Apple (AAPL) made history in June...

Apple (AAPL) made history in June...

The iPhone maker became the first company in the world to hit a $3 trillion market value.

That probably makes sense...

After all, Apple has one of the biggest brands in the world. And it has an incredibly loyal customer base, which helped it rake in nearly $400 billion in revenue last year.

And yet, the company doesn't have a dominant market share for any of its main products.

Apple's share of the global personal-computer market is less than 10%. Its share of the smartphone market is 21%, lagging behind Samsung.

You see, the company's success doesn't stem from dominating one segment...

The tech giant has an entire ecosystem of products and services that are designed to work together.

If you have an iPhone and an iPad, for instance, you can easily share content between the two devices. You can open an e-mail on your phone, start responding... and then finish answering the e-mail on your iPad. You can also enable "Wi-Fi Calling" on your iPhone to make and receive calls on your iPad. And if you have an Apple Watch, you can use it to control your music, get notifications, and even make payments.

Ecosystems like this are convenient. And once you've invested in several products within a particular ecosystem, it's more difficult and costly to switch to another company's products. You'd have to give up all the benefits you're used to and start from scratch.

Companies like Apple know this. And they use it to their advantage as much as possible. If they create strong ecosystems, they can maintain their dominance even if they don't hold a major share of their markets.

Today, we'll take a deep dive into Apple's strategy and look at whether its ecosystem justifies its title as the world's most valuable company...

Apple's worth is hiding under the surface...

Apple's worth is hiding under the surface...

There are more than 2 billion Apple devices in circulation today. The company offers everything from phones, laptops, and watches... to TVs and virtual-reality headsets.

And while the power of its ecosystem is evident, it seems the fundamentals of the business aren't translating into robust profitability...

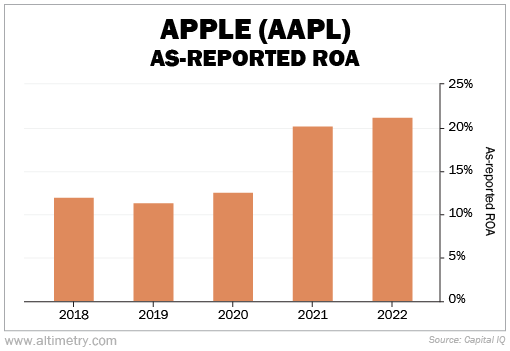

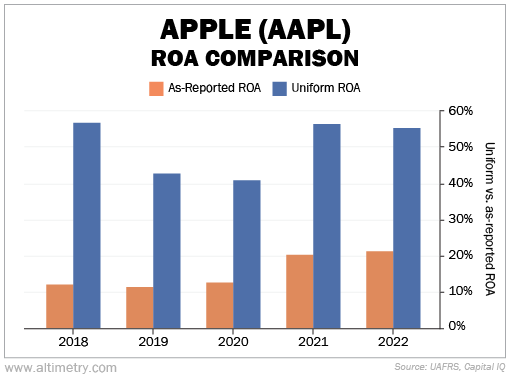

When looking at as-reported accounting numbers, Apple appears to be just a decent company with an average return on assets ("ROA") of 15% since 2018...

However, this picture of profitability doesn't match Apple's competitive advantages at all.

You see, Apple spends billions of dollars on research and development (R&D) every year. Under traditional accounting, these costs are treated as expenses on the income statement. And they make Apple look less profitable.

In reality, those R&D costs should be treated as an investment in the business.

That's why we at Altimetry count R&D costs as an investment that ends up on Apple's balance sheet. Once these accounting adjustments are made, we can see that the average Uniform ROA for Apple is 52% – not 15% like the as-reported metrics show.

Take a look...

Now, a few weeks ago, we covered how Apple's failure to focus on form and function has hurt its returns in recent years. Its Uniform ROA used to be above 150%. That's a far cry from today's levels.

Even so, it's still one of the most profitable tech businesses around. And thanks to its powerful ecosystem of products, Apple's returns aren't likely to get much lower...

Apple keeps customers coming back for more...

Apple keeps customers coming back for more...

Once you're immersed in the Apple "experience," it becomes difficult to leave. The company's seamless integration of products and services is just too convenient for customers.

And while Apple products do work with other companies' devices... they don't work as well. So it makes sense for customers to stick with Apple.

Plus, the company's massive investments in R&D are proof of its commitment to innovation. Just last month, Apple announced its new Vision Pro virtual-reality headset, which combines the digital world with the real world.

It will continue rolling out new products like this. And that will keep its ecosystem strong.

As a result, Apple is likely to remain one of the most profitable tech companies out there.

Regards,

Joel Litman

August 3, 2023

Apple (AAPL) made history in June...

Apple (AAPL) made history in June...