Carl Icahn made his fame with his activist investment strategy...

Carl Icahn made his fame with his activist investment strategy...

Carl Icahn has been labeled harshly as a corporate raider, an aggressive activist investor, and a man who can get whatever he wants out of a company. Over the last 50 years, his track record speaks for itself, thanks to his unorthodox investment strategy.

As an aggressive activist investor, he pushes management teams and other investors of the companies in his portfolio to change operations, and they do as he says.

It's not a shocker to find out he's fought with other financiers about his involvement in management decisions. In 2013, Icahn and billionaire hedge-fund manager Bill Ackman had a notorious shouting match on live television about the nutritional supplements company Herbalife (HLF).

Many of Icahn's nicknames and details of his life and investments were the topics of the HBO documentary released last month, called Icahn: The Restless Billionaire. It tells how he went from a humble childhood in the New York City borough of Queens to a respected Wall Street investor.

Having recently watched the documentary and having watched his moves for nearly two decades, I can say that the documentary painted him in about as good a light as you can, given his track record.

Icahn can make management teams' jobs hard from time to time, but this doesn't change the fact that he's a passionate businessman and one of the first impressive great activist investors of all time.

The legendary investor has consistently made great returns on his investments, and the people who followed in his footsteps have also benefited.

While Icahn has been called many names, socially or environmentally conscious has not been one of them...

While Icahn has been called many names, socially or environmentally conscious has not been one of them...

Around the time the documentary came out, Icahn announced a new activist campaign against McDonald's (MCD).

This campaign is a little different, though. Instead of his usual push to improve shareholder returns, Icahn pushed for the fast-food giant to provide better living conditions for pigs.

Icahn wants to end the practice of putting pregnant sows into cramped gestation crates, which he views as inhumane. Noting that he and his wife have three dogs and a soft spot for pigs, Icahn told the Wall Street Journal:

Animals are one of the things I feel really emotional about.

Though Icahn only owns 200 shares, or roughly $47,000 worth, not nearly enough to have a seat at the table, Icahn's reputation goes a long way...

A February press release from McDonald's states:

Mr. Icahn's ownership provides him with unique exposure to the industry-wide challenges and opportunities in migrating away from gestation crates. Thus, it's noteworthy that Mr. Icahn has not publicly called on Viskase to adopt commitments similar to those of McDonald's 2012 commitment.

Despite McDonald's progress, Mr. Icahn has instead asked for new commitments, including to require all of McDonald's U.S. pork suppliers to move to "crate free" pork and set specific timeframes for doing so...

McDonald's said in its February announcement that it plans to source between 85% and 90% of its pork from farmers who treat their pigs humanely by the end of this year, and it aims to source all its pork from humane farmers by 2024.

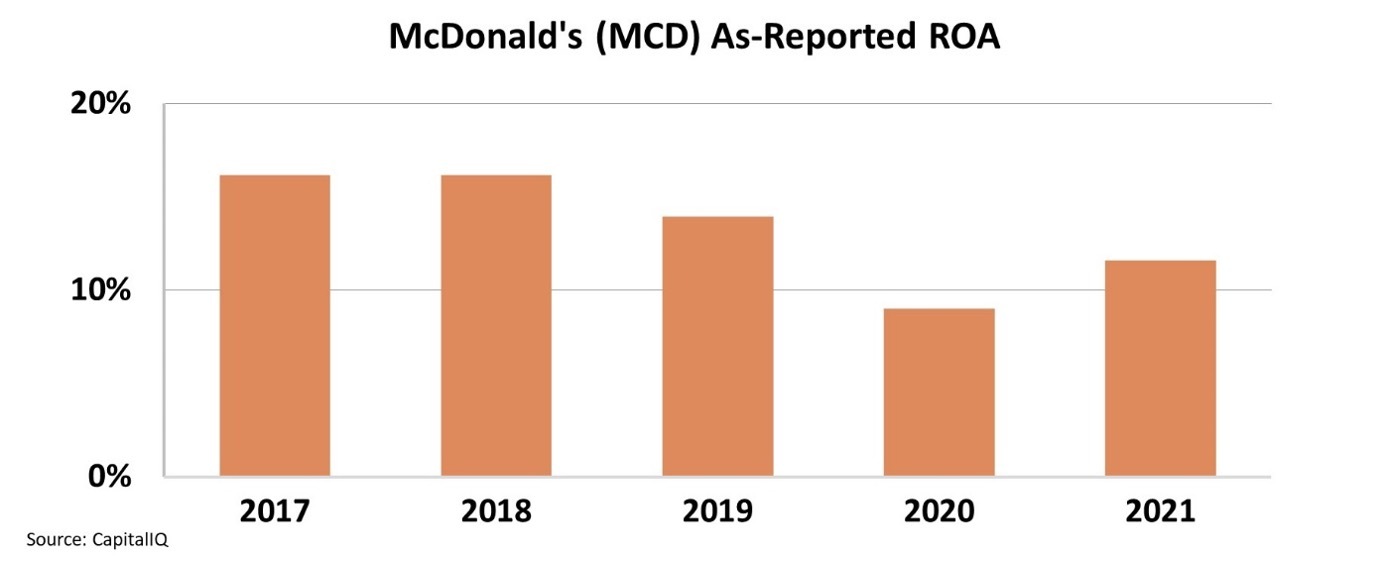

On the surface level, when we look at as-reported metrics, McDonald's seems to be sacrificing some of its profitability by implementing environmental, social, and governance ("ESG") measures.

As-reported return on assets ("ROA") was 12% in 2021. This falls below the 16% levels seen in 2017 and 2018.

This drop signals that perhaps McDonald's is bearing more costs to meet these requests from Icahn for more sustainable and humane practices.

Are these sustainable changes going to help or hurt McDonald's?

Are these sustainable changes going to help or hurt McDonald's?

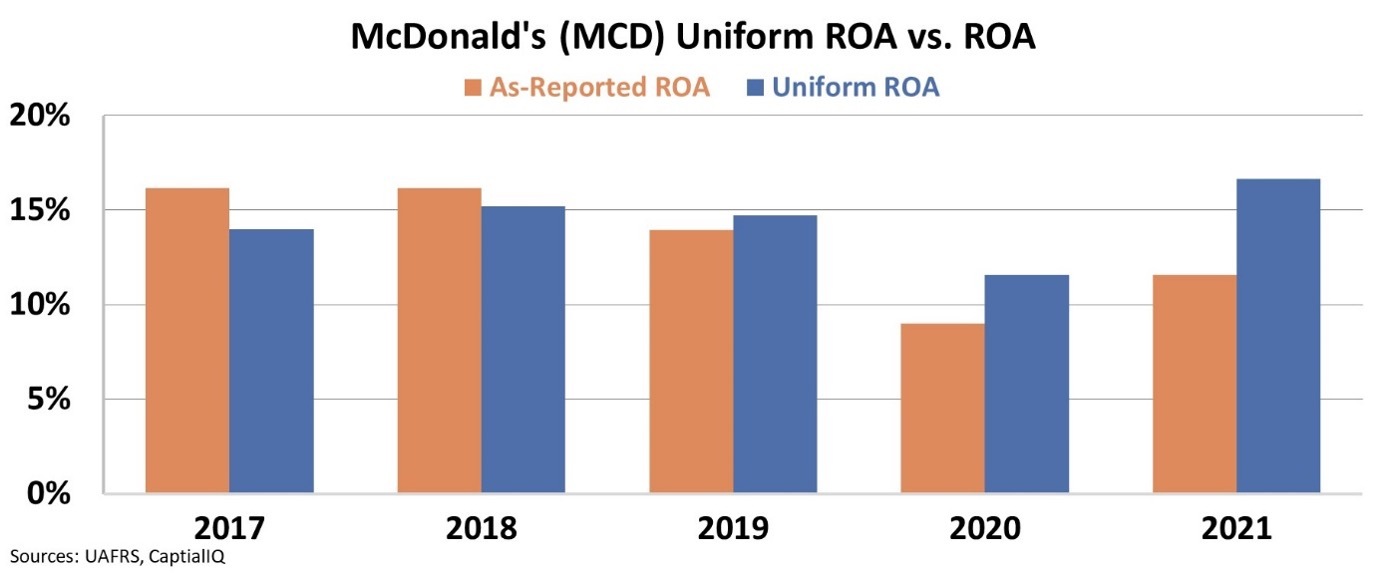

While as-reported metrics make it look like McDonald's ESG initiative is taking from its profitability, Uniform Accounting shows a different picture.

McDonald's actually improved its ROA from 14% in 2017 to 17% in 2021 and is still trending upwards.

Uniform ROA metrics show us that pushing toward better ESG practices could be helping the company. By looking only at as-reported numbers, investors would miss how McDonald's shift to environmentally friendly practices isn't causing profitability to drop.

Thanks to Uniform Accounting at Altimetry, we can see that Icahn isn't abandoning his old way of driving to greater shareholder return, and it shows us a company that can both be ESG-friendly and profitable.

Regards,

Rob Spivey

March 22, 2022

Carl Icahn made his fame with his activist investment strategy...

Carl Icahn made his fame with his activist investment strategy...