Earlier this month, Warren Buffett hosted Berkshire Hathaway's (BRK-B) annual shareholder meeting – a 'Woodstock for Capitalists,' as some call it...

Earlier this month, Warren Buffett hosted Berkshire Hathaway's (BRK-B) annual shareholder meeting – a 'Woodstock for Capitalists,' as some call it...

The event took a somber tone this year.

It was Buffett's first annual meeting without his longtime business partner Charlie Munger, who passed away last November at the age of 99.

On top of that, Buffett had a tough message to deliver to shareholders...

Back in February, he mentioned that Berkshire has "no possibility of eye-popping performance." This month, he added that the company is sitting on a record $189 billion in cash... and can't find any good opportunities to deploy it.

Berkshire already has a massive portfolio. And a lot of its money is in some of the world's largest companies, like Apple (AAPL) and Coca-Cola (KO).

The problem is that its portfolio is now too big. To see any sort of meaningful return, Berkshire would have to make a huge investment.

Yet, as Buffett said at the recent shareholder meeting, "We only swing at pitches we like." He expects the company's cash pile to exceed $200 billion by the end of this quarter.

Today, we'll discuss why Buffett's conglomerate has limited opportunity for exceptional upside going forward. We'll also explain what that means for investors looking for growth in the market...

Buffett believes that if he had less money to invest, his performance would be much better...

Buffett believes that if he had less money to invest, his performance would be much better...

Since 1999, the Oracle of Omaha has often claimed that if he had between $1 million and $10 million, he could make an annual return of 50%, as he did in the beginning of his career.

Now, all he can promise is "a bit better than the average American corporation."

The difference is that today, he just has too big a portfolio and too much cash. At this point, Berkshire will struggle to beat the market because, in many ways... it is the market.

Similar to the S&P 500 Index, it holds some of the world's largest public companies...

As of the first quarter, Berkshire had a $135 billion position in Apple. And it has tens of billions of dollars invested in companies like Coca-Cola and Occidental Petroleum (OXY).

The company is worth nearly $900 billion today. And as we mentioned earlier, it's sitting on almost $200 billion in cash.

So as much as Buffett would love to invest $1 million for a 50% return, that would barely show up in Berkshire's results.

That would be a gain of $500,000... when the company's net income was more than $96 billion last year.

Instead, Berkshire needs to make big bets...

Instead, Berkshire needs to make big bets...

It has to put at least a few billion dollars into a position for it to "move the needle" in its portfolio.

And there are only so many stocks out there large enough for Berkshire to hold a stake in them without taking over the company.

If Buffett could invest anywhere, he'd likely pick small, microcap-sized companies. These kinds of companies have a lot more room to grow – and fast...

For example, insurance company Geico was one of Buffett's first investments back in the 1950s.

At the time, it collected about $8 million in annual premiums. That was roughly triple its premiums from just a few years earlier.

Buffett bought about $10,000 worth of Geico stock in 1951 and sold it for a roughly 50% gain the next year.

Today, Geico is a wholly owned subsidiary of Berkshire... and there's no chance the company's value would ever rise 50% in a year.

It collected almost $40 billion in premiums last year, less than 2% higher than the year prior. It's just too big to double every few years like it did 70 years ago.

That's why it's so important to buy stocks early... before they become something Berkshire could put its money into today.

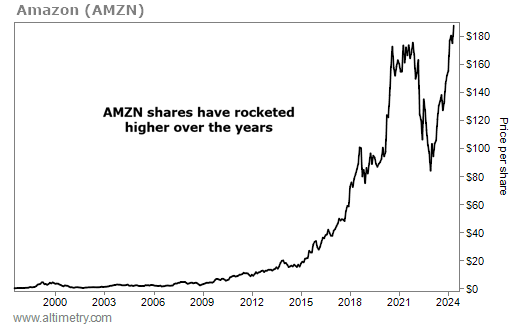

Amazon (AMZN) is a great example of this...

Amazon (AMZN) is a great example of this...

Back in 1997, it was a small cap. The company was worth just $400 million. Today, the e-commerce giant is worth nearly $2 trillion.

If you had invested in Amazon in 1997, you would have seen a more than 250,000% return.

Take a look...

It's a similar story with Internet and data-center company Equinix (EQIX)...

Back in 2003, Equinix was worth around $9 million – a tiny microcap. Now, it's worth roughly $72 billion.

And if you had invested in the company in 2003, you would have seen returns of more than 20,000% since then...

It's going to be a lot harder for these stocks to keep delivering returns like they did early on.

And while Buffett is stuck buying the very largest stocks, investors who aren't responsible for putting $200 billion to work should focus on the kinds of stocks he would've bought back in the 1950s... namely, smaller stocks with a lot of growth potential.

To do that, investors need to look smaller than the S&P 500... They should be looking as small as the microcap stocks in the Russell 2000 Index.

These are the types of investments that built Buffett's legendary reputation in the first place.

Regards,

Joel Litman

May 14, 2024

Editor's note: One of the most important days in the investment world is right around the corner... the Russell reconstitution.

On June 28, the Russell indexes will get their annual "refresh," in which they'll be rebalanced to reflect market changes from the past year. A lot of companies will flow in and out of the Russell indexes... and Joel predicts this year's rebalance could usher in some of the biggest small-cap gains in more than two decades.

To learn all the details – including which five small-cap stocks are the most likely to soar ahead of reconstitution day – click here.

Earlier this month, Warren Buffett hosted Berkshire Hathaway's (BRK-B) annual shareholder meeting – a 'Woodstock for Capitalists,' as some call it...

Earlier this month, Warren Buffett hosted Berkshire Hathaway's (BRK-B) annual shareholder meeting – a 'Woodstock for Capitalists,' as some call it...