Buying bonds used to be about how many people you knew...

Buying bonds used to be about how many people you knew...

Back in the day, when new bonds hit the market, portfolio managers would phone a friend. They'd call all around the country, gathering up the bonds they needed.

That all changed when Howard Lutnick stepped onto the scene in the 1990s. He saw untapped demand for faster bond trading... and he capitalized on that opportunity.

Lutnick created an electronic trading platform for bonds before anyone else considered it. He called it "eSpeed"... and he sold it to Nasdaq in 2013 for $1.2 billion.

Today, he's the chairman and CEO of Cantor Fitzgerald, a long-run market maker and an innovator in the U.S. bond markets. He's also the head of leading global brokerage and financial-technology company BGC Partners (BGCP).

Lutnick's ambition didn't stop there. He has had his sights set on another market for quite some time... Treasury futures.

Unfortunately, CME Group (CME) already has a stranglehold on futures. And according to Lutnick, it's "one of the great monopolies in America."

You see, the futures market has been booming over the past 15 years. Volumes alone have nearly quadrupled. And no one has threatened CME's reign in this vital market.

Today, we'll see if CME's dominance has really created a "great monopoly" like Lutnick claims. We'll also discuss whether BGC Partners can compete with CME...

CME has been beating out competitors for decades...

CME has been beating out competitors for decades...

The company is a titan in the financial markets. And it has been growing for more than a century.

It all started in the 1840s, when the Chicago Board of Trade became the first exchange to standardize forward contracts... also known as "futures contracts." As the name suggests, these contracts are used to lock in a future price. They protect investors from large price moves.

In 2007, the organization merged with the rival Chicago Mercantile Exchange – the first publicly traded exchange in the U.S. – to form CME Group.

And CME Group hasn't grown complacent. It's still the largest futures and options-trading market in the world.

As the leader in global derivatives, CME's products have grown from futures on agricultural commodities to equity indexes, foreign exchanges, interest rates, and even weather.

(To quantify weather, they track things like how much the temperature in a particular region deviates from the monthly or seasonal average.)

CME's size allows it to offer these relatively niche products with strong liquidity. And the stability of its platform doesn't hurt the appeal, either. It has gotten so big that it's now the largest futures exchange for U.S. Treasurys – one of the most liquid assets out there.

That's why BGC Partners is trying to get even just a small piece of the pie.

Previous challengers to CME have tried to replicate its products... or have created their own competing platforms, such as the U.S. Treasury trading platform BrokerTec.

However, CME has a history of buying its competitors. BrokerTec is now a part of CME.

It looks like enviable returns will remain out of reach...

It looks like enviable returns will remain out of reach...

The average company in the U.S. currently generates a 12% return on assets ("ROA"). Restaurants can trend lower, with an average return around 5% to 7%... while software giants are typically higher, at 20% to 30%.

CME is a whole other monster...

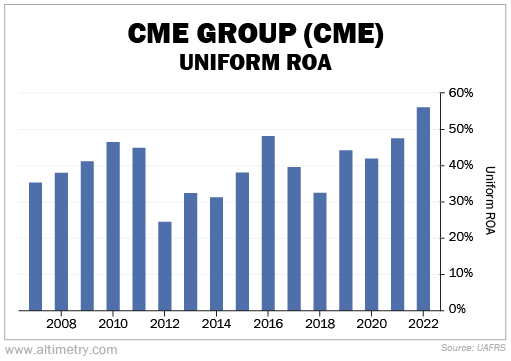

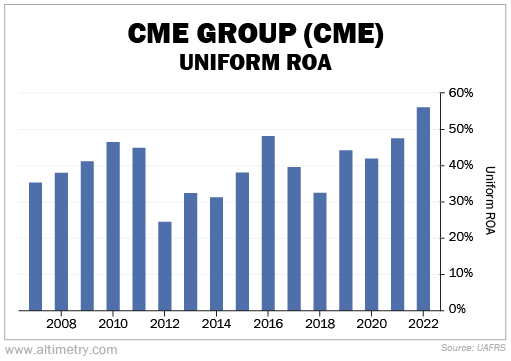

The company's Uniform ROA has regularly been between 40% and 50% over the past decade-plus. Only a handful of companies can generate that profitability – and it's a pretty clear sign that CME has achieved monopoly status.

Take a look...

It makes sense that Lutnick is trying to go after CME's share of the futures market. He's hoping to rake in some of those profits as well...

But CME has already withstood multiple and varied challenges to its business. And it has managed to shrug them off with ease.

That doesn't bode well for Lutnick and BGC Partners.

We'd argue Lutnick will struggle to make inroads on CME's monopoly... It's hard to break into an entrenched opponent.

On the other hand, that's good news for folks who invest in CME. While Lutnick might make a splash creating a new exchange, the business itself isn't likely to make a dent in CME's operations.

All CME has to do is maintain its position... and shareholders will be looking at years of steady returns.

Regards,

Rob Spivey

June 29, 2023

Buying bonds used to be about how many people you knew...

Buying bonds used to be about how many people you knew...