In 2016, pharmaceutical giant AbbVie (ABBV) was about to fall off a patent cliff...

In 2016, pharmaceutical giant AbbVie (ABBV) was about to fall off a patent cliff...

The clock was running out on Humira, its cash-cow rheumatoid arthritis drug.

AbbVie first introduced Humira in 2002. Since then, the company has found a string of massive new markets for it. Humira is now approved for more types of arthritis, Crohn's disease, and ulcerative colitis.

Since it was protected by hundreds of patents, other pharma competitors couldn't introduce generic versions of the drug. They had to stand by and watch its success... or invest billions of their own dollars to come up with an alternative.

AbbVie knew it couldn't afford to lose the protection of its main patent. So seven years ago, it blocked competition through a savvy exploitative trick called a "patent thicket."

The company applied for 312 new patents that had the potential to block competitors for decades. It earned 166 of them. That's how AbbVie kept revenue strong for the past six years... adding another $114 billion in sales.

And in 2021, Humira became the first drug ever to surpass $20 billion in annual revenue.

The Humira revenue and patent thicket were great for AbbVie... But the party couldn't last forever. AbbVie's exclusivity period runs out this year. This time, there's not much it can do to prevent competition.

Without exclusive rights to Humira, AbbVie will face an uphill battle from here. And as we'll explain today, so will AbbVie's investors...

For once, the market saw the trouble coming...

For once, the market saw the trouble coming...

Investors seem to be paying close attention to the pharmaceutical industry. They realize that AbbVie relies on Humira for a huge chunk of its returns.

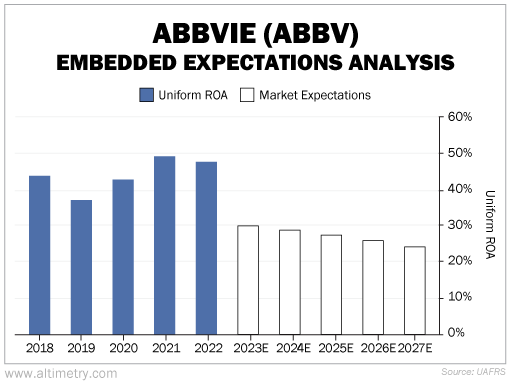

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use AbbVie's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

AbbVie's Uniform return on assets ("ROA") has been above 40% for most of the past five years... more than three times the 12% corporate average.

At the current stock price, the market expects Uniform ROA to fall below 24% by 2027.

Take a look...

With generic brands entering the market, Humira will continue to lose pricing power and market share. That's a death knell for profitability... and investors know it.

AbbVie will be forced to invest more heavily in research and development going forward. It has to find new products to bring to market in place of Humira.

Investors are right to predict an ROA decline...

Investors are right to predict an ROA decline...

AbbVie is a great example of why pharma will always be a difficult landscape to navigate.

This is a complex industry that revolves around drug pipelines, clinical trials, and drug patents. You almost need a medical degree to really understand what's going on.

Although AbbVie and Humira have been successful in the past, the market seems to understand that things are getting tougher.

Don't get fooled into thinking AbbVie is cheap today.

Regards,

Rob Spivey

September 20, 2023

In 2016, pharmaceutical giant AbbVie (ABBV) was about to fall off a patent cliff...

In 2016, pharmaceutical giant AbbVie (ABBV) was about to fall off a patent cliff...