Yi Gang isn't worried about inflation in China...

Yi Gang isn't worried about inflation in China...

He's worried about deflation.

Yi is China's former central bank governor... which might help him feel like he can speak a bit more freely. At a panel in Shanghai last month, he said the Chinese government should be focused on fighting deflationary pressures amid falling prices.

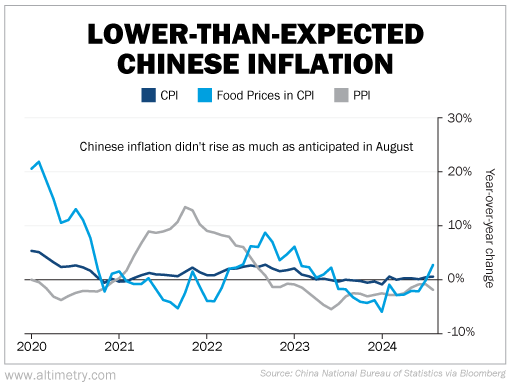

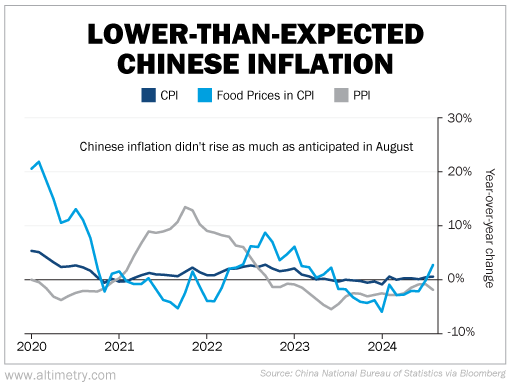

And Yi isn't the only one who's getting worried. Chinese inflation data came in lower than expected last month. That and broader economic concerns led to several stimulus measures from the People's Bank of China and other government agencies.

They cut interest rates... introduced more liquidity for banks... and announced property reforms to try to help boost the domestic housing market.

The announcement sent the market soaring. The Shanghai Shenzhen CSI 300 Index rallied from a low of below 3,200 yuan in early September to peak above 4,200 yuan earlier this month on the news.

But last week... it all came crashing down again. Investors were disappointed to find out this was it.

The Chinese government had brought a pea shooter to an economic tank battle. And as we'll cover, it puts the Chinese economy in a bind...

Chinese inflation is coming off its weakest rise since March 2021...

Chinese inflation is coming off its weakest rise since March 2021...

Core inflation – which is the consumer price index ("CPI") excluding volatile food and energy costs – increased by only 0.3% year over year ("YOY") in August.

Broader CPI, including food and energy, rose by 0.6%. That's lower than expectations, despite being buoyed by higher food costs due to challenging weather conditions.

On top of all that, the producer price index ("PPI") declined 1.8%... 0.4% more than economists forecast.

Just take a look...

One thing is clear... China's inflation is cooling off.

Cooling inflation can be good for economies, to a point. But remember, it also means that consumer demand is falling.

It's particularly noteworthy that food prices rose substantially even as inflation dipped. That's because...

Chinese citizens aren't buying enough stuff...

Chinese citizens aren't buying enough stuff...

They're buying necessities, hence why food prices were up. But many consumer goods are facing deflation.

One such good is cars. Retail sales of passenger vehicles in China fell by 1.92 million units in August. That was the fifth consecutive month of declines, according to the China Passenger Vehicle Association.

And new-home prices in 70 major Chinese cities dropped 0.7% from July to August... down for the 14th month in a row, according to the National Bureau of Statistics.

New-home prices were down a whopping 5.3% YOY, the fastest pace since May 2015. This also comes after a 4.9% slide in July.

If that wasn't bad enough, property investment fell 10% YOY. And home sales plunged 18% YOY.

This inflationary cooling is a symptom of a slowing economy... and a bad sign for China.

The central government's stimulus package feels like a lot of window dressing...

The central government's stimulus package feels like a lot of window dressing...

It doesn't get at the root issues for the economy or for consumer spending.

The problem with deflation is that debt does not deflate. Prices of goods and wages can fall. So can consumers' and businesses' purchasing power. But debt remains fixed.

Deflation increases the real burden of debt... and makes it harder for people and businesses to meet their obligations.

So consider what that means for a company like the Industrial and Commercial Bank of China, the largest multinational bank in the world...

The bank had roughly $987 billion in real estate loans and mortgages alone last year. If property prices keep falling, more borrowers may default on their mortgages as they owe more than the house is worth.

At the end of 2023, the bank's total loan book was $3.7 trillion... all of which becomes riskier as deflationary pressures increase.

The Chinese central bank has tried to ease deflation by reducing the reserve requirements for banks...

The Chinese central bank has tried to ease deflation by reducing the reserve requirements for banks...

That's the amount of cash they need to hold. The measure is supposed to inject more cash into the markets.

But as loan portfolios get riskier, banks will need more cash in their reserves, not less. Letting Chinese banks reduce their reserves could translate to riskier balance sheets.

The People's Bank and the Chinese government have come out with a host of "quick fixes." It's not enough to get the Chinese economy under control. Fixing what's broken won't be an easy task.

As for us... We'll be keeping our money far away as this battle plays out. We recommend you do the same.

Regards,

Rob Spivey

October 14, 2024

Yi Gang isn't worried about inflation in China...

Yi Gang isn't worried about inflation in China...