When investors buy bonds, they naturally hope that the underlying company doesn't go bankrupt...

When investors buy bonds, they naturally hope that the underlying company doesn't go bankrupt...

But even in the event of a bankruptcy, they do have some protection. One of the positives in bond investing is that creditors are reimbursed before equity holders if a company goes under.

Between 2005 and 2019, the average bond holder recuperated $0.40 on the dollar during a liquidation.

But as Bloomberg recently explained, that hasn't been the case during the coronavirus pandemic. Investors are now seeing $0.03 on the dollar... and sometimes even less.

This is far below what bond holders have grown accustomed to, in any time in history.

The state of the economy over the past decade has driven this reduction in yields. The mix of a 10-year bull market in equities and low interest rates has pushed desperate bond investors to search high and low for yield.

To get higher yields on their bond investments, investors bought "covenant lite" bonds. These had minimal safeguards... and investors had limited protections.

Since interest rates were so low, companies began taking on more debt. Additionally, the lack of bond covenants also allowed businesses to borrow against assets like software, intellectual property, and brands.

With low interest rates and a growing economy, the risky debt didn't have much of an adverse effect on credit holders... before the pandemic struck.

As lockdowns swept the country and stores closed, many businesses suddenly saw large losses in profitability. In particular, some companies that were primarily focused on brick-and-mortar retail and energy have had to declare bankruptcy.

And without protections in place, some of these bankruptcies have completely wiped investors out in recent months.

This trend has people worried about the potential for a larger wave of bankruptcies. In that case, credit investors could lose a massive amount of money.

With these concerns rising, let's see what the Uniform numbers show us about whether this wave is around the corner...

The global economy is entering a precarious time...

The global economy is entering a precarious time...

Coronavirus cases are again on the rise. While people are optimistic about vaccines, the U.S. is in the midst of a "third wave" of cases spiking.

To keep citizens safe, some national governments are closing down parts of their countries. Just recently, France, the U.K., and Germany announced various levels of lockdowns. Here in the U.S., some cities and states are starting to do the same.

To add further difficulties, we're moving deeper into autumn... and temperatures are beginning to fall.

Over the past few months, many businesses have moved services outdoors to allow for safe attendance. For many restaurants and brick-and-mortar stores, outdoor areas were the only way to drive income. With temperatures are dropping, many businesses will lose this income.

Understandably, this has investors looking to credit health. Investors want to make sure companies have the cash to pay off obligations. If companies can't pay off debts, they may go under.

Some folks are worried about the possibility of this shake-up affecting the entire economy. To understand if companies can pay off their obligations, we can use our aggregate Credit Cash Flow Prime ("CCFP") analysis.

One of the tools we leverage here at Altimetry is our ability to compile company-specific data to see wider economic trends. The combined CCFP gives us insight into how healthy companies' balance sheets are.

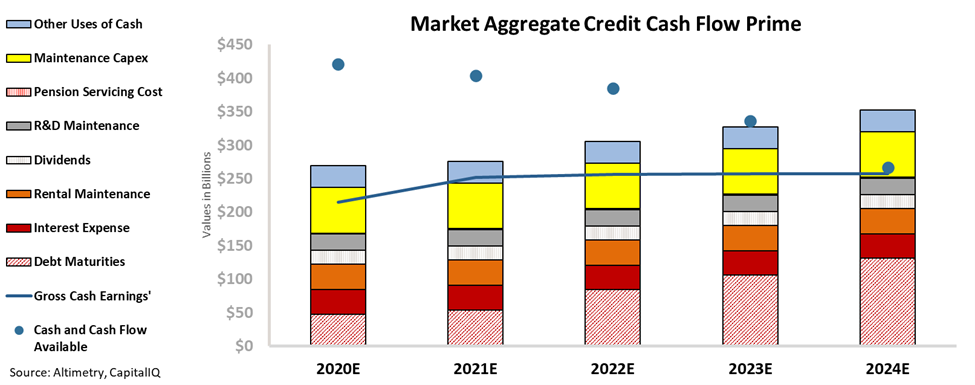

The chart below shows the market's aggregate credit risk. The stacked bars are aggregate obligations for the next five years. We compare this to cash flows (the blue line) and cash on hand at the beginning of each period (the blue dots).

The bottom bars are the ones hardest for companies to "push off" – costs such as debt maturities and interest expense. The higher bars represent obligations that are more discretionary, like maintenance capital expenditures ("capex") and share buybacks.

As you can see, corporate cash flows alone aren't enough to pay off obligations. However, companies have enough cash on hand and cash flows to survive the next four years without needing to borrow more or make tough decisions about cutting obligations. Additionally, companies have a considerable amount of capex flexibility.

The capex flexibility and multiyear runway give companies time to improve operations to meet future obligations. This makes the bond markets safer than they initially appear.

Furthermore, this analysis may even be overstating the debt maturities coming due in the next three years.

This is because investment-grade and high-yield companies have issued more than $1.4 trillion in debt over the past six months. The new debt has helped them refinance near-term maturities and raise capital.

Those lowest bars – the debt maturity obligations – are likely lower than this chart reflects for the next two to three years because of this refinancing.

Overall, the current credit market is in a healthy place. Our aggregate CCFP shows that corporations have significant amounts of cash on hand. And while cash flows are lower this year, companies can use that cash on hand to cover any shortfalls.

While rising coronavirus cases can be scary for markets, companies have the liquidity to weather the storm.

Regards,

Joel Litman

November 23, 2020

P.S. With stores and offices shuttered, businesses across the country sent employees home to work remotely. The "office" as we know it took its final gasping breath... and the opportunity for investors is life-changing. Right now, we've found the stocks in the best position to benefit from this trillion-dollar shift – get the details here.

When investors buy bonds, they naturally hope that the underlying company doesn't go bankrupt...

When investors buy bonds, they naturally hope that the underlying company doesn't go bankrupt...