The next initial public offering ('IPO') that investors are excited about isn't actually an IPO...

The next initial public offering ('IPO') that investors are excited about isn't actually an IPO...

Popular cryptocurrency-trading platform Coinbase is set to go public later this month. However, the company won't be doing so through a traditional IPO. Instead, it will be a direct listing.

This means instead of working with banks to create new shares, Coinbase will be cutting out the middleman to list existing shares on the open market.

Investors looking for a bargain at the ground floor may be sorely disappointed. Coinbase was valued at $90 billion when it last raised capital – a huge value for a service in the competitive world of crypto brokerages.

As the company isn't even one of the largest players operating today, this goes to show the staggering value investors see in the world of cryptos.

Analysts may be looking at Coinbase's business model and scratching their heads at the company's high valuation...

Analysts may be looking at Coinbase's business model and scratching their heads at the company's high valuation...

Traditionally, exchanges earn a small fee on each transaction. While this can be asset-efficient, it isn't necessarily a booming business. It's tied entirely to the growth – or lack thereof – of transaction volumes.

But anyone looking at Coinbase and other exchanges this way is missing the big opportunity. These exchanges are turning themselves from traditional marketplaces into something that resembles a bank as much as an exchange.

As anyone who has paid attention to interest rates over the past decade will tell you, it doesn't pay to save if you're putting money away in a normal savings account. Even "high yield" accounts at places like Goldman Sachs' (GS) Marcus don't beat inflation with a 0.5% APR.

The low-rate environment has been one reason investors are on the lookout for high-yield investments...

The low-rate environment has been one reason investors are on the lookout for high-yield investments...

However, large swaths of the high-yield debt space only offer less than 3% loans. With rising inflation, even that doesn't offer much real yield.

That means investors desperate for yield are looking for a new way to get their money to work for them and earn an income. While many people are living in the world of speculation, chasing dubious cryptos that might rocket higher... a world of crypto income investing has quietly emerged. It's a revolution in the "FinTech" space – the combination of financial services with technology and innovation.

Some crypto exchanges are now offering customers an interest rate on cryptos they keep at the exchange. If investors are willing to allow the exchange to lend out their cryptos, they can make a double-digit annual percentage yield by just leaving their cryptos "in the bank."

In such a low-interest rate environment, this may look like a compelling opportunity.

Coinbase doesn't yet have this feature. But if the company decides to implement it – and Coinbase is working with regulators to approve its own interest-paying arm – this could be a booming growth opportunity that would justify the high valuations.

These aren't savings accounts, but they certainly might be a solution for investors desperately starved for yield...

These aren't savings accounts, but they certainly might be a solution for investors desperately starved for yield...

Some folks are skeptical. Investors are right to think a savings account with these kinds of yields is too good to be true. Those looking for a standard, FDIC-insured savings account would be sorely mistaken.

By letting an exchange borrow your crypto, there's no insured amount in case of a bankruptcy. Rather, you're acting as an unsecured creditor to a nascent bank and its own creditors.

If people borrow in that cryptocurrency, convert it into dollars, and then the crypto rises significantly higher thereafter, they may not be able to pay off their debts... and the folks who lent to them would stand to lose.

This is a risk investors need to be compensated for. That said, it isn't necessarily the main reason interest rates are so high.

The other driver of lofty rates is the simple phenomenon of supply and demand.

If an investor is lending out crypto, it's because someone else is looking for crypto to borrow. Right now, there isn't a large use case for cryptocurrencies in everyday transactions, barring the standouts like electric-car maker Tesla (TSLA) accepting bitcoin as payment. This means most borrowers are looking for liquidity.

Most crypto borrowers are doing so because they already have crypto assets. They're looking to hold their assets but need liquidity now.

They might be crypto miners, crypto exchanges who accept payment for transaction fees in crypto, or companies who have raised capital in an initial coin offering ("ICO"). Their money is tied up in crypto, but they need to pay employees, suppliers, and partners in real-world currencies like the U.S. dollar.

They may even just be sitting on massive capital gains from the cryptos they've owned, but don't want to realize those gains yet by selling the cryptos.

They're borrowing cryptos, like ethereum or bitcoin, from someone else to exchange these coins for a different currency usable in the real world.

Again, considering that much of this borrowing is eventually converted to another currency, if the borrowers see the cryptocurrency they borrowed appreciate, it might be hard for them to repay.

To help counter this, along with controlling the volatility of many cryptos, some exchanges require borrowers to have significant reserves at the exchange – often at least 50% of the value of the loan in the same crypto. This helps reduce the risk that they won't be able to pay back the loan.

Unsurprisingly, the supply and demand of different cryptocurrencies affects the interest rates that folks lending coins out can stand to make...

Unsurprisingly, the supply and demand of different cryptocurrencies affects the interest rates that folks lending coins out can stand to make...

Here at Altimetry, we had one of our interns prepare a presentation on the intricacies of the new crypto banking market. There's huge upside potential for the first few banks or exchanges that figure out crypto lending.

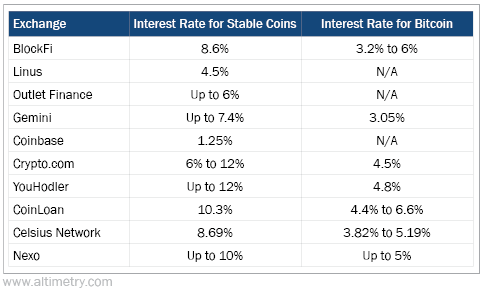

From her research, the interest rate that crypto exchanges will pay on "stable coins" – cryptos whose value is tied directly to the U.S. dollar, like USDC and USDT – is much higher and more available than for leaders in a space like bitcoin.

Once we understood the 'why' behind all the crypto borrowing, this made a lot of sense...

Once we understood the 'why' behind all the crypto borrowing, this made a lot of sense...

The reason comes back to supply and demand. If borrowers are borrowing in a coin so they can get short-term cash liquidity, they want to make sure the value of their debt won't skyrocket against that cash.

Therefore, they borrow in a less-volatile coin like USDC or USDT. This drives up the lending rate for stable coins on the back of heightened demand.

In the table below, you can see some of the recent interest rates that crypto coin owners can earn on different exchanges...

This is another example of how crypto assets behave just like other financial assets, contrary to what some pundits may have you believe. And it's one way that folks struggling to understand why they might want to invest in cryptos could see an economic reason to do so.

I don't want to speak for anyone else, but I've long struggled to see the 'so what' of cryptos other than the vast majority of them being a speculative goal for massive gains...

I don't want to speak for anyone else, but I've long struggled to see the 'so what' of cryptos other than the vast majority of them being a speculative goal for massive gains...

But the idea that an owner of cryptos could actually earn a real income on them makes them a bit more compelling. Enough that for the first time in a while, I've been having conversations with friends about dipping my toes in the space.

That means one of the people I'll be paying attention to as I consider which assets to get involved with is Eric Wade over at our corporate partner Stansberry Research.

Eric is an expert in crypto, and he has a strong understanding of the economics of a lot of the crypto "ecosystem" that many folks don't have.

He began his crypto career by mining bitcoin. Soon, he turned to mining ethereum... and then he taught himself how to build and program his own crypto miners.

On Wednesday morning, at 9:30 a.m. Eastern time, Eric will be holding an event to discuss what he believes is coming next for the space... and how investors could possibly establish lifetime wealth with cryptos.

The event is free to attend... but make sure you register in advance to save your spot. You can do so right here.

Regards,

Rob Spivey

March 29, 2021

The next initial public offering ('IPO') that investors are excited about isn't actually an IPO...

The next initial public offering ('IPO') that investors are excited about isn't actually an IPO...