This year, Cyber Monday made history for all the wrong reasons...

This year, Cyber Monday made history for all the wrong reasons...

As if American consumers needed any more evidence about the ongoing supply chain issues, this year's Black Friday and Cyber Monday results tell us everything we need to know.

For the first time in the promotional holiday's history, this year's Cyber Monday yielded lower sales than last year's. Results came in below expectations, underperforming 2020 by 1.4% – a shortfall of about $100 million.

The story was the same with online sales during Black Friday. But the culprit isn't lowered consumer confidence... People are just as eager to spend their money as in previous years.

We know this because overall online sales for October and November soared nearly 12% over last year's numbers.

Companies are already struggling to meet regular demand. Inventory levels, which were generally depleted anyway, were too thin to cope with the demand spikes for Black Friday and Cyber Monday... So many folks who waited for these promotions to do their holiday shopping ended up empty-handed.

The numbers show how much companies are struggling to meet consumer demand.

Smaller shops are turning to the Internet for support...

Smaller shops are turning to the Internet for support...

While big corporations are turning up the promotional environment to sell holiday inventory, small businesses and new companies don't have the same luxury.

Mom-and-pop businesses don't have access to the same types of e-mail lists and huge social media followings to market their goods. That's why many of them are turning to e-commerce giant Shopify (SHOP) for support.

Shopify is a great solution for small and new businesses because it's a "plug and play" interface. You can use Shopify to launch your own highly customizable e-commerce website and start selling your goods in minutes.

That's great news for the businesses all around the country that didn't get the sales numbers they were hoping for from the recent shopping holidays.

Even better, Shopify's software doesn't cost an arm and a leg – at least, not upfront.

The sales model of the future...

The sales model of the future...

Shopify offers its platform using the increasingly popular Software as a Service ("SaaS") business model.

Rather than charging customers an expensive, one-time fee for a perpetual license, the SaaS model allows customers to subscribe to software products with cheaper, recurring payments.

Not only is it more affordable upfront for customers, but it's also much more profitable for the companies.

The SaaS model helps smooth out companies' revenue streams, which historically would see a huge spike whenever they release a new piece of software and fizzle out until its next release.

It also increases the lifetime value of a customer...

Years ago, software company Adobe (ADBE) would charge $500 or so for a single license to its Photoshop photo-editing software. Using the SaaS model, Adobe now charges $20 a month for ongoing access. As long as a customer sticks around for at least 25 months or just over two years, Adobe will make more money than it would have through the one-time license.

Customers pay less upfront, and software companies end up generating more revenues. It's a win-win, which is why it has breathed life into dozens of tech companies over the past several years, including Adobe, Salesforce (CRM), Microsoft (MSFT), and others.

Shopify's service has been an unequivocal success...

Shopify's service has been an unequivocal success...

With Shopify's services starting at just $29 per month, it's clear why the company has quickly become the biggest publicly traded Canadian company, with a market cap of more than $180 billion today.

It can attract small and medium businesses en masse, and events like a slower-than-expected holiday season only push more people to use its platform.

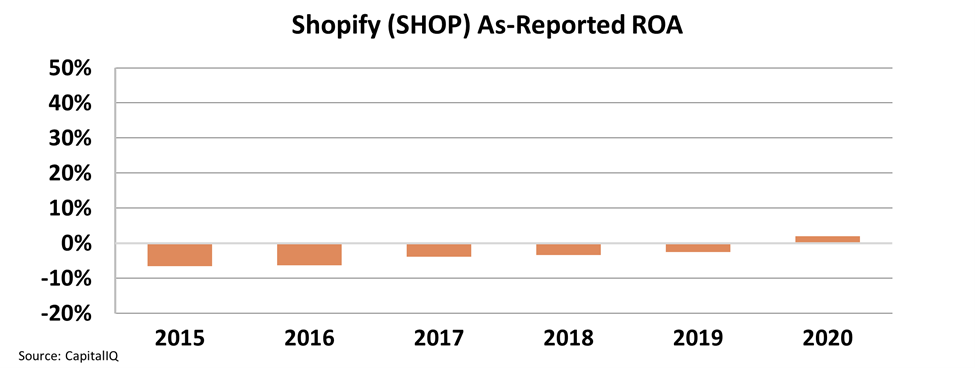

While Shopify has benefited massively from the SaaS model, investors looking at as-reported metrics might not think the company's stock run is justified.

In fact, using GAAP financial metrics, Shopify looks like it's burning cash. Its return on assets ("ROA") was negative for the first five years as a public company, and in 2020, it barely eked out a 2% return.

Any investor looking at these figures would assume that the SaaS model isn't that lucrative.

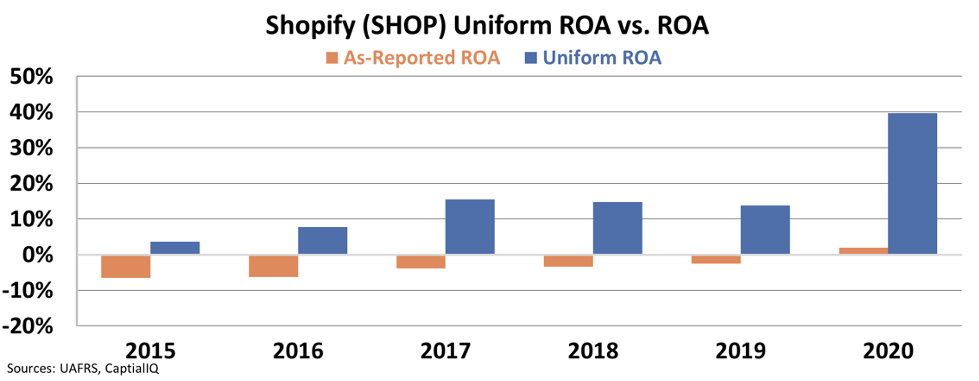

In reality, arbitrary accounting rules – like the treatment of noncash stock option expenses as a cost on the income statement and excess cash looking like a drag on the balance sheet – are distorting Shopify's returns.

Once we properly adjust these line items using Uniform Accounting, we can get a much clearer look at Shopify's real returns. This helps us see how profitable the SaaS model really is.

On a Uniform Accounting basis, we can see that Shopify's Uniform ROA has been strong since it went public in 2015, and it has only been getting stronger. In fact, Uniform ROA has exploded from 4% in 2015 to 40% last year. Take a look...

That massive growth is why the stock exploded from $28 when the company went public in May 2015 to roughly $1,450 today.

That's roughly a 5,100%-plus return in just six years, enough to turn every $5,000 into more than $260,000...

This is the power of SaaS. But you wouldn't know it by looking at the as-reported financials.

Software companies tend to compensate employees with stock options... They have massive research and development (R&D) budgets... And they generate a ton of cash. All of these make the typical SaaS business look terrible under GAAP accounting.

Shopify has been one of the best-performing stocks over the past six years...

Shopify has been one of the best-performing stocks over the past six years...

Six years ago, the company went public with a market cap of around $2 billion. And while Uniform Accounting shows that Shopify continues to gush cash, it's going to take a lot for shares of the $180-billion company to soar another 500% from here.

Fortunately, we've found a company taking a page out of Shopify's playbook. The as-reported numbers make this little-known software company look like a dud. But using Uniform Accounting, we can see that it's a high-growth business with improving fundamentals.

We think the stock has 500%-plus upside from here... And it's only a matter of time before the market spots the real potential. That's why I just put the finishing touches on a brand-new presentation where I walk you through everything you need to know. You can watch it right here.

Regards,

Joel Litman

December 3, 2021

This year, Cyber Monday made history for all the wrong reasons...

This year, Cyber Monday made history for all the wrong reasons...