China's tech stocks have been on a tear since the start of the year...

China's tech stocks have been on a tear since the start of the year...

The Hang Seng Tech Index, which tracks the 30 biggest Hong Kong-listed tech stocks, is up roughly 35% year to date.

The tech-heavy Nasdaq Composite Index is down more than 5% in the same period. And the "Magnificent Seven" alone is down around 13%.

A major driver of this surge is DeepSeek, the Chinese AI breakthrough that surprised global markets earlier this year. It raised investors' hopes that China's tech sector might be more competitive than expected.

The Chinese government has also promised sweeping financial stimulus to boost the economy. Since September, the government has cut interest rates, including on mortgages... urged business leaders to increase spending... and pushed wage increases for workers.

On the other hand, U.S. stocks have struggled under the weight of tariff uncertainty and the risk of inflation.

These differences might make China seem like a better market to invest in than the U.S.

However, China still has a lot of fundamental issues... and the recent stock gains don't erase them.

Chinese companies are a lot riskier than U.S. businesses, on average...

Chinese companies are a lot riskier than U.S. businesses, on average...

Our team covers more than 4,000 publicly listed Chinese companies. Back in September, we highlighted that Chinese companies had major default risk at twice the rate of U.S. companies.

Despite China's stock market rally since then, that number has risen even further... from 6% to 8% of Chinese companies at risk today.

And unlike in U.S. markets, where struggling companies face bankruptcy or restructuring, the Chinese government offers up more debt to keep up the appearance of growth.

This is driving the debt loads of Chinese firms higher, creating a cycle of delayed defaults and mounting financial pressure.

The recent rally in Chinese stocks looks more like a "dead cat bounce" than anything sustainable...

Said another way, this doesn't look like the beginning of a bull rally. It looks like the Chinese market's last signs of life.

This is far from the first time we've seen short-term gains in China...

This is far from the first time we've seen short-term gains in China...

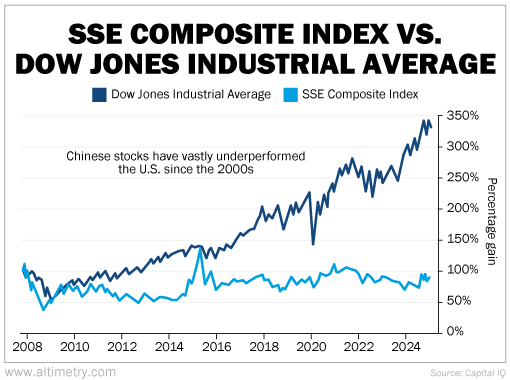

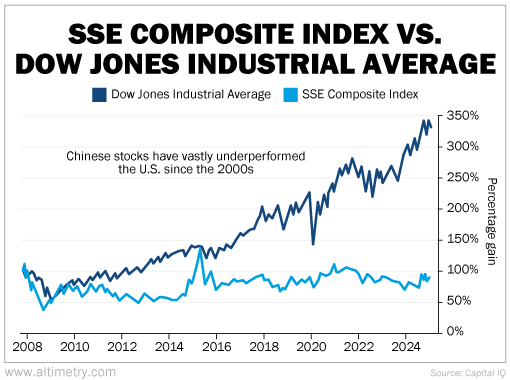

Take a look at the following chart. It compares the return of China's benchmark SSE Composite Index with the Dow Jones Industrial Average from 2008 to 2024.

As you can see, the Dow has surged more than 300% since 2008. And that growth has been strong and consistent, despite significant downside in periods like the 2008 financial crisis and the COVID-19 pandemic.

On the other hand, aside from brief bumps here and there, the Shanghai Index has remained relatively flat over the past decade and a half.

Check it out...

Even with the recent rally, Chinese stocks far underperform the U.S. market.

Despite the short-term surge, China has plenty of lasting problems...

Despite the short-term surge, China has plenty of lasting problems...

The government is trying to encourage investors with financial stimulus. But if anything, those efforts are hurting companies by saddling them with even more debt.

It can't go on forever. There will be a wave of widespread bankruptcies sooner or later.

As long as China's structural problems stick around, the Chinese stock market is suitable for folks who want to capitalize on volatility... but not for long-term investors.

Regards,

Joel Litman

March 24, 2025

China's tech stocks have been on a tear since the start of the year...

China's tech stocks have been on a tear since the start of the year...