Legendary investor Warren Buffett frequently mentions that he adjusts as-reported accounting metrics before making an investment decision...

Legendary investor Warren Buffett frequently mentions that he adjusts as-reported accounting metrics before making an investment decision...

He also implores others to do the same – the GAAP numbers offer an incomplete picture of a company's real performance.

Here at Altimetry, the core of our analysis is based on identifying the dislocations created by these accounting distortions. By using our Uniform Accounting framework, we can sometimes see signals that most investors – and the stock market as a whole – are missing.

These signals are more representative of a company's real performance and valuations. This means we can see businesses for what they really are, often before the market comes to the same conclusion.

It can still be tough to grasp the importance of these dislocations, especially when we write about lesser-known companies.

So today, we'd like to highlight one of our favorite examples to bring up when we're teaching or speaking at conferences.

Everybody knows this company, but it's also one of the most powerful dislocations our methodology has ever uncovered. Not only that, but as of this year, we can say that Buffett agrees with us...

Fittingly, in the aftermath of Cyber Monday, today's company is online-retail juggernaut Amazon (AMZN).

Even though it's one of the largest companies and best-performing stocks in the world today, the road getting there wasn't easy...

For years, negative headlines about Amazon dominated the news.

A 2014 Investopedia article claimed Amazon Never Makes Money But No One Cares – it argued that a company with a 16,000% stock return since 1997 had cumulative profits that were less than the amount ExxonMobil (XOM) takes home every two and a half weeks. That doesn't sound right.

Three years later – and now up to 35,000% returns on AMZN shares since 1997 – Forbes published The Amazon Era: No Profits, No Problem. This makes it sound like we're returning to the dot-com era of eye-popping valuations for companies with no cash flow – a scary thought.

Then, in 2018, something changed. Amazon was profitable. Supposedly, it took Amazon 14 years to make the same amount of profit as it did in just the fourth quarter of 2017. It's like a switch has flipped and the company hasn't looked back since.

And nearly the whole time over the past decade, Amazon has moved higher and higher...

Earlier this year, Buffett revealed a roughly billion-dollar investment in Amazon. He admitted he was late to the party.

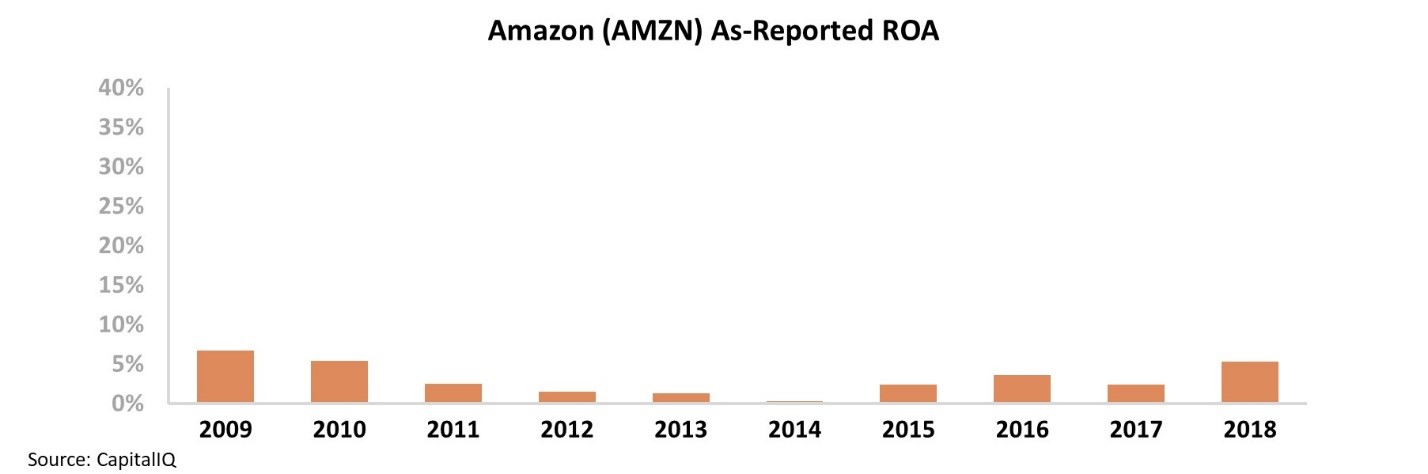

And yet, looking at Amazon's as-reported return on assets ("ROA"), it's difficult to see what changed for the company...

Amazon's as-reported ROA was 5% in 2018 – higher than it had been in a decade – but it's far from the record-breaking year suggested by the headlines.

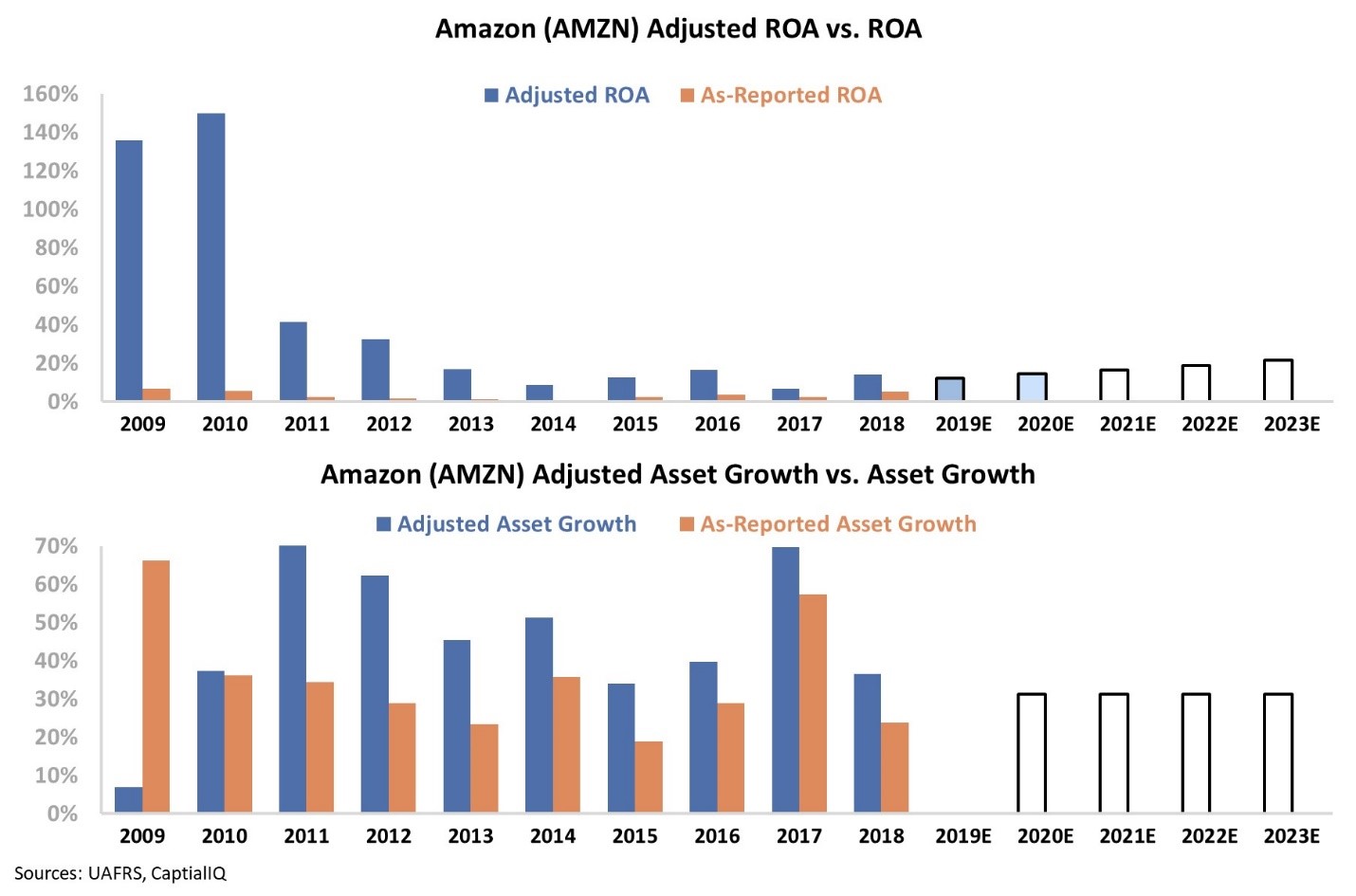

But when using Uniform Accounting, in contrast with the popular opinion that Amazon has just now "flipped a switch," we've seen that this is a company with a historically strong ROA and growth.

The chart below explains the company's Uniform historical corporate performance in terms of ROA and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars). Take a look...

Back in 2009 and 2010, Amazon was producing returns well above 100%. The dislocation between as-reported and Uniform ROA was so large, it's almost impossible to see the as-reported ROA on the chart. And even when almost everyone thought was Amazon was unprofitable in the mid-2010s, the dislocation between its Uniform and as-reported ROA was huge.

While returns have "come back to earth," Amazon is still a massively profitable company – with a 14% Uniform ROA in 2018.

Over the past decade, Amazon has consistently grown its business by more than 30% every year. In 2011, Amazon had $4 billion in Uniform assets. Today, Amazon has $85 billion in Uniform assets... A 14% ROA on $85 billion is just under $12 billion.

This is the source of the dislocation. For years, Amazon looked like it was generating paltry returns while it was focused on growing its business. As a result, the headlines complained that the market was on its way back to the dot-com era – focusing on growth with no sign of profit.

By using Uniform Accounting, we can see why Buffett regrets not acting sooner. Amazon showed its earnings potential years before the market realized.

Although the days of hypergrowth may be behind it, that may not be the end of the story for Amazon... Its ROA expanded from 7% in 2017 to 14% in 2018.

With Buffett's recent investment, he must believe the market still doesn't see the full story for Amazon.

Even when Buffett gets it right, he doesn't always get what he wants...

Even when Buffett gets it right, he doesn't always get what he wants...

Buffett was also in the news this week related to a private-equity deal.

Both Buffett and private-equity firm Apollo Global Management were bidding for IT solutions and software and hardware distributor Tech Data (TECD)... and Buffett was outbid by Apollo. Tech Data, a company that was once on Altimetry's list for potential names for our new High Alpha newsletter, was bought for around $6 billion.

There are a lot of reasons for Buffett and Apollo to like Tech Data. The company has consistently seen an impressive inflection in Uniform ROA the past few years as it has transformed its business. And yet, market expectations haven't fully caught up to fundamental realities for the company.

It looks like Apollo got a deal with Tech Data... and Buffett is still stuck with a $128 billion cash pile. Perhaps by using Uniform Accounting, we can pick out a few other companies he'd want to acquire instead...

Regards,

Joel Litman

December 4, 2019

P.S. To learn more about Altimetry's High Alpha – and gain instant access to our portfolio of open recommendations – click here.

Legendary investor Warren Buffett frequently mentions that he adjusts as-reported accounting metrics before making an investment decision...

Legendary investor Warren Buffett frequently mentions that he adjusts as-reported accounting metrics before making an investment decision...