A slew of legislative actions may completely upend the U.S. marijuana industry...

A slew of legislative actions may completely upend the U.S. marijuana industry...

For many years, U.S. banks and public investors have largely ignored or have been outright denied access to the country's cannabis market.

The drug is still on the federal government's list of controlled substances. This means businesses tied to the trade are cut off from access to funds, as banks must adhere to strict anti-money-laundering laws that deem marijuana illegal.

This has hampered the industry's ability to grow domestically. As such, many cannabis companies have sought stock listings outside the U.S. – particularly in Canada.

However, current legislative tailwinds slowly brewing in Congress have the potential to unleash a surge in domestic growth in the coming years.

Politicians in both chambers of Congress are considering steps to crack open the legal cannabis market in the U.S.

These include a proposed Senate bill to remove marijuana from the Controlled Substances Act and a House proposal – dubbed the SAFE Banking Act – that would allow financial institutions to legally lend money to cannabis companies.

If passed, many public investors – who have been keeping a sharp eye on the industry for a while now – will likely stand to benefit. A favorable legal status would make it much easier for cannabis companies to list in the U.S. instead of Canada.

Considering the reputational improvement and access to larger pools of capital offered by U.S. markets, many folks are excited about how this wave of legislation could provide multiple catalysts for a boom in the cannabis market.

This is an exciting time for cannabis companies, but not all of them will benefit from the industry's massive potential...

This is an exciting time for cannabis companies, but not all of them will benefit from the industry's massive potential...

To know which ones will pop after listing and which ones will fizzle out, you need to first understand the real financial picture of the companies in question.

This means stripping out all of the distortions in the as-reported financials and applying Uniform Accounting methods.

Then, looking at the real numbers, we can discover – once the legislation is approved – which companies are actually primed to make money.

But that's not all...

You also need to take a deeper look at what the market is already pricing in to make sure the pop hasn't already happened and you are just late to the party.

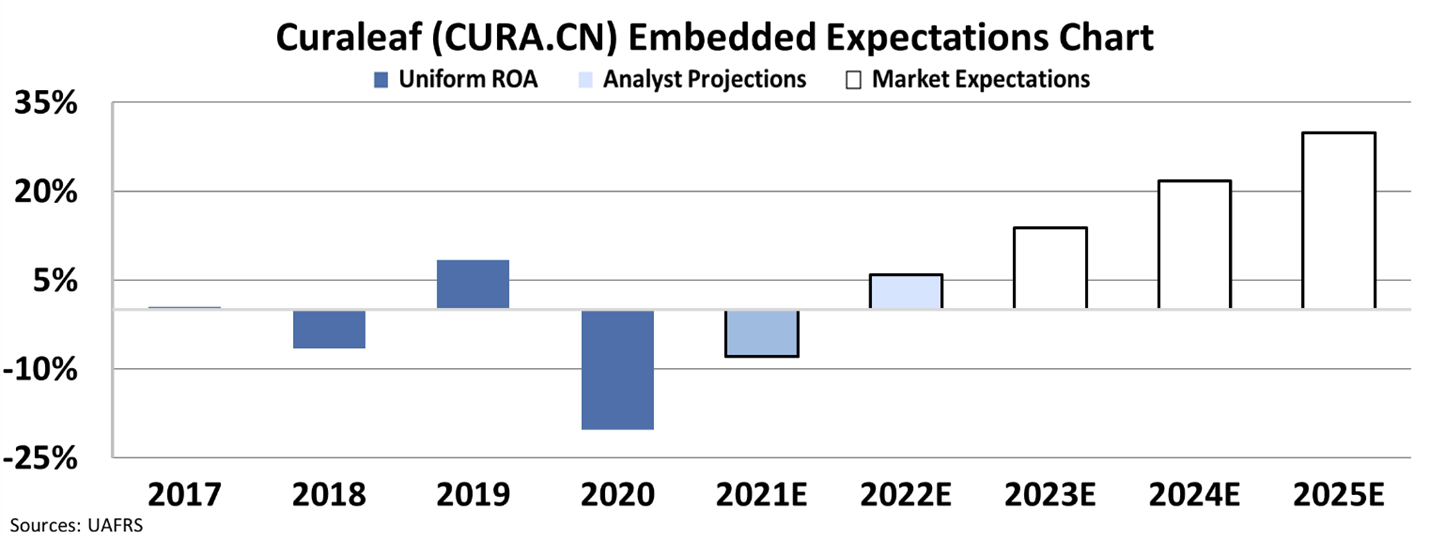

A good example is Curaleaf (CURA.CN), a $12 billion Canadian cannabis company that trades at almost 10 times Uniform assets – meaning investors value the company 10 times more than its asset base. That's a steep valuation... and implies that the market has grand expectations for the company.

To take a closer look at how big these expectations are, we can use our Embedded Expectations Analysis.

The chart below shows Curaleaf's Uniform return on asset ("ROA") levels. The dark blue bars are historical performance, the light blue bars are analyst expectations, and the white bars are the market's expectation at the current stock price.

Even if Curaleaf grew its business by 30% per year, its Uniform ROA – which has only ever been positive once in the company's history – would need to reach 15% levels to meet these expectations. As you can see below, that's a record high...

That growth opportunity and profitability level aren't impossible to reach, but they're still a long way from where Curaleaf is now. As our Embedded Expectations Analysis shows, the company's stock is already priced for perfection... and any misstep could send CURA.CN shares plummeting.

Even with big, industry-wide changes, you have to be selective about which horses you back...

Even with big, industry-wide changes, you have to be selective about which horses you back...

This is why, in our Altimetry's High Alpha service, we have used our Uniform Accounting framework to boil down the ocean of cannabis companies into two compelling ideas that we like right now.

Both of these companies are primed for big upside as the U.S. further legalizes the cannabis industry... And the market hasn't realized it yet.

To learn more about High Alpha – and find out how to gain instant access to both of these recommendations, along with the full portfolio of open picks – click here.

Regards,

Rob Spivey

August 11, 2021

A slew of legislative actions may completely upend the U.S. marijuana industry...

A slew of legislative actions may completely upend the U.S. marijuana industry...