Companies are refinancing as fast as they can...

Companies are refinancing as fast as they can...

Regular readers know we're worried about the state of U.S. credit. As interest rates rose above 5% over the past two years, banks were less willing to lend.

Corporate America didn't care, though. These businesses had a lot of debt coming due this year and next... and they finally reached a breaking point in the first quarter.

Companies refinanced most of their upcoming high-yield debt out to 2027 and beyond. We wrote back in April that it might just be enough to delay a recession for a while longer.

That hasn't completely solved the country's credit problem, though...

You see, most of those companies are large ones with good banking relationships. Even though they were able to refinance, they had to do so at extremely high interest rates.

Many smaller businesses simply don't have that option. They aren't large enough to issue bonds... there wouldn't be enough demand. And as we mentioned, banks aren't too eager to lend today.

Sixty-six U.S. companies went bankrupt in April... the second-highest monthly number since 2020 and only one less than in March 2023. Most of these businesses had less than $1 billion in total debt.

Small businesses are going to struggle for the foreseeable future. But as we'll explain, one group of advisory firms is more than happy to reap the rewards.

Not all investment banks live and die by big deals...

Not all investment banks live and die by big deals...

Sure, the very biggest – Morgan Stanley (MS), Goldman Sachs (GS), and JPMorgan Chase (JPM) – are unlikely to get out of bed for less than $1 billion.

But boutique investment banks thrive in that smaller space.

Boutique banks aren't really banks... They're more like advisory firms. They help broker mergers and acquisitions (M&A) and refinancing deals like investment banks do, but they usually just provide advice.

Big banks often back those deals up with debt and equity financing, whereas boutiques outsource that part.

And because they just work on the advisory side, there's no conflict of interest with refinancing... So boutiques tend to win a lot of business with bankrupt or restructuring companies.

Some of the biggest players in this space, like Evercore (EVR) and Lazard (LAZ), saw advisory fees jump 21% in the first quarter of 2024 compared with a year ago.

Lazard in particular had great returns in 2023...

Lazard in particular had great returns in 2023...

The boutique firm makes most of its money advising clients on M&A, refinancing, and restructuring deals.

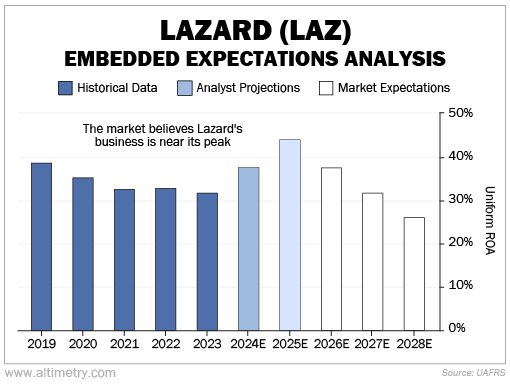

Lazard's Uniform return on assets ("ROA") has been above 30% since at least 2019... coming in at 32% last year. That's more than two and a half times the corporate average.

We expect returns to be even better in the next two years. Wall Street agrees... forecasting Uniform ROA of 37% in 2024 and an impressive 44% by 2025.

And yet, the market isn't convinced. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Lazard's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

At current levels, investors expect Lazard's Uniform ROA to fall to a five-year low.

Take a look...

Wall Street understands that boutiques have a lot of business coming in... even if investors don't see it.

Boutiques don't need to rely on bond issuances or even M&A to keep minting money...

Boutiques don't need to rely on bond issuances or even M&A to keep minting money...

They'll have plenty of advisory work with the companies that are going bankrupt. And they'll help those that need to restructure fast to avoid bankruptcy.

My team and I have been keeping a close eye on the boutique banking space for a while. And Lazard is far from the only great investment... In fact, we identified another strong contender late last year.

This business is a rising star in bankruptcy advisory. It has a long history of building strong relationships with its clients... and snapping up top talent as industry bigwigs look for a change of scenery.

And best of all, shares are cheap today.

Make no mistake... this is a world-class company. We're so confident in its prospects that we've described it to High Alpha subscribers as "the clear winner of the recession-era bankruptcy wave."

If you're interested in buying in – and accessing all our High Alpha research for 50% off the regular list price – click here to learn more.

We're far from "in the clear" when it comes to bankruptcies. Small and midsized businesses are still hurting. And they don't have the same refinancing opportunities as the very biggest companies.

That's why these boutique banks have a great opportunity to keep growing their businesses this year... and their stocks should rise in kind.

Regards,

Joel Litman

May 23, 2024

Companies are refinancing as fast as they can...

Companies are refinancing as fast as they can...