Whenever legendary investor Warren Buffett buys a stock, copycat investors pounce...

Whenever legendary investor Warren Buffett buys a stock, copycat investors pounce...

They buy what Buffett buys and sell what Buffett sells. It can cause those stocks to surge from a buying frenzy... or plummet from a sell-off, even if Buffett was merely trimming his position.

That's why he asked the U.S. Securities and Exchange Commission to keep certain details of Berkshire Hathaway's (BRK-B) holdings confidential over the past three fiscal quarters. That way, Buffett's holding company could buy into a specific company without worrying about other investors bidding up the price.

Now that it's done buying, Berkshire finally revealed its mystery investment... a $6.7 billion stake in insurance company Chubb (CB).

Buffett's investment in Chubb equates to a more than 6% stake in the company and makes Chubb the ninth-largest holding in Berkshire's portfolio.

Shares of the insurance giant surged more than 8% in the days following the announcement.

Buffett loves insurance businesses. And he knows how profitable the best ones can be... So this wasn't a shock for investors.

Yet, Chubb's stock has started to come back down to where it was before Berkshire's investment was revealed. It seems investors are missing what Buffett sees in this $107 billion insurer.

Insurance companies are 'steady Eddie' businesses... even in economic downturns.

Insurance companies are 'steady Eddie' businesses... even in economic downturns.

That's because insurance is a necessity.

No matter what's going on in the economy, people need to keep paying for their insurance coverage. This gives insurers a steady stream of cash flow.

They collect premiums up front and pay out claims later. If the premiums they collect exceed the claims they pay out, insurance companies earn a profit.

That said, insurers don't make all their money from premiums...

The pool of cash from unclaimed premiums is called "float." You can think of float as a zero-interest loan. Insurance companies can invest that float for their own benefit.

Especially in high-interest-rate environments like today, this part of the insurance business makes a ton of cash... something Buffett understands well.

Berkshire owns insurance companies Geico, General Re, and National Indemnity. And it has invested in many others over the years.

Chubb – Buffett's latest investment in this space – is the world's largest publicly traded property and casualty insurer.

It operates in 54 countries and territories and focuses mostly on high-end customers and specialized areas like boat and yacht insurance and jewelry and art coverage. Chubb is also the No. 1 commercial lines insurer in the U.S.

These businesses aren't going anywhere anytime soon... Folks are going to keep paying to insure their expensive goods. That means Chubb's cash flows should be steady.

Buffett knows insurance companies like Chubb are set to make more money with interest rates at elevated levels (and likely to remain there for some time). Investors, on the other hand, seem to be missing the opportunity...

Despite high interest rates, investors don't expect better returns on Chubb's investments...

Despite high interest rates, investors don't expect better returns on Chubb's investments...

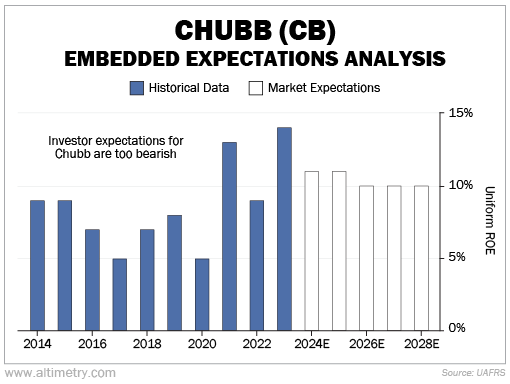

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

From 2014 to 2020, Chubb's Uniform return on equity ("ROE") was around 8%. That's decent, though on the lower end of the company's range. The main reason for that is lower investment profits due to low interest rates.

In a high-interest-rate environment, Chubb consistently earns double-digit Uniform ROE.

Returns peaked at 14% in 2023. And even though interest rates aren't likely to come down in the near future, the market expects Uniform ROE to fall to 10% in the coming years.

Take a look...

Unless we see a significant drop in interest rates, investors' expectations – though they aren't terrible – are too bearish.

This might be the opportunity Buffett sees in this company... a high-quality insurer trading at a cheap valuation.

More eyes have been on Chubb after Berkshire's reveal...

More eyes have been on Chubb after Berkshire's reveal...

As we said earlier, copycat investors clamored into the stock once Buffett shared Berkshire's mystery investment.

Yet, since the initial spike, Chubb shares have started to come back down and now mostly remain flat.

It has been less than a month since Buffett's stake in Chubb was announced... and Buffett is best known for his long-term investing mindset. So investors seem to be missing the opportunity here.

Interest rates are expected to remain high for a while, which means Chubb should keep raking in cash.

It's only a matter of time before investors see what Buffett sees.

Regards,

Joel Litman

June 13, 2024

Whenever legendary investor Warren Buffett buys a stock, copycat investors pounce...

Whenever legendary investor Warren Buffett buys a stock, copycat investors pounce...