Baby Boomers have amassed unthinkable wealth...

Baby Boomers have amassed unthinkable wealth...

And over the next few decades, their children are set to carry that torch.

Market researcher Cerulli Associates estimates younger generations are set to inherit roughly $105 trillion over the next 25 years.

That's about the same level as global GDP in 2023. It's also 45% higher than the forecast Cerulli made just three years ago.

About $2.5 trillion will change hands this year. And by 2048, Millennials are set to inherit $45 trillion, surpassing Generation X as the largest benefactors of this wealth windfall.

This incredible wave of money is being called the "Great Wealth Transfer." Far too many folks don't know how to handle such a massive influx of cash... So today, we'll go over the basics.

The earlier you start, the smoother it will go...

The earlier you start, the smoother it will go...

Inheritance management is a long-term game. It's impossible to know how factors like estate taxes, annual tax-free gift limits, and asset transfer laws will change over time.

That said, you can give yourself a leg up by putting assets to work in the right places... and making sure you aren't caught flat-footed when a major financial event arrives.

This lesson doesn't only apply to folks on the receiving end of the Great Wealth Transfer. If you expect to pass anything on to your kids in the coming years, you might worry about how best to do that while minimizing taxes.

At the same time, you should keep growing that money until it's time to hand it off.

There's no "one size fits all" approach to managing your money. Your goals, spending habits, and potential life changes all factor in. Managing around a potential inheritance only complicates matters further.

One thing never changes... Allocation is all about when you need your money.

One thing never changes... Allocation is all about when you need your money.

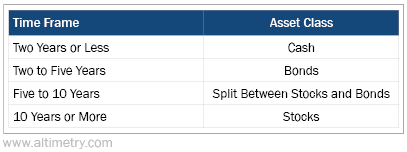

Centuries of market history have proved the best time frames for each asset class. With money you won't need for a decade or more, the best place to put it is in stocks.

Here's how it breaks down...

Taking a long-term view, stocks have risen for most of the past century. They rose about 73% of the time in any given one-year holding period.

If you stretch that out to a 10-year period, stocks rose 94% of the time. And if you waited a few more years, they rose 100% of the time.

Said another way, if you plan on passing money down to someone who won't need it for the next decade... converting it to cash is a big mistake. You'll be leaving money on the table.

One thing is certain – it's time to get serious about asset allocation...

One thing is certain – it's time to get serious about asset allocation...

To that end, we're excited to introduce a brand-new interactive tool for Altimetry users.

It's called Wealth Foundation... and we designed it to help track everything you need to consider for your long-term wealth planning journey.

It can be tough to envision all the factors at play – not just your current assets, income, and expenses, but all possible changes in the future.

Wealth Foundation works as a step-by-step survey. Fill in the details... and the tool builds out a sample balance sheet, income statement, and asset allocation model.

We included prompts covering the most common kinds of expenses folks might have today or in the future, like real estate purchases, college tuition payments, or vacations.

And the best part is... This tool is completely free to use. Click here to access it now.

(Please keep in mind, Wealth Foundation should be used for informational and educational purposes only. It's not intended as personalized investment advice.)

A longer-term view of your wealth can help you maintain the best possible portfolio – not just for yourself, but for your family.

It's the best thing you can do to set them up for financial security.

Wishing you love, joy, and peace,

Joel

February 21, 2025

Baby Boomers have amassed unthinkable wealth...

Baby Boomers have amassed unthinkable wealth...