When investing legend Warren Buffett buys stock, it tends to get a lot of fanfare...

When investing legend Warren Buffett buys stock, it tends to get a lot of fanfare...

The market thinks he's seeing something big. Folks rush to report on what he's buying... how much... and even to copy the trade themselves.

So when word got out that Buffett bought nearly $1 billion worth of Capital One Financial (COF) stock last month, you might have expected it to make waves.

You'd be wrong. Investors didn't even bat an eye. We saw almost nothing of the usual coverage, and the market hardly seemed to care at all.

I was surprised, too... at first. Then I took a closer look and realized there might be a good reason for investors' apparent disinterest.

After all, Capital One is the type of regional bank that has been catching bad headlines for the past three months. In the bank's latest earnings call, CEO Richard Fairbank warned that Capital One will battle the effects of inflation and struggling consumers for the rest of the year.

It's also one of the banks most exposed to subprime credit. That's thanks to its massive credit-card business, which is targeted to riskier borrowers.

Capital One is facing a lot of bad news. No wonder the market isn't interested in what Buffett sees.

But we are.

Today, we're diving into Buffett's latest big investment. There's a lot more going on with Capital One than meets the eye. And Buffett's trades during the past few bank crises show us what investors are missing.

Buffett has a habit of betting on big banks and financial companies...

Buffett has a habit of betting on big banks and financial companies...

He swept in to save investment bank Salomon Brothers during the 1987 market crisis. And during the Great Recession, he gave Goldman Sachs (GS) the vote of confidence it desperately needed through a $5 billion cash infusion.

These weren't acts of good faith – they were smart investments. Salomon offered Buffett a 9% annual dividend for his $700 million. And he made a 60% return on his Goldman bailout.

Buffett's crusade has taken him beyond investment banks for years. His love for insurance companies and consumer finance drove him to controlling stakes in Geico and Berkshire Hathaway Reinsurance. And he's a longtime holder of American Express (AXP) stock.

So many folks were surprised when he didn't use the regional-bank crisis as an opportunity to swoop in. He didn't make a big splash rescuing one of the plunging lenders, fulfilling his hero complex and his love of the industry all at once.

However, Capital One hits on a few hallmarks of every great Buffett investment.

Buffett loves to buy companies with strong, durable competitive moats...

Buffett loves to buy companies with strong, durable competitive moats...

He focuses on the types of businesses that he can own forever. Even more, he likes to buy them when they're undervalued in the short term.

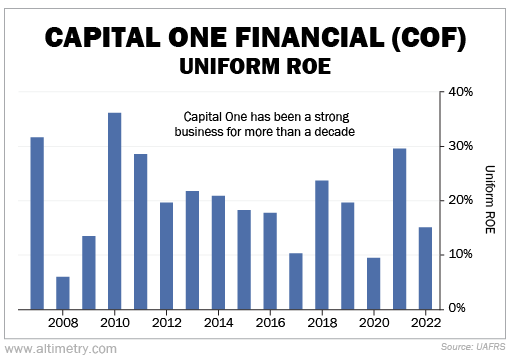

Capital One is just that kind of business. Its Uniform return on equity ("ROE") has hovered around 20% since 2007. That's more than twice the 8.5% average cost of capital for banks.

Take a look...

So far, Capital One checks all of Buffett's boxes. It has a strong brand name... and it has converted that brand name into a massively profitable business.

Its Uniform ROE only dipped below 10% twice. It hit about 6% in 2008 – the worst year for banks in modern history – and just below 10% in 2020.

Even better for Buffett, the market has soured on Capital One...

Even better for Buffett, the market has soured on Capital One...

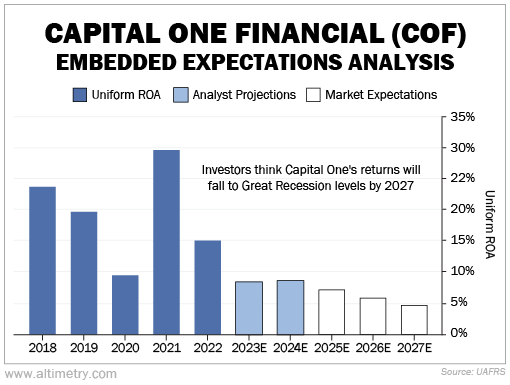

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA works a lot like a betting line in a sports bet. We use the current share price to calculate what investors expect from a company's future performance... and compare those forecasts with our own. It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Right now, investors forecast that Uniform ROE will fade to less than 5% by 2027. Similar to 2008, Capital One is building its loan-loss reserves – a cushion to prepare for a surge in defaults with tough times ahead.

The market is getting ahead of itself. Remember, the only time Capital One's Uniform ROE got even close to 5% was in 2008... and we don't expect things to get that bad this time around.

Wall Street analysts don't expect its Uniform ROE to drop that far. They think it will stay right around the cost of capital...

Buffett knows Capital One is world-class at controlling risk...

Buffett knows Capital One is world-class at controlling risk...

Because it lends to riskier borrowers, it has to control those risks well to keep its returns so high. It's the third-largest provider of credit cards in the U.S. and has forged long-term relationships with its client base.

We think the market is too worried about Capital One.

Yes, things are bad in the bank sector now. However, this should only be a transitory headwind for quality banks like Capital One. ROE will rebound.

That's why Buffett is buying today... and it's why Capital One may be this year's version of his Goldman trade. You still have time to invest alongside Buffett.

Regards,

Joel Litman

June 7, 2023

When investing legend Warren Buffett buys stock, it tends to get a lot of fanfare...

When investing legend Warren Buffett buys stock, it tends to get a lot of fanfare...