Dear reader,

Let's dissect the old idiom, "Nothing is certain but death and taxes."

Many people attribute this quote to Benjamin Franklin in 1789, but it was first recorded in 1716 in the transcript for actor and playwright Christopher Bullock's The Cobbler of Preston.

I suppose it's fitting that the quote's origin falls in the "uncertain" category. The idiom has held up well, but it glosses over something important: the tax rate.

Perhaps this was less likely to change in the 18th century. But today, global tax rates are subject to frequent changes. Geopolitical competition driven by taxes is a regular topic.

Presidential elections ensure federal tax law remains in the conversation at least every four years. This impacts all of us in a fairly obvious way, but there are implications that aren't often discussed.

The "real" returns on stock investments are impacted by economic inflation and capital gains tax.

Here's a quick thought experiment...

Imagine you invest in a stock that generates a 10% return in a year. In that same year, let's say the U.S. economy experiences a 2% inflation rate. This inflation rate has basically wiped out 2% of your returns from the stock, meaning your "real" return is only 8%.

Next, consider the fact that when you sell a stock, you have to pay a "capital gains" tax. For simplicity, we'll use the highest capital gains tax bracket, 20%. Take that same 10% stock return... When you cash out, you don't keep a 10% return – you keep 8%.

These two factors, inflation and capital gains, compound on each other. In times of high inflation and high taxes, investors end up keeping much weaker "real" returns on the same investment.

In the example above, an investor's "real" tax-adjusted return is 6.4%, not the 8% after-tax return or the 10% gross return.

To use an even more exaggerated example, let's use the same return stream and the same tax rate, but with 10% inflation instead.

An investor would pay a 2% tax on his 10% gain. But the real pre-tax return is actually 0% – the investor made 10%, but that just keeps him up with inflation. With taxes, the investor now has a negative 2% real after-tax return.

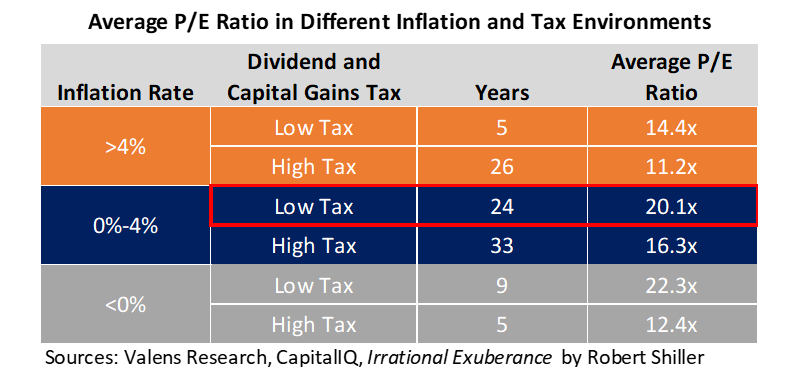

It makes sense, then, that investors would be less willing to pay for the same nominal returns under different tax and inflation conditions. In the table below, you can see the impact inflation and capital gains have on market valuations.

I've highlighted our current environment in red. Right now, the U.S. is in a low-tax, low-inflation environment. This is one of the best conditions for the stock market, with price-to-earnings ("P/E") ratios averaging around 20 over the last 100 years in this market dynamic.

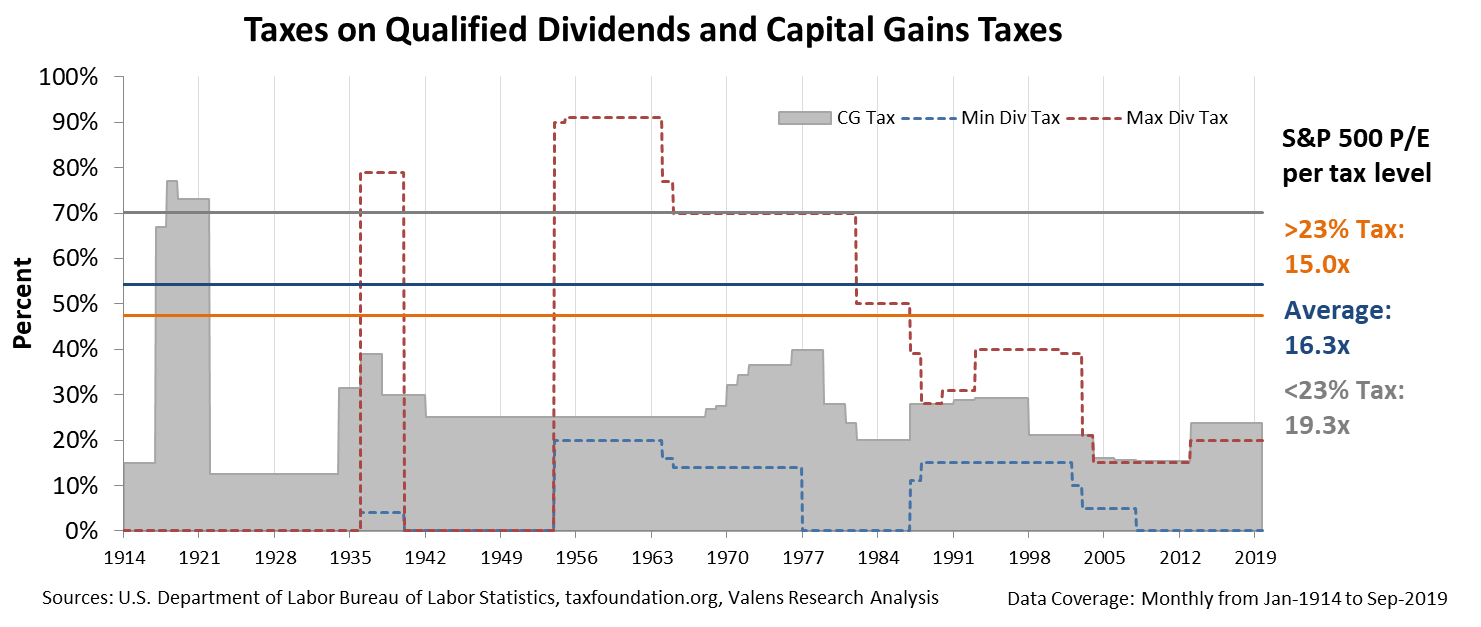

The Federal Reserve typically targets a 2% inflation rate, and it's done a good job maintaining this over the past several decades. As I mentioned before, the long-term capital gains tax currently maxes out at 20%, which is near historically low levels. For context, from 1960 to 1963, total tax on investment – including tax on both capital gains and dividends – was more than 70%. I'm glad I wasn't investing in that era.

One of the leading Democratic presidential candidates, Joe Biden, recently proposed increasing the top capital gains rate to 39.6% for individuals earning more than $1 million annually. When you include the standard 3.8% net investment tax, this means the top earners will pay roughly 44% in capital gains taxes.

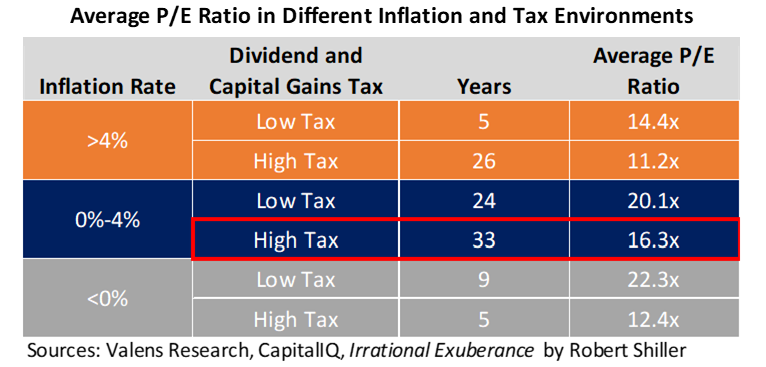

Assuming inflation stays within recent ranges, a 44% capital gains tax pushes us firmly into the "high tax" environment. You can see below the impact that will have on market valuations...

Higher taxes deflate valuations significantly, with the market-average P/E ratio falling from 20 to nearly 16. Right now, the market-average P/E ratio is around 21. All else being equal, if Biden's tax plan were adopted, we would likely see valuations pull back by as much as 20% over time.

Logically, this makes sense – when investors can hold onto less of their returns, they are willing to pay less in the market.

So the next time somebody brings up "death and taxes," remember to ask them: What's the tax rate? It doesn't just impact your take-home check... but your investments as well.

Regards,

Joel Litman

October 21, 2019