Can you put a value on putting a man in space?

Can you put a value on putting a man in space?

Apparently, it's worth somewhere between $36 billion right now to upwards of $120 billion in the future.

We were tuned in on Saturday – likely as many of you were as well – to watch the historic rocket launch.

After an initial delay on Wednesday, the launch of a Crew Dragon capsule – on a SpaceX Falcon 9 rocket – went off without a hitch... and the crew docked with the International Space Station ("ISS") on Sunday morning.

The philosophy behind moving near-earth orbit launches into the hands of private companies initially raised some eyebrows, but it's in line with how the U.S. and governments across the globe have supported innovation on many fronts over the decades.

When technologies are in their infancy and the path to profitability isn't clear, the government has regularly stepped in to provide funding. After all, the Internet, the initial trips to the moon, GPS, seismic imaging, MRIs, and genetic research (the human genome project) are just a few of the multitude of innovations that started with government research.

But once technologies reach the point of monetization – once "research" changes to "development" – it makes sense for private enterprise to step in. This is what the commercial launch program represents. SpaceX and plane maker Boeing (BA) – which is also building a launch platform for NASA to use – have a clear path to making money by launching things into near-earth orbit... including astronauts, satellites, and supplies for space stations..

This frees up government agencies like NASA to focus on the research for "harder" and earlier-stage initiatives – like returning to the moon, putting a man on Mars, or even understanding how to take on impressive feats like mining asteroids.

Near-earth orbit can clearly be a viable business for private enterprise. Between its satellite and NASA launches – and the creation of a global mesh satellite Internet initiative called Starlink – SpaceX is already one of the highest-valued private companies in the world.

We know the world will eventually return to normal...

We know the world will eventually return to normal...

After we've learned to manage the coronavirus – either with a vaccine, sufficient herd immunity, improved social distancing protocols, or a combination of all three – much of the world will start looking like it did just a few months ago.

We're already seeing many types of businesses open again – including some restaurants, hair salons, and places of worship.

Though most of these places are operating at reduced capacity and with increased safety measures, with enough time and successful containment, we'll start to see these places return to "business as usual."

After all, there's no way to get a haircut online, and concerts and sporting events just aren't the same when you're watching from your living room.

That said, we're seeing rumblings of sustainable change in certain parts of the economy. Regular Altimetry Daily Authority readers know we've talked about this regularly over the past two months.

While many people might have doubted their ability to work from home before the pandemic, it turns out the difference is minimal.

Employer fears of productivity loss when employees work from home have been shown to be overblown – most workers are just as effective, if not more effective, when working from home.

Likewise, many workers feared they'd miss the office. While some do miss their office setup and the social aspects of work, it turns out many people like the flexibility of working from home and the time they save on commuting.

As companies come to terms with this changing world, they're likely to start to adjust plans for how they staff their offices.

And as corporate leases come due over the next few months and years, many companies – big and small alike – may consider cutting their office space to optimize for a workforce that's spending a lot more time working from home.

This has huge implications for the future of commercial real estate ("CRE"). These are the buildings that house offices, as well as warehouses and other corporate locations.

It's likely to mean less demand for office space in general, which affects occupancies, supply and demand, rental rates, and therefore the financial viability of these often highly levered businesses.

Discussions are happening about how the coronavirus will disrupt the CRE industry. But we haven't heard nearly as many conversations about how it could be just as significant for companies that directly supply the CRE industry.

CoStar (CSGP) is a great example... The company's main business is providing the CRE industry with analytics, online tools, and consulting services.

CoStar does a lot of the behind-the-scenes work for CRE firms – managing clients, contracts, and rent, as well as risk management.

Considering CoStar's end market, investors wouldn't be surprised if the company's valuations were recently suppressed.

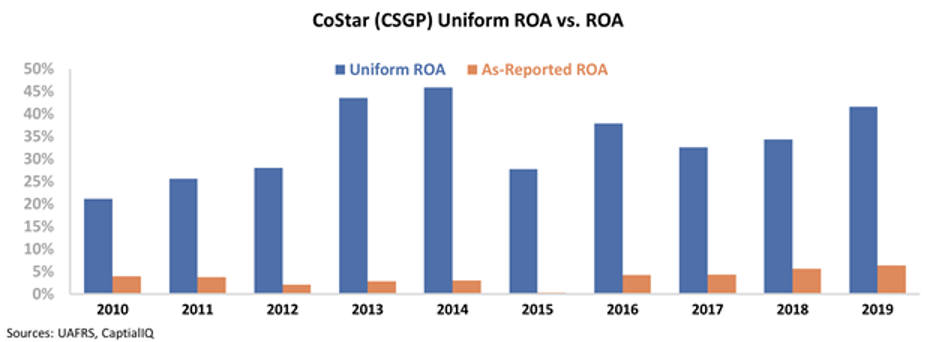

However, the market sees CoStar a bit differently. Investors seem encouraged by CoStar's strong historic Uniform return on assets ("ROA"), and so the company's valuations are sky-high.

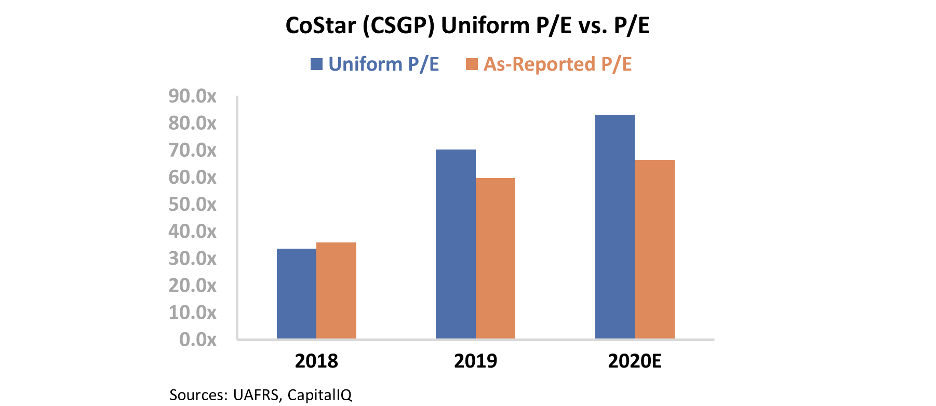

With market-average price-to-earnings (P/E) ratios near 20, CoStar is clearly expensive on both an as-reported and a Uniform basis... with figures closer to 65 and 83, respectively.

When we dig into the firm's Uniform returns, it's clear what the market is reacting to.

Contrary to distorted as-reported metrics, CoStar is actually a profitable company. Its Uniform ROA – which removes the effect of goodwill, excess cash, and other distortions – is strong and getting stronger. After bottoming at still-impressive 28% levels in 2015, CoStar's Uniform ROA expanded back to 42% last year.

This profitability trend certainly warrants premium valuations... but CoStar's current stock prices still seem too extreme.

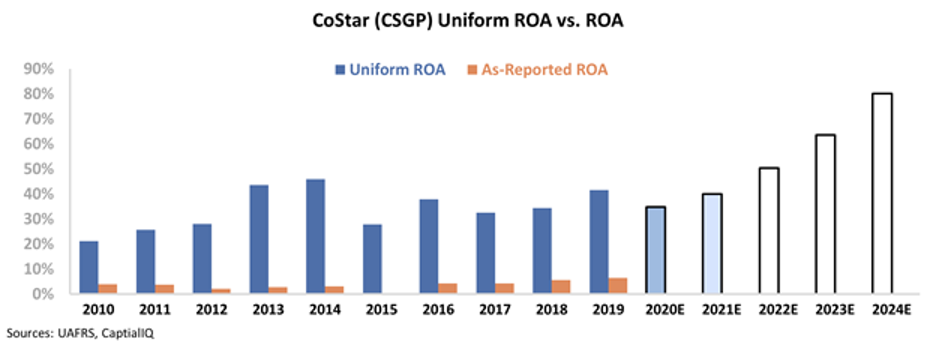

The chart below is the same chart as above, with incremental data added. It shows CoStar's historical profitability as represented by Uniform ROA (dark blue bars) relative to analyst expectations for the next two years (light blue bars) and market expectations for the company at current valuations (white bars).

As you can see, at current stock valuations, investors expect CoStar's Uniform ROA to continue expanding to an all-time high of 80%...

CoStar has seen an impressive ROA improvement recently, but these expectations seem unrealistic. They might be too aggressive even in a normal environment... and considering the potential long-term effect that the coronavirus will have on CoStar's ability to do business, they appear irrational.

When looking at any company, it's important to look not just at historic profitability trends... but also at what the market is expecting, as well as the factors that could affect the business going forward. For CoStar, it appears investors are paying attention to history... but not thinking about the reality of the company's future.

Regards,

Joel Litman

June 2, 2020

Can you put a value on putting a man in space?

Can you put a value on putting a man in space?