The most important factor in building Altimetry...

The most important factor in building Altimetry...

Warren Buffett once said, "In looking for people to hire, look for three qualities: integrity, intelligence, and energy. And if they don't have the first, the other two will kill you."

We approach recruiting and hiring people with the same mindset we have when reviewing management teams.

Determining integrity, or more importantly, deciphering if there is a lack of integrity, is first and foremost.

The corollary to Buffett's "integrity, intelligence, and energy" is obvious. The last thing you'd want inside your business or running the companies in your portfolio is a group of highly intelligent, highly motivated fraudsters. They'll be too good for you to catch!

Society would be better off if the people with the least integrity were also "couch potatoes." So would any business.

When we see bad business situations and want to advise our clients not to touch these stocks, we add those companies to a "Do Not Buy" list of stocks.

The primary criterion that lands a stock on our "Do Not Buy" list is finding that management lacks integrity in their numbers, words, or business structure.

What is our track record for choosing bad players? Around 100 companies have made it into our list over the years. Among those companies, the average return is negative 50% within months of making our notorious list.

That average is sort of capped in a way because a stock can't fall more than 100%... We've picked many that have fallen to zero.

Are we doing some amazing, complicated mathematical accounting forensics? Later in the process, we leverage our complex models to understand the company. But our first stage of Fundamental Forensics is something anyone can do, but people just don't take the time for whatever reason.

We look at the nature and location of the headquarters. We Google all the addresses listed in their Securities and Exchange Commission ("SEC") filings and other places. We check out the certified public accounting ("CPA") firm that they've chosen and run a check on the CPAs themselves. Of course, we examine the background of each management team.

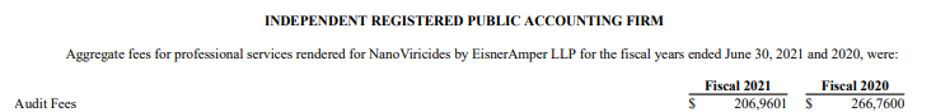

In the case of NanoViricides (NNVC), a company on our "Do Not Buy" list, its CPA firm couldn't even get its own audit fees correct in the DEF 14A filing.

That's right... The listed audit fees for the company were not even a correctly written number. I said jokingly that I had not been aware that a six-figure dollar amount could have seven numbers in it until this point.

Here's an actual picture straight from the SEC database.

Subscribers to Altimetry's Microcap Confidential newsletter know the importance of self-policing stocks.

There are many other reasons that NanoViricides has made the "Do Not Buy" list. The stock has dropped more than 60% since we first highlighted it in July 2019. The SEC simply doesn't have the time or resources to police all the publicly traded companies.

We also run an analysis on the integrity of the data itself and even audit the words and the story. For instance, our Earnings Call Forensics ("ECF") highlights management's verbal cues that may be ignored otherwise.

Would you ever loan money to someone without even asking them why they want your money? If not, how could an investor ever buy the equity of a firm without first checking the veracity of their verbal statements?

Evaluating the integrity of management and their verbal and financial communications is paramount in our investment process.

It's also the first and most important criteria when hiring our people.

We seek the highest levels of integrity when hiring...

We seek the highest levels of integrity when hiring...

We build our firm in a way that reflects how we would want to be analyzed by others, just as we analyze other firms.

I once worked at a firm that claimed they hired the "best and the brightest." I still don't even know what that means.

Did my former employer only hire people with the highest IQ? That would be a strange place to work, and I'm not sure that "highest IQ" is the best criteria for several functions of an organization... including my position!

I think that I'd never get hired into a firm that only hired those with extremely high IQs. I am certain that many of Altimetry's people have higher IQs than me.

Does that mean that the firm hired only people with straight As? There is clear and demonstrable evidence that emotional intelligence ("EQ") is more important and essential for the top leaders in most roles, particularly client-facing ones.

But what grades reflect the level of a person's EQ? We can't rely on scores that don't test the most important skills.

We look for people with the highest integrity first, and we all know what that means...

We look for people with the highest integrity first, and we all know what that means...

There is "business speed in trust." No number of lawyers in the world can write up a contract that will account for every possible scenario that could happen.

At some point, we must rely on our mutual integrity with our clients, partners, and workforce to know that, whatever happens, each party can live up to the spirit of their agreements.

That kind of relationship between business partners is how we want to interact with our workforce and among each other within our workforce.

We want to hire people with integrity and show the highest integrity in our dealings with others.

That goes for our people... and the people of the stocks we seek to invest in.

I hope each of you has a great weekend and week ahead.

Love, joy, and peace,

Joel

March 11, 2022

P.S. A few weeks ago, I was invited to the Pentagon to share my forensic accounting insights on the stock market. But there's one thing I didn't tell the generals: where I think the smart money is going next. I just put together a video presentation where I lay out all the details (including one of my favorite ways to play this coming megatrend). Watch it here.

The most important factor in building Altimetry...

The most important factor in building Altimetry...