This economy just won't die...

This economy just won't die...

It's no secret that the market has been trending downward in recent months. Everywhere you turn, the financial media can't stop talking about the possibility of a recession.

As early as mid-June, more than 70% of economists believed the economy was heading for a recession in 2023.

I understand why folks are worried. They're paying attention to the signs... and preparing their portfolios for the coming downturn.

My team and I don't believe we're facing a true recession yet. That being said, we're in the midst of what's called an "earnings recession." And signs are beginning to point toward a true recession on the horizon.

That doesn't mean it's time to panic.

We're not saying that we're in a recession right now. We aren't even saying that it will happen tomorrow or right away.

Instead, it will most likely start somewhere between the middle of next year and the middle of 2024.

And as I'll explain today, an important survey just released some promising data for investors...

Folks are paying close attention to the Purchasing Managers' Index ('PMI')...

Folks are paying close attention to the Purchasing Managers' Index ('PMI')...

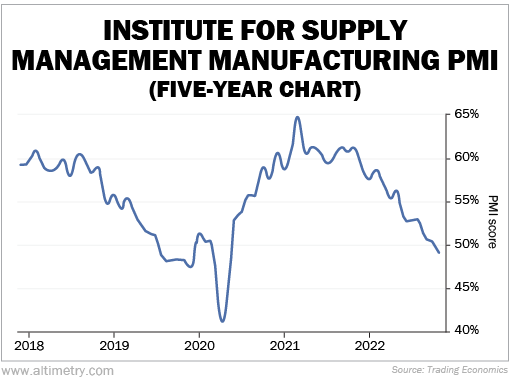

The PMI is a key economic indicator from the Institute for Supply Management. It's based on several monthly surveys that poll companies across the manufacturing and services sectors.

The results can tell us a lot about the health of our economy.

A 50% PMI score is considered "flat." Results below 50% are bad, while anything above 50% means the economy is growing.

We did see a slight contraction in the Manufacturing PMI report. It fell to 49%, which indicates a tiny slowdown.

Take a look...

A slowdown of any kind isn't great. Still, it's way less than the 43% we saw early in the pandemic. And it certainly doesn't mean we're doomed.

There are plenty of encouraging signs ahead.

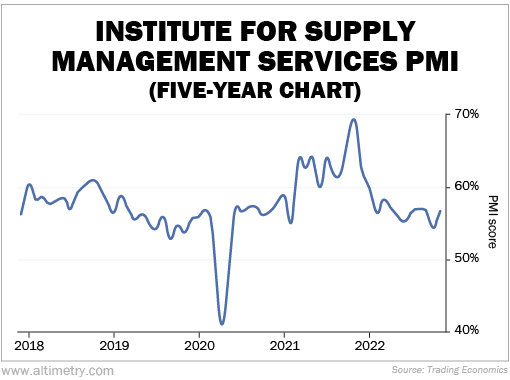

You see, the PMI also surveys the services sector. Those numbers more than made up for a slight dip in manufacturing.

The Services PMI jumped to 56.5%. That's up from 54.4% in October.

Check it out...

That was way better than people expected. The median projection was for a decline to 53.5%.

So while some industries have struggled recently, others are still holding the market up...

So while some industries have struggled recently, others are still holding the market up...

Layoffs at tech and communications companies are getting most of the attention. Meanwhile, services like mining and agriculture are doing just fine.

The PMI data reminds us that even though economic activity is slowing, it's not falling off a cliff.

That is why the market will likely keep trading sideways in the near term. We're seeing a lot of conflicting data on economic activity. It suggests that we aren't set for a steep drop-off yet... nor are we primed for growth.

Interest-rate hikes need time to work their way through the economy. That's likely a prerequisite before the market moves in any direction.

Eventually, higher rates will start to slow spending and the credit market. And that will probably force us into a modest recession.

Until that happens, you shouldn't be acting as if we're in a recession today.

Don't abandon equities. We're more likely to deal with choppy trading than a freefall going forward.

Keep being tactical in your investing choices. This isn't the time to throw good money after bad in risky stocks. Even so, there are plenty of opportunities in a sideways market.

Regards,

Joel Litman

December 19, 2022

This economy just won't die...

This economy just won't die...