2020 will go down as a banner year in the history of the 'console wars'...

2020 will go down as a banner year in the history of the 'console wars'...

Tech giants Microsoft (MSFT) and Sony (SNE) have both released the next version of their popular video-game consoles. Microsoft is debuting the Xbox Series X, and Sony is rolling out the PlayStation 5.

In the most recent versions of these consoles, Sony outsold Microsoft in the latter half of both devices' life cycles. This was partially because Microsoft spent its time focusing on the entertainment capabilities of the Xbox One instead of just gaming, and so judging it by video-game numbers alone is misrepresentative.

Microsoft is again looking to turn the tables by shifting how it measures its performance in the console wars. As CNBC explains, the company is focusing on engagement rather than console shipments.

Microsoft is marketing its Xbox Game Pass to differentiate itself from Sony. Game Pass is a subscription service that gives users access to more than 100 games, and not just on the Xbox platform. Users who pay a premium can access games on other platforms, such as phones and computers.

The company also plans to upgrade its offerings over time by acquiring the video-game development studios themselves. Microsoft now has 23 studios, compared to 11 in 2018. The biggest selling point for Sony is its superior slate of exclusive games, but Microsoft is looking to close the gap.

Microsoft's focus on subscriptions is also leading to higher margins. Consoles are a lower-margin business than recurring subscriptions, so the company is more focused on signing people up for Game Pass than actually selling consoles.

Only time will tell who wins this console war... But Microsoft has learned from its past mistakes and is charting a new course.

On the other hand, one video-game company has avoided competing directly in the console wars...

On the other hand, one video-game company has avoided competing directly in the console wars...

As we discussed yesterday, Japanese video-game maker Nintendo (NTDOY) is expanding beyond selling consoles with its upcoming theme park opening next year.

In the video-game world, the company has avoided competition over the past few decades by focusing on different demographics. Nintendo offers more casual, family-friendly consoles and content. The firm has focused on providing unique gaming experiences compared to Sony and Microsoft.

Nintendo also avoided the console wars by releasing its platforms, like the Switch, during an "off" cycle for the other platforms. New versions of Xbox and PlayStation consoles were released in 2013 and 2020. Nintendo avoided these by releasing the Switch in 2017, thus capturing a unique segment of the market.

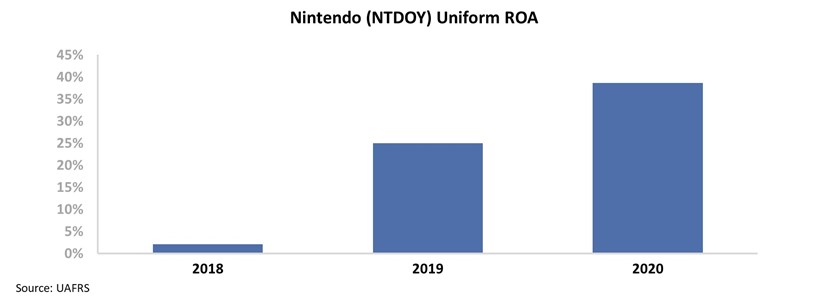

Thanks to the off-cycle launch, Nintendo has enjoyed strong demand. As we highlighted yesterday, the company's Uniform return on assets ("ROA") has surged from 2% to 39% over the past three years.

This earnings growth has been great for Nintendo... but a company's historical returns don't tell us where its stock is headed.

To understand this, we need to look at what investors are expecting the company to do in the future. If investors see through the accounting "noise," they may expect returns to improve. With steep expectations, the stock doesn't look as compelling.

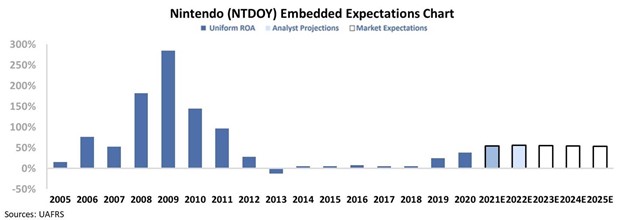

The chart below shows Nintendo's historical performance in terms of ROA (dark blue bars) versus what Wall Street analysts think the company is going to do in the next two years (light blue bars). The white bars show the expected returns that investors are pricing into the current stock price.

As you can see, Nintendo's returns are cyclical following its product launches. The success of the Wii in the late 2000s led to a record Uniform ROA.

However, returns fell to close to zero as Nintendo couldn't replicate the success of the Wii in the following years with the Wii U.

Now, Wall Street is projecting the company's returns to continue rising to 56%, and the market is pricing returns to stay roughly at those levels in perpetuity afterwards.

If Nintendo can break the "console cycle" and become more of a software-based business, it may be able to meet the market's ROA expectations in the future. The company has begun to focus on a subscription model – similar to Microsoft's Game Pass – as well as invest in content outside of its consoles.

And yet, these expected profitability levels haven't been seen since the success of the Wii in the late 2000s. So if Nintendo has a more normal replacement and research and development (R&D) cycle, those high expectations may be far too optimistic.

Regards,

Rob Spivey

December 16, 2020

2020 will go down as a banner year in the history of the 'console wars'...

2020 will go down as a banner year in the history of the 'console wars'...