Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from our latest episode, including a recent solar-policy announcement... and a U.S.-based business that has spent years preparing for this moment.

Read on below...

The U.S. is slamming the brakes on a critical trade loophole...

The U.S. is slamming the brakes on a critical trade loophole...

The Trump administration recently announced sweeping new tariffs on solar panels imported from Southeast Asia.

These aren't your average trade duties... the steepest penalties reach an eye-popping 3,521%, according to Bloomberg.

The rules target companies accused of routing Chinese solar components through countries like Cambodia, Vietnam, and Malaysia to sidestep existing tariffs. This new policy eliminates a two-year exemption for these countries and classifies many of the imports as circumvention.

Said another way, they'll now be subject to punitive duties under existing China-focused tariffs.

This policy closes a critical loophole. Chinese solar manufacturers have dominated the U.S. market despite earlier trade barriers.

And as we'll explain, one U.S.-based solar business is set to benefit – because it was already ahead of the curve...

While competitors expanded Asia operations to cut costs, First Solar (FSLR) kept production close to home...

While competitors expanded Asia operations to cut costs, First Solar (FSLR) kept production close to home...

The solar-panel maker was one of the only major players to double down on American manufacturing. It ramped up investment in U.S. facilities over the past five years... betting energy policy would shift toward domestic sourcing.

It recently completed a major expansion in Ohio. It's building additional factories in Alabama and Louisiana.

The company even uses minerals that don't rely on Chinese supply chains. So it has a secure supply chain and a domestic production base. And it's already compliant with trade rules that others will soon struggle to meet.

In effect, the new policy penalizes competitors... while reinforcing First Solar's business model.

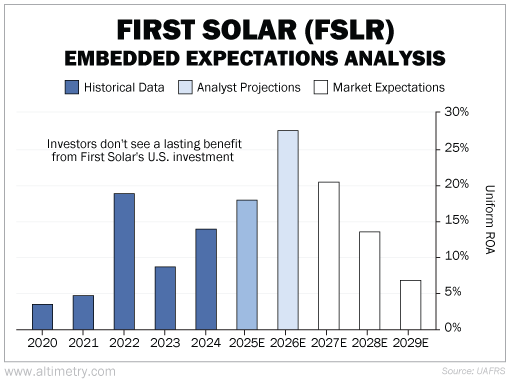

We've already seen the results of this U.S.-first approach. Between 2018 and 2022, First Solar's Uniform return on assets ("ROA") rose from just 2% to nearly 19%. And that jump came while others wrestled with supply-chain volatility and inflation.

But the market doesn't seem convinced those gains will stick. We can see that through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Longtime subscribers know we also like to look at near-term Wall Street expectations. Analysts tend to have a pretty good grasp of a company's performance over the next year or two.

When it comes to First Solar, these folks expect Uniform ROA to surpass 27% by 2026 – more than twice the 12% corporate average.

But despite favorable policy tailwinds and improving performance, investors don't share Wall Street's confidence. They think Uniform returns will fall below 7% by 2029... giving up any gains from this U.S.-centric business model.

Take a look...

Investors don't realize how much this trade policy shift has reshaped the solar landscape.

And they're not giving First Solar credit for building this edge long before solar policy hit the headlines.

First Solar is finally reaping the rewards of a long-term strategy...

First Solar is finally reaping the rewards of a long-term strategy...

And the market still expects profitability to decline. That's a big disconnect between perception and reality.

Competitors are getting sidelined by tariffs. Domestic demand is on the rise. And First Solar is entering its strongest competitive position in more than a decade.

The U.S. solar resurgence is only just beginning. First Solar deserves a lot more consideration than it's getting.

Regards,

Joel Litman

May 9, 2025

P.S. We dove deeper into First Solar in the latest episode of Altimetry Authority. Check it out on our YouTube channel right here... and be sure to click the "Subscribe" button.

The U.S. is slamming the brakes on a critical trade loophole...

The U.S. is slamming the brakes on a critical trade loophole...