We've been waiting for the other shoe to drop in commercial real estate ('CRE')...

We've been waiting for the other shoe to drop in commercial real estate ('CRE')...

For a while after the pandemic, nothing was happening. It was just a frozen market with no deals clearing.

Now, debt is finally coming due. And even some of the best real estate investors are taking huge losses... like Starwood Capital's Barry Sternlicht.

Starwood just defaulted on $365 million in loans across three buildings in Oakland, which it surrendered to Deutsche Bank.

When Starwood bought the buildings five years ago, they were valued at almost $500 million. The loans were worth about 74% of the property value.

You can generally find a real estate buyer as long as the loan is worth no more than 80% of the property value. So the fact that Starwood defaulted rather than finding another buyer suggests the property value fell at least 10%... to about $450 million.

Some investors think the entire drop in real estate value is now behind us. But as we'll explain today, Starwood is only the start. We don't think folks are worried enough about what's to come.

Even seemingly 'safe' CRE companies are priced with too much optimism…

Even seemingly 'safe' CRE companies are priced with too much optimism…

Boston Properties (BXP) is a real estate investment trust ("REIT") that owns office space across major U.S. markets. Its locations include Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, D.C.

This diversification might seem like a good thing for Boston Properties. However, aside from New York... all of these cities now have higher office vacancy rates than the national average.

The company's Uniform return on assets ("ROA") was already just 4% from 2020 to 2022. That's about breakeven. With 13% of full-time employees fully remote last year, returns fell to a meager 2.5%.

Shares have dropped almost 60% from their pre-pandemic highs. So you might assume Boston Properties has already gotten punished.

But even at these low prices, the market is still predicting a rebound of profitability to 2019 levels...

But even at these low prices, the market is still predicting a rebound of profitability to 2019 levels...

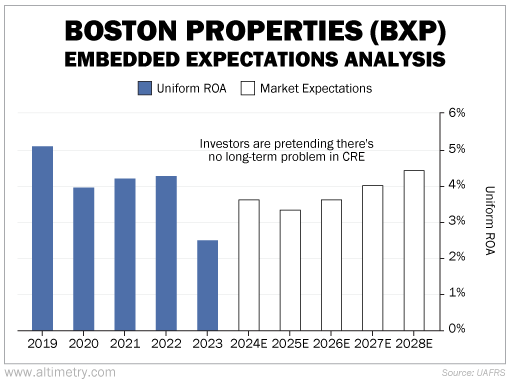

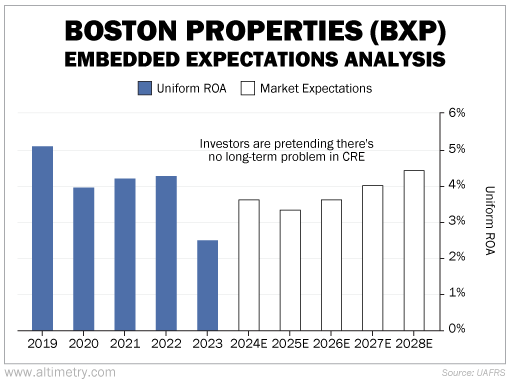

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current prices, investors expect Boston Properties' Uniform ROA to rebound to 4.4% by 2028.

Take a look...

It's fair to say that Boston Properties is actually in a better position than most other REITs.

Its offices are in the downtown areas of the biggest cities in the country. And its debt-to-capital ratio is about 59% today... much lower than Starwood's was five years ago.

Even so, the recovery investors expect is far too optimistic.

Much of the U.S. is adopting hybrid or work-from-home models. We're facing prolonged high interest rates. And families continue to migrate out of cities. The markets for REITs like Boston Properties will continue to be squeezed.

It would take a miracle for Boston Properties to rebound so quickly. Property values – and CRE stocks – have much further to fall.

Regards,

Joel Litman

April 8, 2024

We've been waiting for the other shoe to drop in commercial real estate ('CRE')...

We've been waiting for the other shoe to drop in commercial real estate ('CRE')...