Industry giant Ernst & Young ('EY') is going boldly where plenty of accounting firms have gone before...

Industry giant Ernst & Young ('EY') is going boldly where plenty of accounting firms have gone before...

The big accounting companies often have multiple "arms" to their operations. They specialize in tasks like auditing and taxes. But these services overlap with consulting.

It's an easy way for the "Big Four" accounting companies (EY, PricewaterhouseCoopers, Deloitte, and KPMG) to compete with the "Big Three" strategy consultants (McKinsey, Bain, and Boston Consulting).

These accounting powerhouses want to diversify their offerings. After all, companies already use them for auditing... so they've already established relationships with these businesses. It's a natural leap for the "Big Four" to cross-sell business advice and strategic planning as well.

And the skill sets of top-level accountants and consultants are closer than many realize.

With this logic in mind, the Big Four have frequently built consulting arms... then spun them off for good money. Now, EY is doing it yet again.

The company originally built its consulting arm in the '80s and '90s. It sold the business in 2000 to Capgemini for $11 billion.

Partners get paid when the company sells a unit. The company can use the leftover cash to repeat the process in the future.

This time, the split is a little different. It could be via an initial public offering ("IPO"). And the owners are looking to sell the original audit firm.

According to the Wall Street Journal, insiders say they're confident this split – internally code-named "Project Everest" – will allow each entity to grow at its own rate.

The consulting industry is growing much faster than the accounting industry. This means taking the consulting side public allows the company to benefit from those growth tailwinds. These benefits can be used to support the slower-growing but necessary accounting side.

If consulting is the new accounting for EY, the move will allow that consulting business to grow as organically as it can without limitations.

To get a better idea of what this move could mean for EY, we can look to a similar example... Accenture (ACN).

Accenture was the classic consulting spinoff guinea pig...

Accenture was the classic consulting spinoff guinea pig...

As another ex-consulting arm of former "Big Five" company Arthur Andersen, Accenture provides long-term business strategy and consulting services to clients. It escaped before the Enron scandal blew Arthur Andersen up in the early 2000s. Since then, it has become a top name in the consulting world.

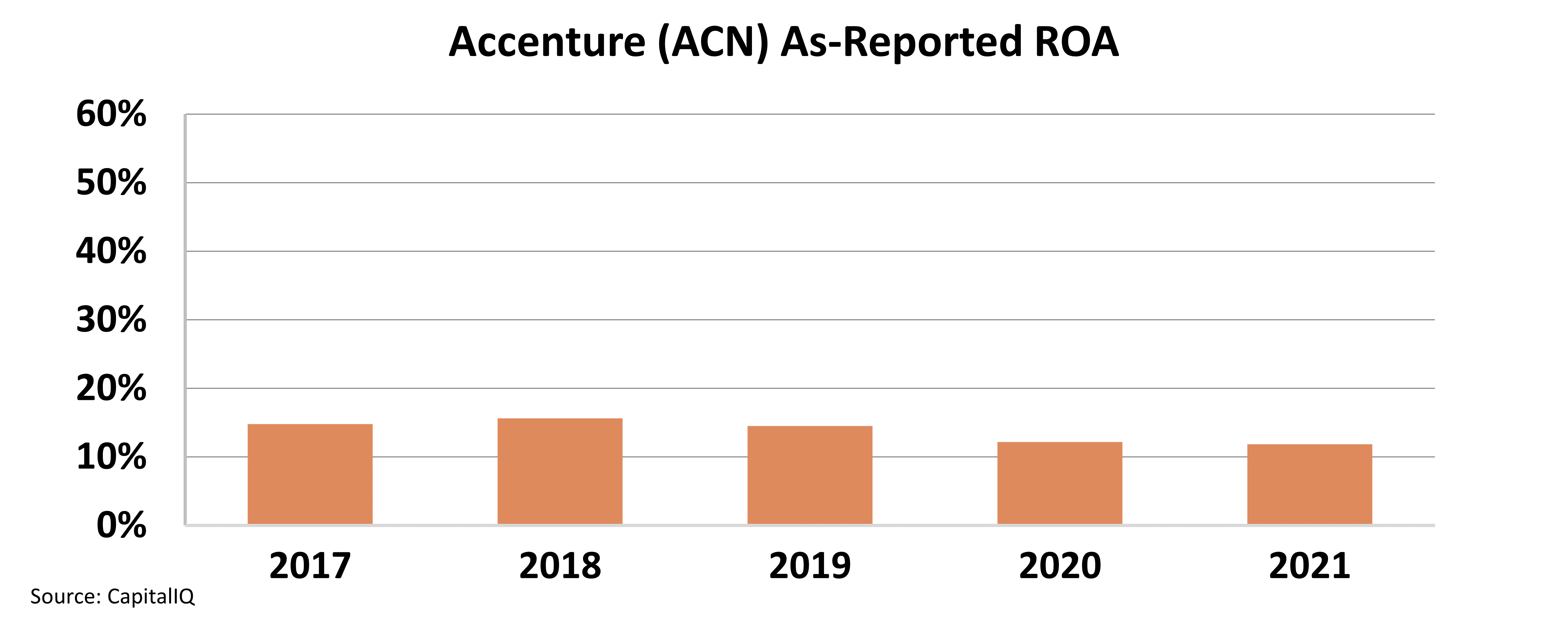

But as-reported metrics may have the market believing it's a declining business. Take a look at this chart of Accenture's return on assets ("ROA")...

Since Accenture's IPO in 2001, its ROA has hovered around 15%. That's a bit better than corporate average returns of 12%. But in the past two years, it has fallen to just 12%.

Based on Accenture's numbers, it looks like EY is betting on an average business...

Based on Accenture's numbers, it looks like EY is betting on an average business...

But what if consulting is actually the key to success?

The market may expect EY's consulting side to perform similarly to Accenture. And if investors are looking at the as-reported metrics, the move might seem bewildering.

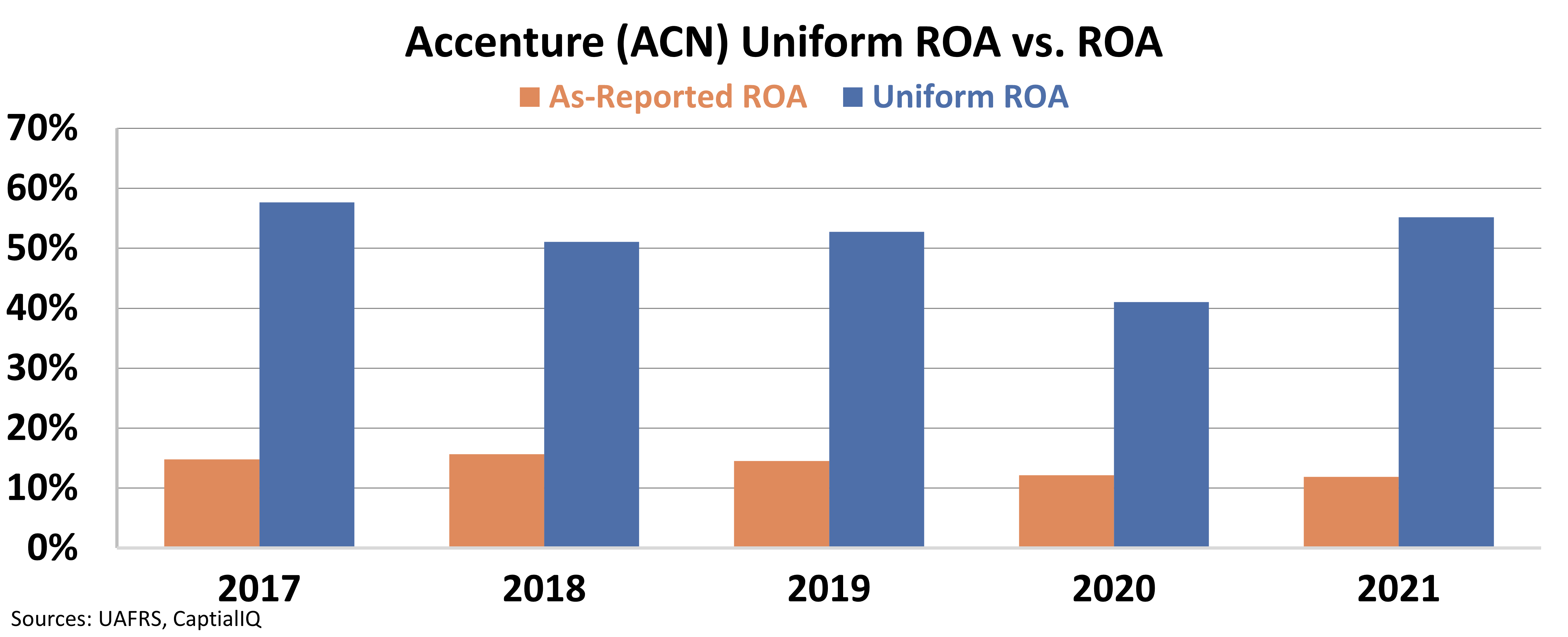

But when we scrub the financials using Uniform Accounting, we see why EY is betting on consulting...

Uniform Accounting shows us that consulting firms are profitable. Accenture's returns aren't average. Its Uniform ROA has actually been above 40% for the past five years. Taking out 2020, that number has been consistently above 50%.

If EY's consulting business looks anything like Accenture, it's clear why the company is spinning off its audit business to focus on consulting.

Regards,

Joel Litman

July 7, 2022