It's too late to reverse China's one-child policy...

It's too late to reverse China's one-child policy...

The Chinese government is worried its aging population will increase its share of retirees and shrink its workforce.

Back in the 1970s, China's leader Deng Xiaoping and others feared explosive population growth. And the government passed its famous one-child policy in 1979, which limited births across the country.

Over the past 40 years, this has created a demographic wave of unintended consequences.

China's fertility rate was 1.3 in 2020. That's below 1.8 – the rate considered ideal for healthy population growth.

In 2016, China changed its policy to allow up to two children. It also raised the retirement age.

And this year, China raised the limit to three children.

Despite the policy changes, experts say the population will continue to decline. Even with a three-child policy, current forecasts expect China's population to peak at 1.41 billion in 2025 before beginning to contract.

For Chinese citizens, it's not just the law standing in the way of having more children. It's the economic conditions, too. These include the cost of raising a youngster, the support structures needed while parents are working, and more.

The country's weak government safety nets are why Yuan Xin, a population studies professor at Nankai University in Tianjin, thinks more needs to be done to reverse this degrowth.

"A whole package of services and policies, such as child care, tax rebates for parents, housing subsidies, and even gender equality, are needed to create a social environment that encourages parents to have more babies," he says.

Without government spending on safety nets, society has adapted...

Without government spending on safety nets, society has adapted...

Many Chinese of childbearing age think that having more children is out of the question. A big reason is because of how much they invest to ensure one child is set up for long-term success.

In a country with a limited safety net, these parents need their child to succeed and take care of them when they retire. And they don't just invest heavily in their education. They also invest in their health care.

That's big money for Global Cord Blood (CO), formerly known as China Cord Blood. The company has five cord blood banks – three in Beijing, one in Guangdong, and one in Zhejiang province. These are some of the largest provinces in China by gross domestic product ("GDP").

As such, this tiny stock could be an interesting investment opportunity. But before rushing in, let's look at the fundamentals.

For this, we'll turn to our Altimeter tool and Uniform Accounting...

For this, we'll turn to our Altimeter tool and Uniform Accounting...

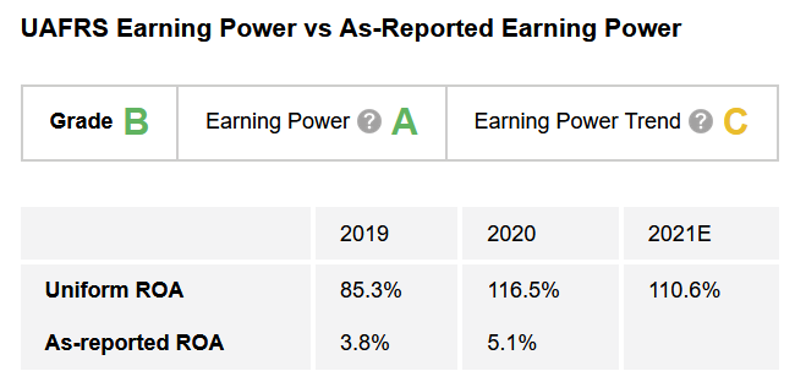

Using the power of Uniform Accounting – which removes the distortions in as-reported financial metrics – The Altimeter shows you grades to rank stocks based on their real financials.

After we clean up the numbers, we can see historically that Global Cord Blood has robust profitability, thanks to the demand from people with their eggs literally in one basket. With an 11% return on assets ("ROA") forecasted for 2021, Global Cord Blood gets an "A" for Earning Power.

However, these high returns are dropping from even more robust 2021 returns, which means Global Cord Blood earns a "C" for Earning Power Trend.

Putting it all together, Global Cord Blood earns an overall "B" for Performance. Overall, despite a small hiccup, the company is minting money from fulfilling this service.

Using Uniform Accounting, we can brush aside the misleading as-reported returns to see the real profitability of Global Cord Blood's business and how the stock could potentially be an interesting investment.

And yet, we wouldn't be surprised if you've never heard of Global Cord Blood…

And yet, we wouldn't be surprised if you've never heard of Global Cord Blood…

The company has a less than $700 million market cap – placing it solidly as a microcap stock.

Thanks to Uniform Accounting, we can identify potential gems in the rough before these stocks are picked up by the investing community and rocket higher.

And thanks to decades of experience conducting "fundamental forensics" on companies of all sizes, we also know when to avoid names with major red flags.

Our Microcap Confidential newsletter details our favorite microcaps today with massive upside potential ahead. Among the 17 open positions we recommend in Microcap Confidential, the average return is 82%, including five triple-digit winners.

And for a short time, you can get access to all of our microcap research with a special offer that includes one FREE year of Microcap Confidential.

We've put all the details together in a brand-new presentation, but it won't be available for much longer. Click here to watch it before it goes offline for good.

Regards,

Rob Spivey

June 24, 2021

It's too late to reverse China's one-child policy...

It's too late to reverse China's one-child policy...