Everything is 'made in China'... except for the best chips.

Everything is 'made in China'... except for the best chips.

China still relied on a lot of Western chips until recently... including plenty from U.S. powerhouses like Intel (INTC) and Advanced Micro Devices (AMD).

Over the past few years, though, the U.S. and China have been gearing up for another round of the chip war. The U.S. has been pulling back on what it sells to China in order to limit China's access to our technology.

Now, China is reportedly banning government agencies from buying Intel's and AMD's chips.

According to the Financial Times, the rules were first announced in December... and the country is starting to enforce them. China wants to develop better chips at home so it doesn't have to rely on other countries.

However, there's one big problem with this plan... The Chinese chip industry isn't as advanced as it wants us to believe.

China has known for years that its access to American chip tech is running out...

China has known for years that its access to American chip tech is running out...

That's why last year, Chinese tech company Huawei Technologies partnered with Semiconductor Manufacturing International Corp. (0981.HK) – or "SMIC" for short.

Huawei and SMIC planned to make a state-of-the-art, seven-nanometer chip. It seemed like a big step in the right direction for Chinese chipmaking. Except they left out one little detail...

China can't build the chip without equipment made by two American companies... Applied Materials (AMAT) and Lam Research (LRCX).

The country is hustling to get as much equipment as it can. It imported a whopping $40 billion of chip machinery last year, up 14% from 2022.

This is nothing new on America's end. Lam has quietly dominated the chip-equipment market for nearly a decade.

Lam first popped up on our radar back in 2016...

Lam first popped up on our radar back in 2016...

At the time, returns were on pace to surpass 20%... something it had only done in a few standout years.

Normally, we would've cast this aside as a short-term boost. Semiconductors are cyclical, so we might have chalked it up to a spike in demand.

But we did some more digging... And we found something more powerful backing Lam's performance.

The company had the best parts for making high-quality memory chips. And it had numerous patents to protect those tools. (Today, that number sits at more than 11,000.)

In other words, nobody else could compete with Lam's parts.

That's still the case today. Otherwise, China would find another way to make its new chip.

Considering Lam's near-monopoly on memory-chip manufacturing parts, you'd expect it to have unbeatable returns.

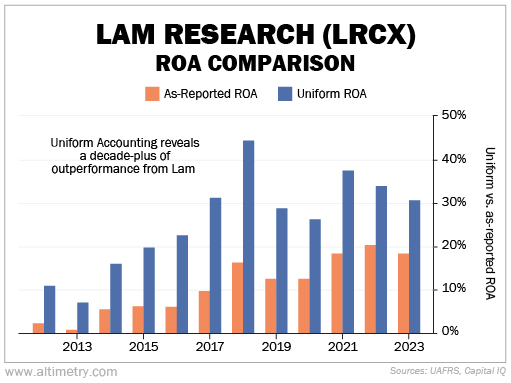

Yet as-reported numbers told a different story in 2016... and they still do today.

Generally accepted accounting principles ("GAAP") show Lam was booking returns of less than 10% through 2016. Its performance was well below the 12% corporate average.

While it has improved since then, Lam's as-reported return on assets ("ROA") is still only around 20%.

When we clean up the numbers using Uniform Accounting, we can see Lam is significantly more profitable. The discrepancy is so big that Uniform ROA was double as-reported ROA from 2018 to 2021.

Take a look...

Lam's Uniform ROA has been above 20% since 2016... and has averaged above 30% since 2017.

We have a long history of outstanding returns with Lam...

We have a long history of outstanding returns with Lam...

Its intellectual-property protection gave us confidence in the company's long-term returns in 2016. We recommended it to our institutional clients that December... and closed it in mid-2021 for a 490% gain.

In February 2020, we also recommended Lam Research in our Altimetry's Hidden Alpha monthly advisory. Subscribers who followed our advice secured a 112% combined gain in less than a year and a half.

It might get harder for Lam to sell to China if chip restrictions keep mounting. But that doesn't mean this business is bound to slow down. The growth of AI is boosting chip demand faster than ever.

Regards,

Joel Litman

April 11, 2024

Everything is 'made in China'... except for the best chips.

Everything is 'made in China'... except for the best chips.