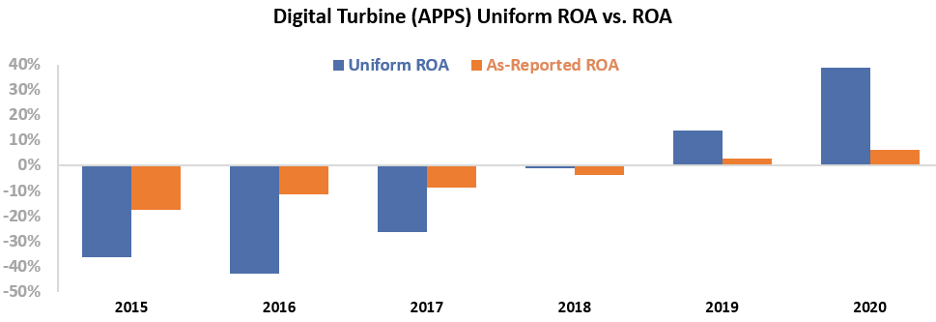

However, this picture of Digital Turbine's performance doesn't accurately capture the extent of the company's success. This is due to distortions in as-reported accounting, including the GAAP treatment of goodwill. And it means the market has missed how massively successful Digital Turbine's transformation has been.

By further monetizing the smartphone market, the company has made itself into an essential business for larger carriers like Verizon and AT&T.

And Digital Turbine's Uniform ROA didn't just inflect positively... it skyrocketed. This year, the company's Uniform ROA is 39%, not the 6% as-reported figure. Take a look...

Digital Turbine has been able to effectively provide software to allow bigger players to better monetize the valuable real estate of the smartphone screen.

However, understanding how strong historical returns have been doesn't explain if the stock is undervalued or overvalued.

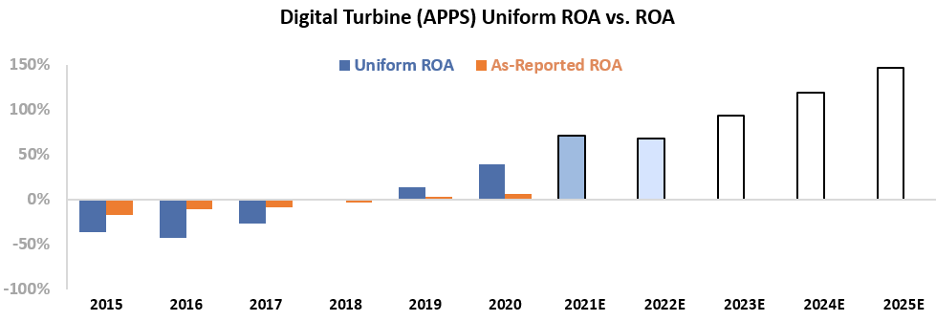

To see if Digital Turbine can continue to create value for shareholders, we can use the Embedded Expectations Framework to easily understand market valuations.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, both analysts and the market expect Digital Turbine's returns to grow well beyond current levels. Market expectations are for returns to expand to 147% in 2025 – almost 4 times higher than current levels.

The reward to bring bloatware to the smartphone market is clearly high. That said, while this has proven to be a successful business model, expecting ongoing, pronounced growth may be unsustainable. Unless Digital Turbine can fundamentally change how apps are downloaded and advertised, it may struggle to match these valuations.

Without Uniform Accounting, investors would miss Digital Turbine's massively high profitability. They also might think they're chasing a company just inflecting to profitability that has sky-high upside, when they're really looking at a firm that's already highly profitable... and has to get much more so to possibly justify market expectations.

Regards,

Rob Spivey

September 3, 2020

P.S. Over the past few weeks, we've highlighted more than a half-dozen names that Daily Authority readers specifically have asked us to analyze... and more are to come. What names would you like us to give the Uniform Accounting treatment to? Send an e-mail to [email protected].

As we here at Altimetry know well, new businesses emerge from any crisis...

As we here at Altimetry know well, new businesses emerge from any crisis...