Disney (DIS) isn't the only company racing to open up new theme parks...

Disney (DIS) isn't the only company racing to open up new theme parks...

The media titan opened a Star Wars park in 2019 and is now building Marvel-themed parks across the globe.

In a normal world, where the coronavirus pandemic hasn't largely shut down demand, this style of theme park has been a huge hit – beginning in 2010 with Universal Studios' Harry Potter World.

Despite the challenged environment, Universal plans to open its $580 million Super Nintendo World this coming February. The park was originally slated to open in July but was postponed due to the pandemic. The new start date is tentative, as cases rise across Japan.

Attendees will immerse themselves in Japanese video-game maker Nintendo's (NTDOY) rich universe. Customers will be able to board a Mario Kart ride inside a recreation of villain Bowser's castle. Additionally, visitors can collect virtual coins by wearing a wristband as they explore the park.

Attendees will also be able to apply their console skills throughout the theme park, including being able to interact with different park features via a Switch console.

Additionally, Universal and Nintendo have bigger plans for Super Nintendo World than just Japan... These include additional potential parks in Universal Studios Hollywood and Universal's Epic Universe in Florida.

It's no surprise Universal decided to partner with Nintendo for this park...

It's no surprise Universal decided to partner with Nintendo for this park...

The video-game maker has some of the most iconic and enduring intellectual property ("IP") in the world. This includes characters and content such as Mario, Donkey Kong, The Legend of Zelda, Pokémon, and Kirby.

Nintendo has consistently been at the forefront of innovation in the gaming space. The firm is known for producing the Game Boy, GameCube, Nintendo DS, Wii, and most recently the Switch. These innovations span more than three decades.

The products are also considered more consumer-friendly and accessible than traditional consoles.

The Wii's launch in 2006 helped to redefine the industry. The Wii was more family-friendly and cheaper than its Xbox and PlayStation counterparts.

Nintendo's most recent innovation, the Switch, is a combination of mobile and console gaming. Consumers use a handheld device that can also connect to a TV for more cinematic play.

The Switch has sold more than 68 million units, beating out competitor Microsoft's (MSFT) Xbox One.

Nintendo has consistently created industry-leading consoles and franchises. And only recently has the company tried to leverage its strong brand outside consoles to grow the business.

Nintendo's foray into theme parks marks a strategic shift. The company is now working to integrate its industry-leading IP with other revenue sources.

As such, investors might expect a company with a long history of innovation and content to earn premium returns. After all, Nintendo has consistently released top-selling consoles and games over three decades since entering the video-game business.

However, GAAP accounting paints the picture of a sub-par business with low returns.

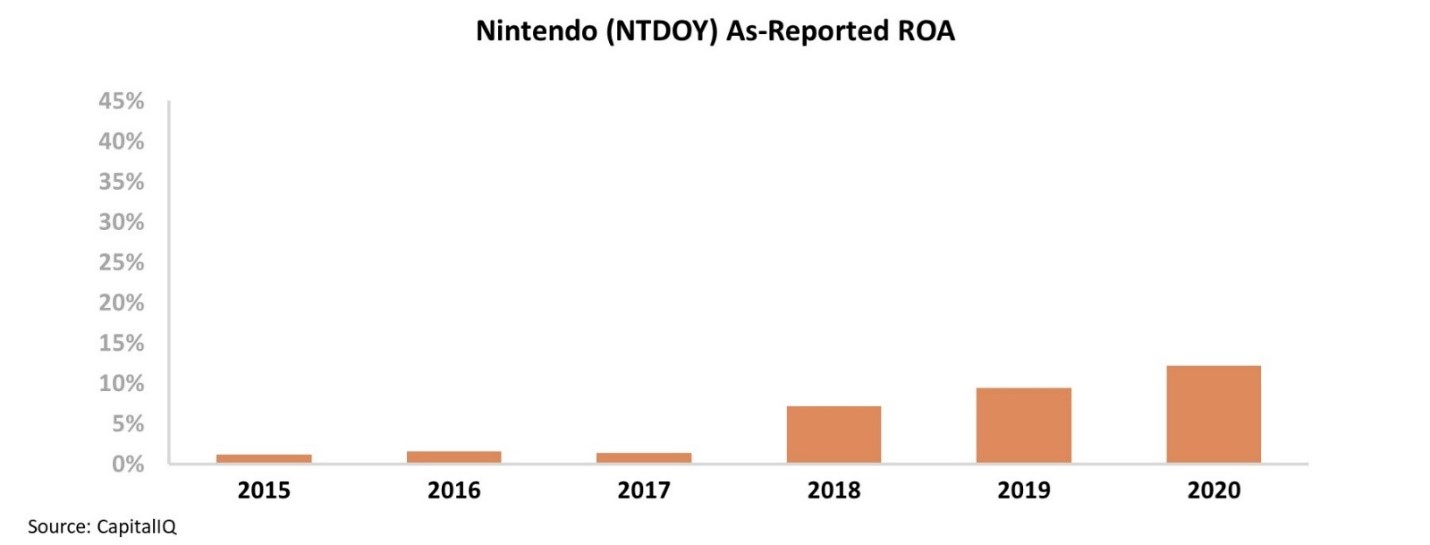

Nintendo's as-reported return on assets ("ROA") was just 12% this year. Despite growth through 2018, returns are only now brushing market averages. Take a look...

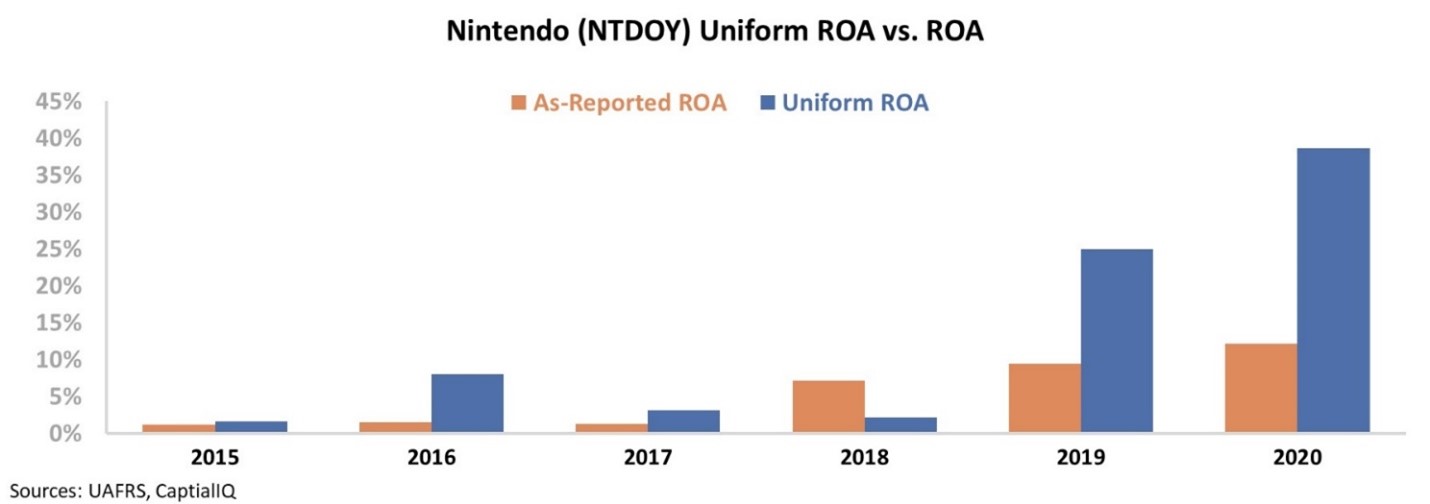

It appears as though Nintendo's launch of the Switch and market dominance hasn't translated into recent outperformance... but this couldn't be further from the truth.

Due to distortions in as-reported accounting – including the treatment of goodwill – Wall Street is severely understating Nintendo's profitability.

The company's actual returns have been at least 3 times higher than the as-reported numbers since 2016. Since the launch of the Switch in 2017, Nintendo's Uniform ROA has roared higher from 3% to 39% this year.

The Switch's worldwide success combined with a focus on digital game sales and adding customers to Nintendo's online platform has clearly improved returns.

But without Uniform Accounting, investors would miss this strong performance. They might see Nintendo as a company with average returns instead of growing profitability.

Ultimately, the success of the Switch and the increased focus on software has led to strong returns. Nintendo now looks to pivot and better monetize its franchises. If it can do this with products like Super Nintendo World, further growth lies ahead.

Stay tuned... in tomorrow's Altimetry Daily Authority, we'll take a look at what the current environment means for Nintendo's valuation.

Regards,

Rob Spivey

December 15, 2020

Disney (DIS) isn't the only company racing to open up new theme parks...

Disney (DIS) isn't the only company racing to open up new theme parks...