The coronavirus pandemic has caused a big shift in where we choose to live...

The coronavirus pandemic has caused a big shift in where we choose to live...

Since the crisis began, folks have been moving out of urban areas and into the suburbs – looking for more space due to increased time at home. Their lives are changing... and a new home with new surroundings means new spending habits as well.

One secondary effect of this is a climbing demand for a family's first car or to upgrade a current car.

Those folks still employed have more disposable income to spend on a new car, as they aren't spending on travel and other expenses they had before the pandemic.

And as Bloomberg explained last month, the exodus to the suburbs has been nothing short of record-breaking for new-car sales.

Additionally, the average price for new cars in the market has been rising as a result of the increased demand. We've seen a shift to more expensive cars as well.

Bloomberg mentioned how rising prices for new cars started a domino effect in the used-car market...

Bloomberg mentioned how rising prices for new cars started a domino effect in the used-car market...

At the beginning of the pandemic, folks looking to purchase a car on a tighter budget initially turned to the used-car market.

As demand for used cars heated up, prices began to climb. The economics of buying used became less attractive... so car buyers have turned to the new-car market.

Furthermore, folks with used cars are willing to sell them at a higher price before buying a new car – thus helping to power new-car sales as well.

Overall, both the new- and used-car markets have seen a spike in demand throughout the pandemic, leading to higher prices for vehicles across the board.

Most of the car industry has benefited from the surge in demand for both new and used cars...

Most of the car industry has benefited from the surge in demand for both new and used cars...

Automakers aren't the only companies riding this tailwind... For example, used-car auctioneers have been able to charge a premium for their services during the pandemic.

Demand for used cars is increasing, and the price of cars is increasing at the same time – creating a positive feedback look for car auctioneers such as KAR Auction Services (KAR).

The company not only benefits from higher demand... It also makes a greater commission when a car sells for a higher price at auction.

KAR Auction Services has also made various strategic decisions throughout the pandemic that have been crucial to operations. For example, the company has made all auctions digital.

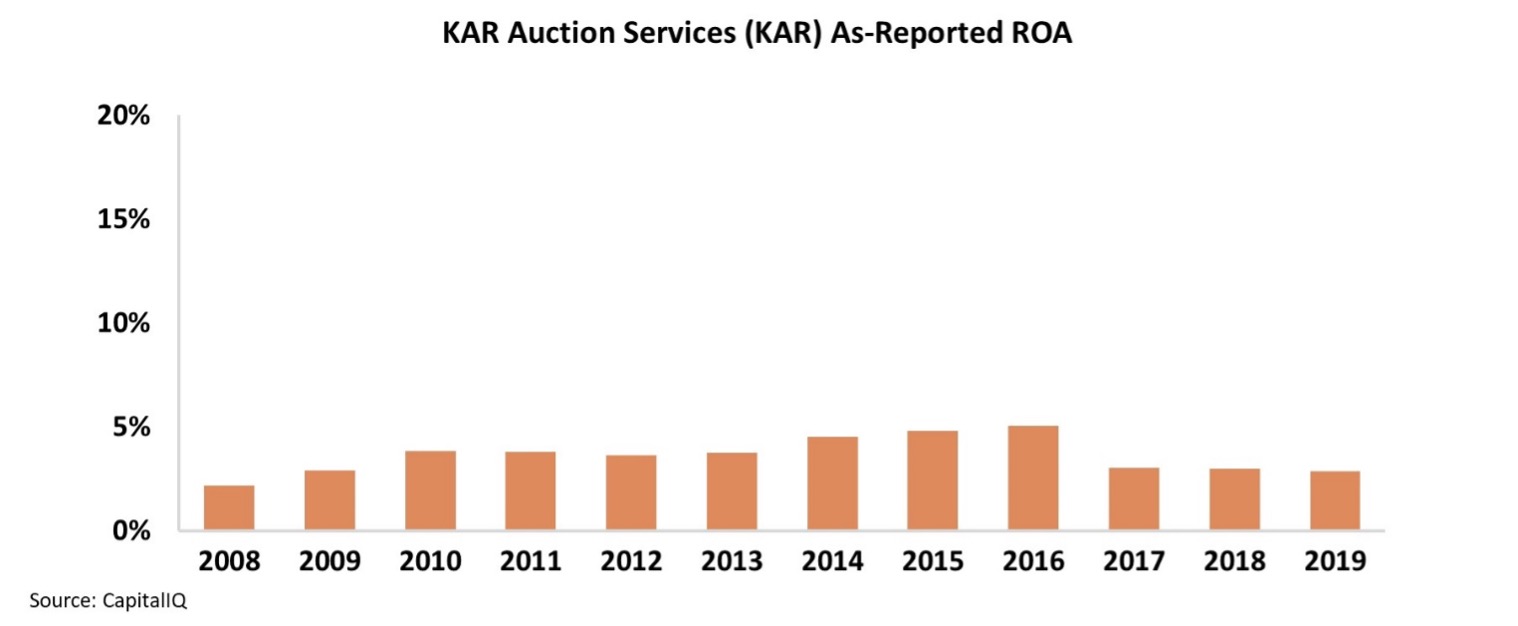

However, looking at the bad GAAP data – which is full of accounting distortions – KAR Auction Services would appear to be in a weaker position going into the pandemic. On an as-reported basis, the company has failed to generate return-on-asset ("ROA") levels above 5% since 2008.

Cost-of-capital levels are also around 5%, so this might lead investors to believe KAR Auction Services has consistently struggled to maintain profitability, with little hope even of external tailwinds turning things around.

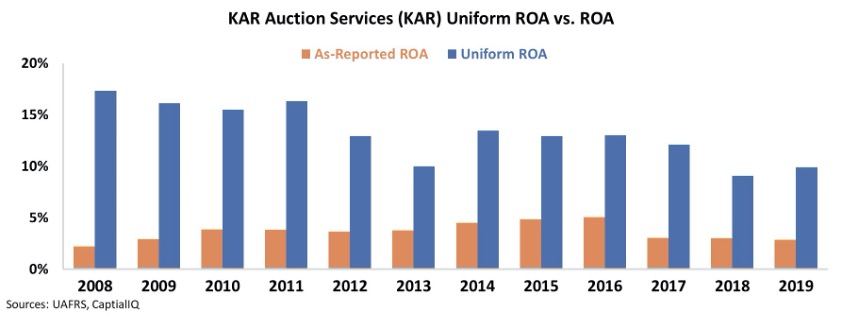

In reality, this below-average ROA is just "noise" from bad accounting. Once we adjust for GAAP distortions using Uniform Accounting, we can see the KAR Auction Services' real performance leading up to the pandemic.

Uniform Accounting paints a clearer picture of the company's profitability levels. As you can see in the chart below, KAR Auction Services has been able to generate Uniform ROA above 10% levels since 2008 – far higher than the as-reported figure. This is all before accounting for record used-car sales in 2020.

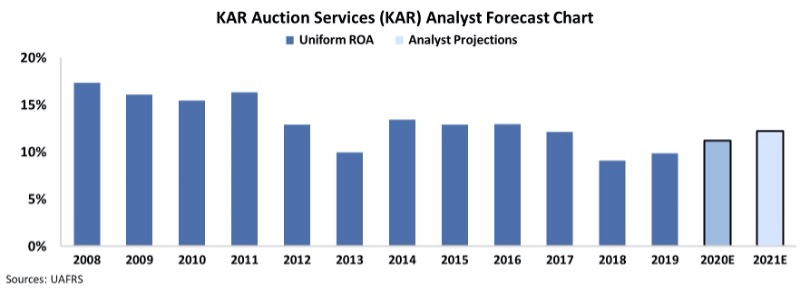

To understand what analysts are pricing in for KAR Auction Services in the next two years from a Uniform perspective, we can look to the next two years of forecasts.

Right now, Wall Street analysts are forecasting Uniform ROA to grow to 12% levels in 2021.

These bullish expectations are due to the company's stronger fundamentals as a result of the surging demand in the car industry.

Those looking at the real numbers recognize how strong KAR Auction Services has been in the first place... and how its macro tailwinds and operational changes are boosting profitability for the future.

Regards,

Joel Litman

February 16, 2021

The coronavirus pandemic has caused a big shift in where we choose to live...

The coronavirus pandemic has caused a big shift in where we choose to live...